FA Alpha Daily

Powered by Valens Research

Yesterday, we discussed how Adobe (ADBE) is successfully integrating AI into its offerings and benefiting greatly from it.

This wasn’t the first great move the company managed to pull off in its history…

Adobe’s shift from selling boxed software to a subscription model stands as one of the most dramatic turnarounds in tech.

Before 2011, the company relied on infrequent, high-priced releases of the Creative Suite, shipping CDs every 18-24 months.

That approach capped growth, created revenue cliffs, and left customers waiting for updates.

In the wake of the 2008 recession, the company’s management recognized that a cloud-based subscription would smooth earnings, deepen customer engagement, and harness real-time usage data.

By introducing Creative Cloud in 2011, Adobe converted a lumpy, perpetual revenue stream into predictable, recurring income.

Wall Street braced for initial dips in revenue. Profit and cash flow did decline as the old model wound down but Adobe tracked a transparent three-year transition plan tied to new metrics like annual recurring revenue and average revenue per user.

As customers embraced continuous updates, bundle pricing, and cloud features, churn fell and ARR climbed.

The payoff was extraordinary. Adobe’s market capitalization surged from about $16 billion pre-transition to over $175 billion, driven by sustained double-digit top-line growth and margin expansion.

PROS (PRO) also made a similar move… with a rougher start.

PROS operates as a software-as-a-service company, specializing in price optimization services for industries that experience frequent price changes, like airlines.

The company initially established itself within the airline and travel sectors but has since broadened its reach into new markets, including retail and automation, assisting businesses in determining the most effective pricing strategies.

At its core, the company provides software that helps other businesses improve their sales and profitability.

Its main offerings fall into two key categories. The first is price optimization and management, where the software analyzes market data to recommend the best real-time price for a product or service.

The second is sales effectiveness, centered on its Configure, Price, Quote (CPQ) tools. These tools automate the process for sales teams to configure complex deals, price them accurately according to business rules, and generate quotes quickly.

While expanding into sectors like manufacturing and distribution, PROS also maintains its deep roots in the travel industry with specialized solutions for airline revenue management and dynamic fare pricing.

The company transitioned from selling software licenses to adopting a cloud-based SaaS model approximately a decade ago.

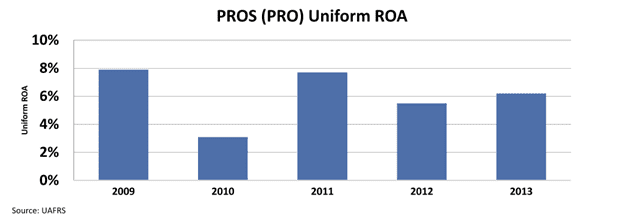

The previous license-based approach yielded modest results, having around 6% Uniform return on assets ”ROA” between 2009 and 2013.

The shift to a SaaS model required substantial investment and a lengthy period of building out its platform, during which the company reported losses for nearly ten years.

However, this strategic change has proven successful, with PROS now having returned to profitability with achieving 8% ROA last year.

Recent performance indicators underscore this positive trajectory.

In the latest earnings, subscription revenue grew by 10% compared to the previous year, while total revenue, which encompasses maintenance and services, saw a 7% increase.

The subscription revenue is particularly important due to its recurring nature, high gross margins exceeding 80%, and its role as the primary engine for earnings growth.

There is strong demand for the company’s AI-based CPQ products, partly driven by a more volatile economic environment influenced by tariffs.

This volatility necessitates more dynamic pricing from businesses to account for fluctuating costs and changing consumer sentiment, thereby increasing the need for PROS’s offerings.

Supporting this, management noted that sales cycle times decreased by more than 10% year-over-year in the last quarter.

Furthermore, forward-looking metrics such as recurring deferred revenue were up 15%, and trailing twelve-month recurring calculated billings increased by 14%.

However, the market worries that a weaker macroeconomic climate could affect the company’s performance, particularly given its exposure to the airline industry, which might face reduced consumer demand.

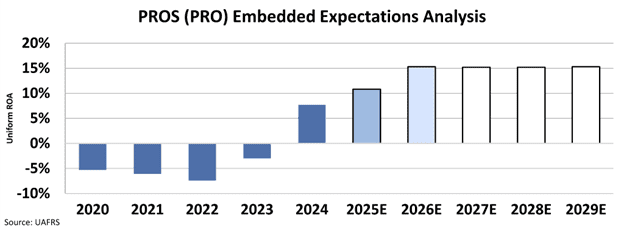

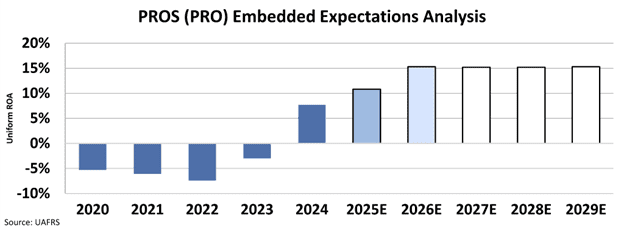

We can see what the market thinks through our Embedded Expectations Analysis (“EEA”) framework.

The EEA starts by looking at a company’s current stock price. From there, we can calculate what the market expects from the company’s future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

At the current stock price, the market predicts that the company’s Uniform ROA will only increase to around 15%—far below the average ROA of an SaaS business which hovers around 20% to 25%.

A key factor in the PROS’ improving financial health is the operating leverage inherent in its business model.

While revenue has been growing, expenses have remained relatively stable, with the total employee count showing minimal growth over the past two years.

Furthermore, the company’s industry standing, recognized by its leadership position in both the Gartner Magic Quadrant and IDC MarketScape for CPQ, along with its distinct customer base and extensive partner ecosystem, contributes to its stable market position.

As PROS’ subscription-based business continues to expand and achieve profitable growth, its returns have the potential to increase beyond market expectations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Officer &

Director of Research

at Valens Research

Today’s analysis highlights the same insights we share with our FA Alpha Members. If you want to an get in-depth analysis of market trends and uncover undervalued stocks, become an FA Alpha Member today.