Interest rate-hike odds have changed significantly since early March due to the Silicon Valley Bank collapse. Although the Fed raised rates during its March meeting, the market expected it to be the final hike for the foreseeable future. In today’s FA Alpha, we will discuss how March 2023 and the interest rate-hike odds of this month can make or break the economy.

FA Alpha Daily:

Monday Macro

Powered by Valens Research

In early March, the economy was humming along. Stocks were up slightly from the start of the year. And while a looming recession was making investors nervous… the market was still “business as usual” for the most part.

The recent slew of bank collapses changed everything…

Silicon Valley Bank (“SVB”), Silvergate Capital (SI), and Signature Bank (SBNY) fell apart in the course of a week… at least in part due to high interest rates. The bank runs shook investor confidence. And to top it all off, a fast-approaching Federal Open Market Committee (“FOMC”) meeting was at the forefront of everyone’s minds.

Before panic engulfed the market, the prevailing opinion was that the Federal Reserve would hike interest rates three more times… keep rates flat for about a year… and start cutting rates in 2024.

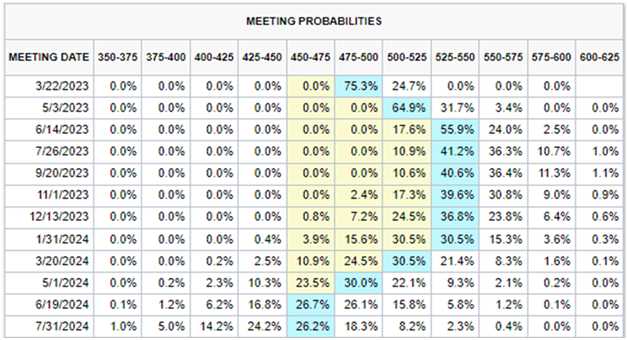

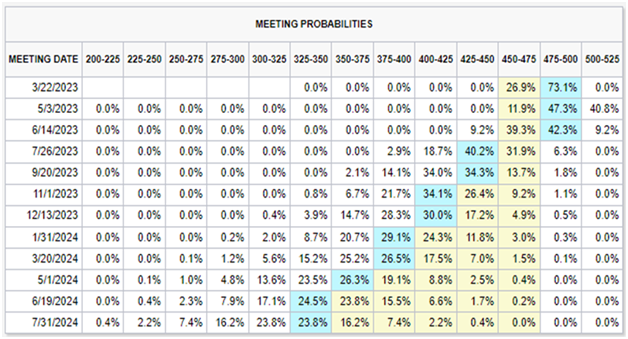

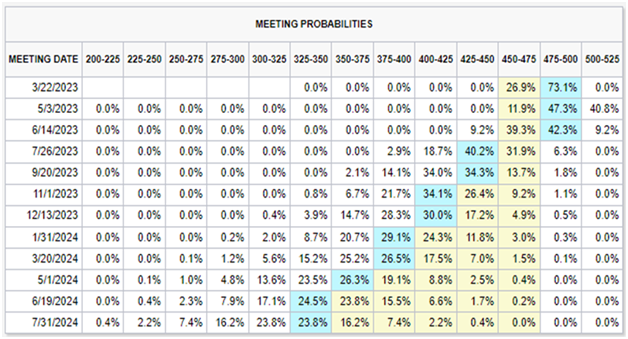

Because of these collapses, folks now expect the Fed to start slowing rate hikes immediately. Take a look at the following tables, which compare investor expectations from early March and last week.

At Thursday’s FOMC meeting, the Fed raised rates to 5%. Investors think that’s as high as rates will go. And they’re probably right… considering how volatile the market is today, the economy can’t take much more pressure from the Fed.

This may seem like uncharted territory. Inflation is still high, yet the central bank is about to lose one of the main tools in its inflation-fighting arsenal. However, today’s environment is more familiar than you might think.

The Fed was in a similar position in the late 1940s. It used a number of tools to combat inflation for about a year… and then put its efforts on pause. As we’ll explain today, the results will likely be similar to what we can expect in 2023.

The Fed tends to use the same playbook in challenging times.

We’ve drawn a lot of parallels between the economy today and in the 1940s. It took until 1947 for the Fed to finally accept that inflation was getting out of hand. Once it did, the central bank raised interest rates.

It was a pretty modest hike, from 0.37% to 1% over six months. That’s a lot less aggressive than the rate hikes we’ve been seeing for the past year. However, a closer look reveals that it was aggressively tightening its balance sheet in other ways.

In the 1940s, the Fed started trying to stimulate the economy to increase the money supply (a sort of precursor to modern-day quantitative easing). It did this to help keep the cost of funding the war effort low.

By 1947, the Fed owned close to 100% of outstanding U.S. Treasurys. This was a lever the Fed could use to keep interest rates tamped down. Then it dramatically changed its strategy.

To tighten market liquidity and cool down inflation, the Fed went on a selling spree. Within a year, it owned less than 50% of Treasurys. This was a form of way-more-aggressive quantitative tightening.

The Fed wasn’t done, either. It also jacked up the reserve requirement for banks from 20% in 1947 to 26% by September 1948. Reserve requirements dictate how much money banks are required to keep at the Fed. So this was a staggering constriction on their ability to lend.

And the economy didn’t topple over. The Fed’s actions created volatility, to be clear. Still, they didn’t cripple the economy, even as the financial system recovered.

All of the Fed’s actions during the late 1940s helped cool off inflation. This is very similar to what the central bank has been trying to do for the past year, mainly through rate hikes this time.

Trouble in the bank sector is making that harder. The Fed has to take its foot off the gas with rate hikes. That doesn’t mean it’s powerless, though. It can cool off the economy by selling Treasurys back into the market.

In the late 40s, the Fed was able to successfully cool off the economy and bring it to a pretty soft landing.

While the headlines from the banks that went under recently have put the market on edge, it’s telling that the stock market isn’t plummeting.

This is because conditions overall remain healthy. We’re keeping a close eye on the bank sector, and we think the Fed will do what it needs to do to provide stability.

So don’t panic that the Fed just lost its ability to hike rates any further. Once the bank sector has stabilized, the Fed will be able to keep moving the economy towards a landing.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

To see our best macro insights, become an FA Alpha and get access to FA Alpha Pulse.