Europe’s decision to cut off Russian energy imports has led to a surge in demand for coal, a fossil fuel that is often seen as less environmentally friendly than renewable energy sources. This is good news for companies like Alpha Metallurgical Resources (AMR), a leading U.S. supplier of metallurgical and thermal coal, as it has seen its profitability soar in recent years due to the surge in demand for coal. Despite the current high demand for coal, The market is pricing in a decline in demand for AMR’s coal products due to climate change concerns and the increasing focus on renewable energy sources. In today’s FA Alpha Daily, we’ll look at AMR using Uniform Accounting to see how it is well-positioned to continue to generate strong profits.

FA Alpha Daily:

Tuesday Company Specific

Powered by Valens Research

The Russian invasion of Ukraine caused a huge diplomatic and humanitarian crisis. Another big result it had was its impact on the energy markets.

With Russian natural gas and oil out of the supply chains, the demand for substitute resources skyrocketed, causing massive increases and volatility in prices.

Europe turned elsewhere to find different energy sources to survive the winter. Although governments and environmental groups have been pushing clean energy and ESG for a long time, necessity for energy pointed Europe towards other energy sources.

The continent needed a new supply and needed it fast. Coal emerged as a pragmatic interim solution, especially in light of the limited liquid natural gas infrastructure present at the time.

Demand for fossil fuels grew. The diminishing nuclear power output from France, Germany, and Belgium further elevated the need for coal.

Europe was able to acquire coal more easily than other resources because there was no complicated infrastructure needed for coal like there is for liquid natural gas.

Although Europe was able to get its hands on coal easily, it would come at a cost. Russia is the third-largest supplier of coal in the world, so when European countries swore off Russian coal, the global supply available declined.

Increased demand and a constricted supply meant prices of coal shot up.

The price of coal jumped from $170 per ton in December 2021 to $344 per ton in December 2022.

And with the Russia-Ukraine crisis having no end in sight, we can expect the price range of coal to remain higher than its pre-war levels.

There are a few companies that stand to benefit from this continued demand, and Alpha Metallurgical Resources (AMR) is one of them. It is a leading provider of metallurgical coal, which is an essential ingredient used in the steelmaking process.

The company specializes in mining, processing, and selling metallurgical coal, primarily to steel manufacturers across the globe.

The high demand for coal after the Russia-Ukraine crisis began resulted in high profitability for the company.

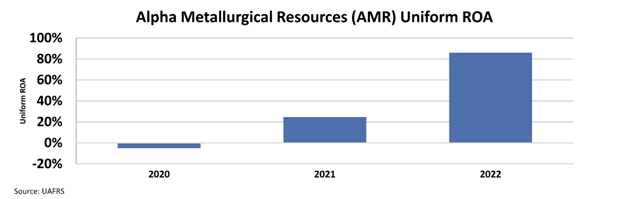

The company’s return on assets (“ROA”) jumped from -5% in 2020 to 25% in 2021 and then 86% in 2022.

The chart shows that the company performed incredibly well during the onset of the Russia-Ukraine Crisis, which began in early 2022. As this crisis lingers on, Alpha Metallurgical Resources should continue performing well.

And yet, the market fails to recognize this opportunity.

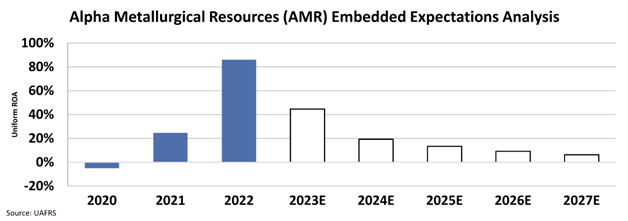

We can see this through our Embedded Expectations Analysis (“EEA”) framework.

The EEA starts by looking at a company’s current stock price. From there, we can calculate what the market expects from the company’s future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

At the current stock price, the market expects the company’s ROA to fall to 6%. Investors are assuming demand will collapse.

Given the continuance of the Russia-Ukraine crisis and high demand from Europe, these expectations seem overly pessimistic.

The company has substantial potential to scale its operations and continue benefiting from its macro tailwinds.

That is why Alpha Metallurgical Resources showed up on our screen. The company makes a great FA Alpha 50 name due to its potential for high returns and low expectations from the market.

Throughout financial market history, many of the world’s most successful investors have been candid in their belief that Generally Accepted Accounting Principles (“GAAP”) distort economic reality.

Warren Buffett, for example, once said investors should “concentrate on the world of companies, not arcane accounting mathematics.”

Investors who neglect the very real issues with as-reported accounting can find themselves caught up in investing with the crowd, blindly following hot “themes” without a thorough grasp of how to understand the businesses in question.

The only true way to focus on the “world of companies,” as Buffett suggests investors do, is to present a clear picture of how a business operates, something that can only be done by adjusting financial statements to reflect the arbitrary nature of certain accounting rules that leave much to discretion.

The world’s best investors understand the need to make these adjustments, which allows them to focus not on picking out the most popular companies but rather on looking for great names in sleepy areas that the market isn’t paying much attention to. From there, the goal is to then identify quality companies with significant growth potential at reasonable prices.

That’s exactly what we’ve set out to do with the FA Alpha, our monthly list of 50 companies that rank at the top for quality, high growth, and low valuations.

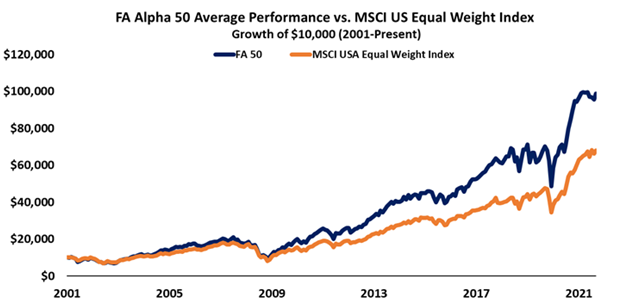

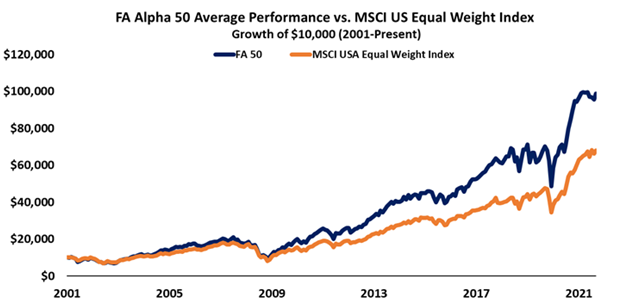

This list has outperformed the market by 300 basis points per year for over 20 years now, effectively doubling the performance of the market by focusing on the real fundamentals and valuations of companies with our proprietary Uniform Accounting framework.

See for yourself below.

To see the other 49 names on the list, click here.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

Today’s highlight, Alpha Metallurgical Resources (AMR) is one of the top stock picks from FA Alpha 50 this month. To see more stock picks like this, become an FA Alpha and get access to FA Alpha 50.