Plexus (PLXS), an outsource manufacturing company, is at the intersection of three major trends in the United States. With its balanced business and stable end markets, the company is strategically positioned to benefit from the supply-chain supercycle and investments in aerospace and defense, and to weather a recession. However, the market believes that the company’s profitability will weaken over the next five years. In today’s FA Alpha Daily, we will take a closer look at Plexus using Uniform Accounting to see the company’s true profitability and what the market is missing.

FA Alpha Daily:

Thursday Uniform accounting analysis

Powered by Valens Research

There are three big themes converging on the U.S. economy today. Understanding these helps us focus on the correct areas and find opportunities in the market.

One is the supply-chain supercycle you have heard us talk about many times.

After a decade of underinvestment in supply chains and infrastructure, the pandemic has been an eye-opening experience for the U.S.

Lead times got extended, orders got canceled, and manufacturers saw increasing supply chain costs. The U.S. needs to rebuild its infrastructure and enhance its manufacturing capacity, and fast.

Companies are now bringing their manufacturing facilities back home, benefiting from incentives like the Bipartisan Infrastructure Bill. In its first year alone, the bill has allowed over $185 billion in funding of projects for new roads, bridges, facilities, and other infrastructure.

The second big theme is the reinvestment cycle we are experiencing in the aerospace and defense industry.

With the ongoing war in Ukraine, the U.S. has been sending more aid and equipment to our European allies. At the same time, we are replacing our stockpiles, increasing the need for aerospace and defense production.

Finally, we have the unfortunate truth of a recession on the horizon. Inflation is still high, interest rates have been rapidly increasing, and several industries already feel the declining demand.

This means the cost of capital for projects is a lot higher, and we are likely to see growth subside. This might result in higher unemployment and a decline in consumer demand.

Plexus (PLXS) manages to be at the crossroads of all three trends.

It is an outsource manufacturer of industries. With its positioning, it captures the supply-chain supercycle, aerospace and defense investment cycle, and spending on healthcare and life sciences, which is a more stable end market if we enter a recession.

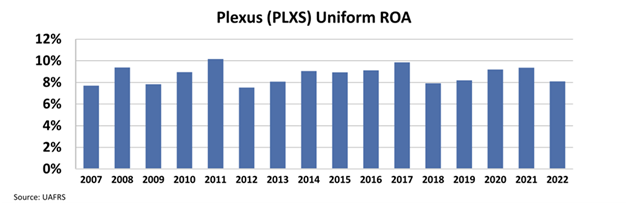

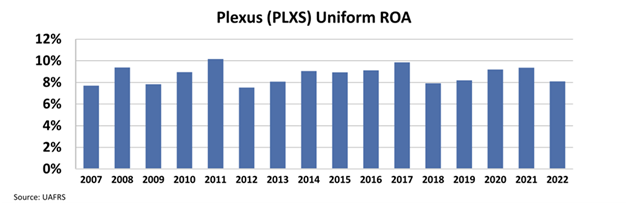

The business is pretty stable. Its Uniform return on assets (“ROA”) has been around 8% for the last two decades. Even around the great recession of 2009, the business performed very well.

Plexus has proved that it is a very balanced business with exposure to rising trends and stable end markets.

It could even see a bit of a boost over the next few years as the supply-chain supercycle ramps up.

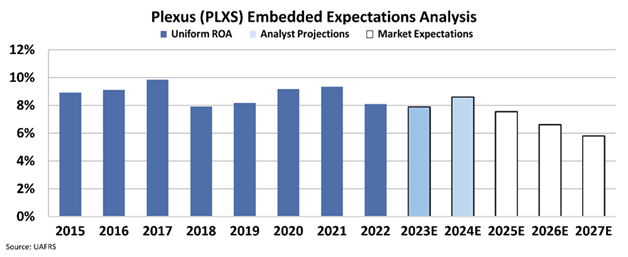

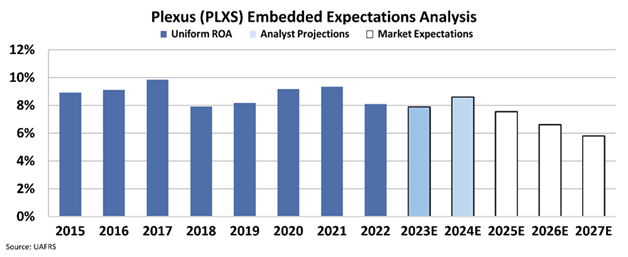

And yet, the market is pricing its profitability to decline to levels not seen in the last two decades.

We can see this through our Embedded Expectations Analysis (“EEA”) framework.

The EEA starts by looking at a company’s current stock price. From there, we can calculate what the market expects from the company’s future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

At the current stock price, the market expects the company’s ROA to fade to its cost of capital, which would be the lowest in the last two decades.

The market does not seem to realize there are two big tailwinds driving the business, that are only going to get bigger in the next decade. Additionally, it is exposed to another big defensive end market.

As these trends play out, Plexus will see demand for its services skyrocket. That means higher profitability and a potential upside.

SUMMARY and Plexus Corp. Corporation Tearsheet

As the Uniform Accounting tearsheet for Plexus Corp. (PLXS:USA) highlights, the Uniform P/E trades at 16.9x, which is around the corporate average of 18.4x and its historical P/E of 16.0x.

Average P/Es require average EPS growth to sustain them. In the case of Plexus Corp, the company has recently shown a 1% growth in Uniform EPS.

Wall Street analysts provide stock and valuation recommendations that in general provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, Plexus Corp.’s Wall Street analyst-driven forecast is a 9% EPS growth in 2023 and a 19% EPS growth in 2024.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify Plexus Corp’s $96.62 stock price. These are often referred to as market embedded expectations.

The company is currently being valued as if Uniform earnings were to shrink by 2% annually over the next three years. What Wall Street analysts expect for Plexus Corp.’s earnings growth is above what the current stock market valuation requires through 2024.

Furthermore, the company’s earning power is 1x its long-run corporate average. Moreover, cash flows and cash on hand are 1.3x its total obligations—including debt maturities, capex maintenance, and dividends. Also, the company’s intrinsic credit risk is 120bps above the risk-free rate.

All in all, this signals average credit risk.

Lastly, Plexus Corp.’s Uniform earnings growth is in line with its peer averages and its average peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

The Uniform Accounting insights in today’s issue are the same ones that power some of our best stock picks and macro research, which can be found in our FA Alpha Daily newsletters.