European defense spending is set to surge, and investors are watching closely to capitalize on the boom. As military budgets grow, Rheinmetall is drawing attention amid a rally in defense stocks. In today’s FA Alpha Daily, we look at the market expectations for Rheinmetall’s profitability compared to elite defense players like Lockheed Martin.

FA Alpha Daily

Powered by Valens Research

The U.S. contributes two-thirds of NATO’s total defense budget.

But rising tensions with Russia—along with political pressure from the Trump administration—are forcing European allies to step up.

Member states are preparing to commit a staggering 5% of their GDP to defense-related investments by 2032. This marks a full-scale rearmament not seen since the Cold War.

The new target combines 3.5% in direct defense spending, with an additional 1.5% for “military-adjacent costs.” This includes areas like cybersecurity, logistics, and dual-use goods.

All the changes are creating a frenzy among investors.

Defense stocks across Europe are rallying as markets try to price in a coming boom. Wisdom Tree’s Europe Defence ETF (LON:WDEF) is up 20% year-to-date.

Some investors are treating this moment like a generational tailwind for military contractors.

But not every European defense contractor will come out on top despite what the market seems to think.

Rheinmetall (XTRA:RHM) is Europe’s latest defense darling…

The German contractor is in the spotlight as investors rush to capitalize on a breakout moment.

As Germany’s top supplier of ground systems, Rheinmetall supplies armored vehicles, large-caliber munitions, and high-tech weapons systems.

With NATO gearing up for a record-breaking expansion, Rheinmetall seems like a perfect bet.

There’s only one problem: This business has never delivered elite returns.

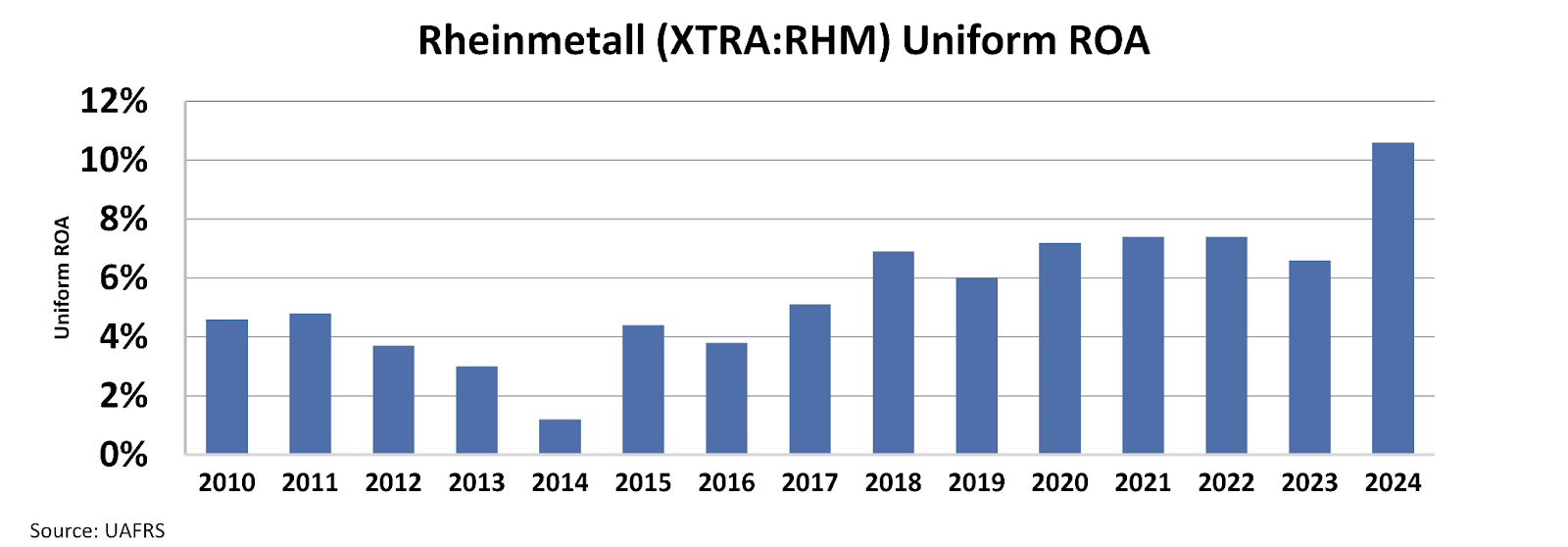

Rheinmetall has been around through periods of extreme geopolitical tension like Syria in the late 2010s and Crimea in 2014. But Uniform return on assets (“ROA”) hovered in the low single digits all that time.

Returns only cleared the 10% mark once between 2010 and 2024. And it took the threat of war on Europe’s doorstep and ballooning military budgets for Uniform ROA to reach double digits last year.

We see 2025’s 11% returns as a new baseline for the company. But investors think this is just the beginning.

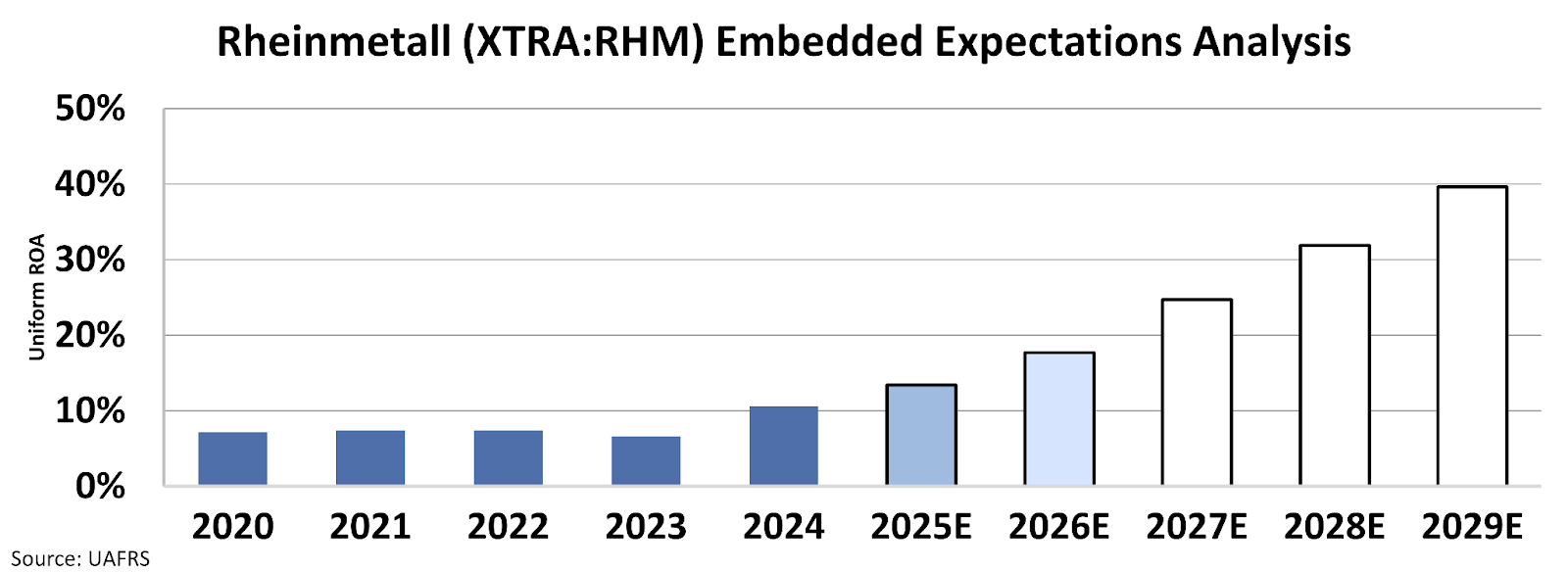

We can see this through our Embedded Expectations Analysis (“EEA”) framework.

The EEA starts by looking at a company’s current stock price. From there, we can calculate what the market expects from the company’s future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

The market assumes Uniform ROA will soar to 40% by 2029. That’s nearly four times higher than Rheinmetall’s best result yet.

Take a look…

Investors are looking for near-perfect returns.

Not only is this a lot to ask of Rheinmetall. It’s also far above what’s typical, even for top-tier defense contractors. Lockheed Martin (LMT), the U.S.’ top contractor, has never returned more than 26%.

The business has never come anywhere close, even during boom times.

NATO’s new era will create plenty of opportunity but that doesn’t mean every defense stock is a bargain.

Rheinmetall isn’t about to become the Lockheed Martin of Europe, no matter what the market seems to think. Until last year, it averaged returns of just 5%.

Just because a company makes tanks doesn’t mean it’s built to print cash.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Officer &

Director of Research

at Valens Research

Today’s analysis highlights the same insights we share with our FA Alpha Members. If you want to an get in-depth analysis of market trends and uncover undervalued stocks, become an FA Alpha Member today.