Rising inflation and interest rates are squeezing consumer spending and small businesses, impacting industries heavily dependent on them, like the payments sector. Rating agencies worry about consumer market volatility and exhibit bias against payment companies due to their substantial exposure to this instability. Priority Technology (PRTH), a fintech firm offering payment and data processing services, is an example of a payment company affected by this bias. In today’s FA Alpha Daily, we’ll examine PRTH’s credit risk profile using Uniform Accounting and evaluate rating agencies’ fairness in assessing the company.

FA Alpha Daily:

Wednesday Credit

Powered by Valens Research

The U.S. economy has been in flux for some time now.

Inflation hit a 40-year-high last year and the effects are still visible today. Furthermore, consumers are cutting back on spending due to the Fed’s interest rate hikes.

These issues significantly affected small and midsize businesses (SMBs). On top of these, rising costs for rent, labor, and supplies made the problem even worse.

As a result, some sectors had deep trouble in this macroeconomic conjecture and payments is one of them.

Since the payments sector is highly exposed to consumers and SMBs, both transaction volumes and revenues saw a significant decline in recent years.

As volatility continues in the consumer market, rating agencies became concerned about the future of the industry. The uncertain outlook caused rating agencies to develop a bias against the payments sector, which led to lower credit ratings for many payments companies.

Priority Technology (PRTH) is a great example of this.

The company’s financial products and services allow companies to collect, store, and send money on a scalable platform, from fintech to integrated payments and banking. It is basically a SaaS company for payments.

SMBs make up the vast majority of the business. The merchant segment accounts for more than 80% of the overall revenue.

The company offers end-to-end systems for merchants from consumer exposed sectors such as real estate, hospitality and retail.

However, although the targeted end market is struggling, it doesn’t mean every single business by itself is in trouble.

The company’s revenue has grown by an average of 20% per year over the last five years. It is a well-managed company with a strong track record of growth.

Moreover, the company only has $6 million outstanding on its 2026 revolver, and besides that, it has no debt due until 2027. Its cash flows greatly exceed its operating obligations every year, so it should have plenty of time to build a cash buffer to start paying that debt down.

Credit rating agencies, however, have a more pessimistic outlook, as they believe that the exposure to consumers and SMBs pose a major risk.

S&P has assigned Priority Technology Holdings a “B-” credit rating, indicating a high likelihood of default of 24% over the next five years. This rating also places the company in the risky high-yield basket.

Based on the company’s strong financial position, Priority Technology should have a much higher credit rating.

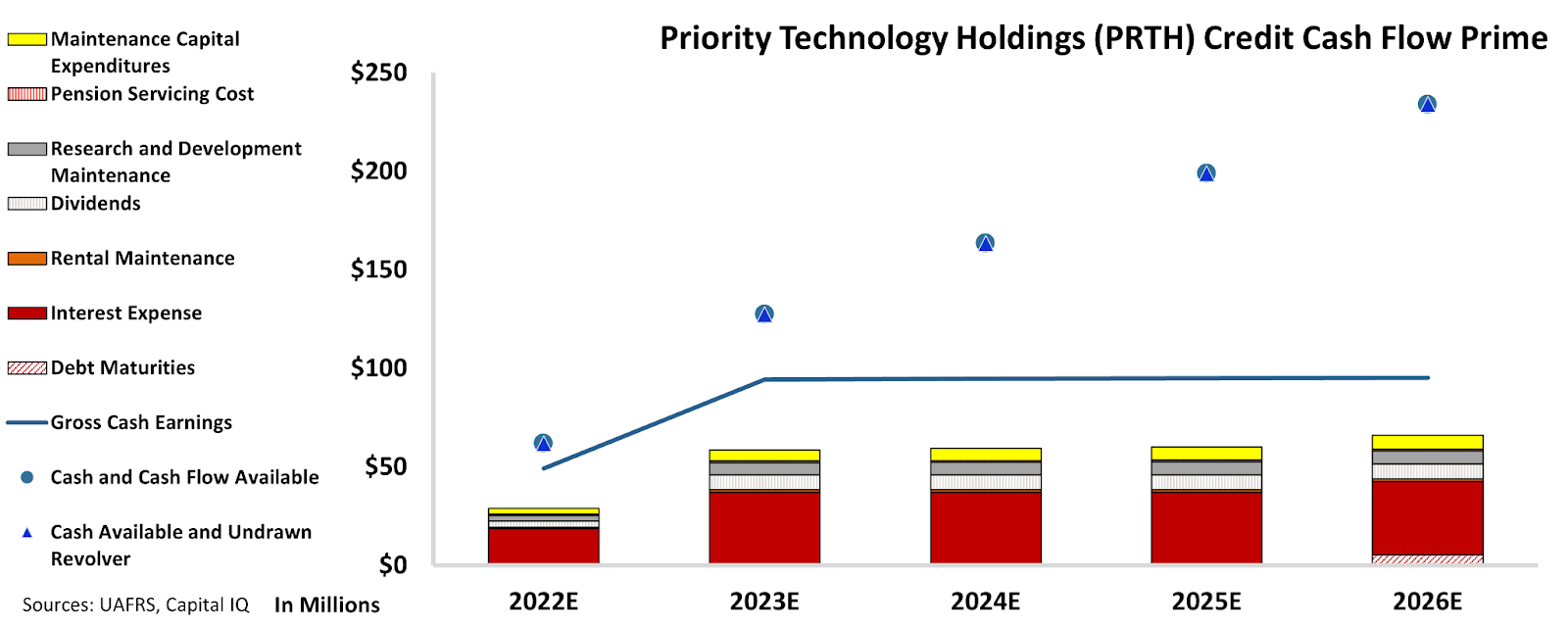

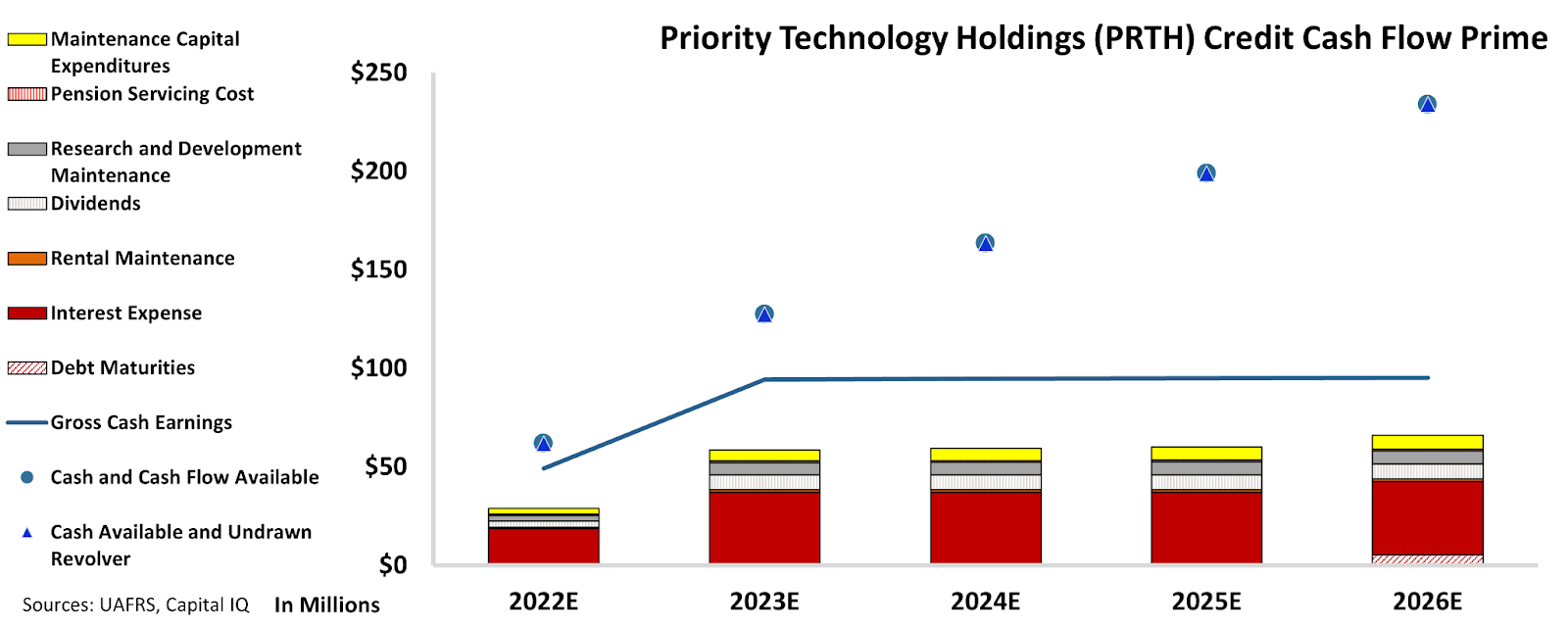

We can figure out if there is a real risk for this company by leveraging the Credit Cash Flow Prime (“CCFP”) to understand how the company’s obligations match against its cash and cash flows.

In the chart below, the stacked bars represent the firm’s obligations each year for the next five years. These obligations are then compared to the firm’s cash flow (blue line) as well as the cash on hand available at the beginning of each period (blue dots) and available cash and undrawn revolver (blue triangles).

The CCFP chart indicates that Priority Technology Holdings’ cash flows are more than sufficient to meet all of its financial obligations in the future.

The chart implies that the company has a solid financial foundation and should be able to meet its obligations without difficulty in the next five years.

Despite its exposure to consumers and SMBs, the company’s ample cash reserves and robust cash flow generation provide it with significant financial flexibility in the event of an economic downturn.

Due to these factors, our analysis of Priority Technology Holdings’ financial statements indicates that the company is not facing a significant risk of default, contrary to the assessment of the rating agencies.

Therefore, we rate Priority Technology Holdings “IG4+”, which means the company is placed among the safer investment-grade basket. This rating implies that the company’s risk of default is around only 2% as opposed to S&P’s overstated risk of default around 24%.

It is our goal to bring forward the real creditworthiness of companies, built on the back of better Uniform Accounting.

To see Credit Cash Flow Prime ratings for thousands of companies, click here to learn more about the various subscription options now available for the full Valens Database.

SUMMARY and Priority Technology Holdings Inc. (PRTH:USA) Tearsheet

As the Uniform Accounting tearsheet for Priority Technology Holdings Inc. (PRTH:USA) highlights, the Uniform P/E trades at 13.6x, which is below the global corporate average of 18.4x but above its historical P/E of 12.5x.

Low P/Es require low EPS growth to sustain them. In the case of Priority Technology, the company has recently shown a 200% Uniform EPS shrinkage.

Wall Street analysts provide stock and valuation recommendations, that in general, provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, Priority Technology’s Wall Street analyst-driven forecast is for a 18% and -0% EPS growth in 2022 and 2023, respectively.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify Priority Technology’s $3 stock price. These are often referred to as market-embedded expectations.

Furthermore, the company’s earning power in 2021 was 10x the long-run corporate average. Moreover, cash flows and cash on hand are 2x its total obligations—including debt maturities and capex maintenance. The company also has an intrinsic credit risk that is 1250bps above the risk-free rate.

Overall, this signals a high credit risk.

Lastly, Priority Technology’s Uniform earnings growth is above its peer averages and is trading in line with its average peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

This analysis of Priority Technology Holdings Inc. (PRTH:USA) credit outlook is the same type of analysis that powers our macro research detailed in the member-exclusive FA Alpha Pulse.