The recent boom in demand for oil and energy also entails stronger demand for the services of industry players like Schlumberger Limited (SLB), one of the biggest oil & gas equipment and services companies in the world. Today’s FA Alpha Daily will dig into what investors can expect from Schlumberger Limited using the Embedded Expectations Analysis framework.

FA Alpha Daily:

Thursday Uniform accounting analysis

Powered by Valens Research

Energy has taken center stage as the commodity seemingly interconnected to all our macroeconomic issues.

This recent spike in energy prices has illuminated the need for investment in energy sources other than just oil and gas as folks become beholden to the prices at the pump.

The underinvestment in other energy options has created surefire supply demand issues.

Environmental impact and a diversification of energy sources make it clear that the ESG wave has momentum in the long run.

The clearest solution that the U.S. is pursuing is to invest into O&G names in the short term, and in the long term invest in other alternative energy sources and cleaner fuel.

That means stronger demand and spending in the short-term for companies like Schlumberger Limited (SLB).

Schlumberger is one of the biggest oil & gas equipment and services companies in the world. They provide the technology to access energy-notably one of the largest offshore drilling companies.

They are in a cyclical industry, but the cycle is set to take off based on the booming demand and constricted supply the world finds itself in.

Looking historically, Schluberger reaped the benefits of a good cycle pre 2015. They had strong returns as high oil prices improved the bottom line. During this cycle, Uniform Return on Assets (ROA) was 15% or higher, above the corporate average of 12%.

But, Schlumberer is cyclical in nature and has suffered in recent years. ROA has fallen to hover around 5% with dismal outlooks.

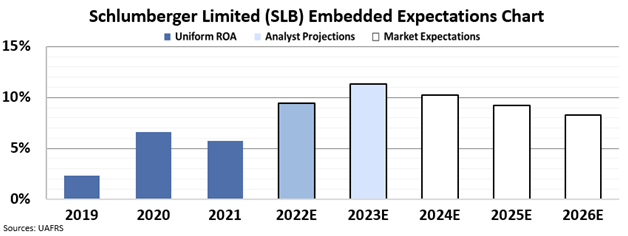

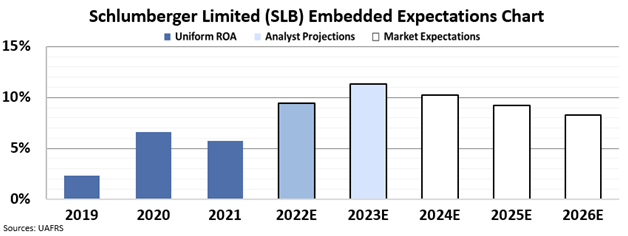

However, with our Embedded Expectations chart, we can see a strong mismatch between analysts and market expectations. Wall Street analysts who study the company project return to climb as the next O&G cycle kicks off. Meanwhile, the market expects the company to continue languishing at low, sub-corporate average returns.

The coming O&G cycle would reap great benefits for Schlumberger. Based on the power of Uniform Accounting and Valen’s Embedded Expectations Analysis, it is clear to see the market is overlooking their potential.

Were Schlumberger to execute going into this next wave of strong O&G spending, the market would be surprised and the stock price would follow.

SUMMARY and Schlumberger Limited Tearsheet

As the Uniform Accounting tearsheet for Schlumberger Limited (SLB:USA) highlights, the Uniform P/E trades at 18.0x, which is around the global corporate average of 19.3x, but below its own historical P/E of 23.4x.

Average P/Es require average EPS growth to sustain them. In the case of Schlumberger, the company has recently shown a 26% decline in Uniform EPS.

Wall Street analysts provide stock and valuation recommendations that in general provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, Schlumberger’s Wall Street analyst-driven forecast is 100% and 32% EPS growth in 2022 and 2023, respectively.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify Schlumberger’s $35 stock price. These are often referred to as market embedded expectations.

The company is currently being valued as if Uniform earnings were to grow by 7% annually over the next three years. What Wall Street analysts expect for Schlumberger’s earnings growth is above what the current stock market valuation requires in 2022, but below its requirement in 2023.

Furthermore, the company’s earning power in 2021 is 1x the long-run corporate average. Moreover, cash flows and cash on hand are 1x its total obligations—including debt maturities, capex maintenance, and dividends. All in all, this signals low dividend and credit risk.

Lastly, Schlumberger’s Uniform earnings growth is below its peer averages, but the company is trading near its average peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

The Uniform Accounting insights in today’s issue are the same ones that power some of our best stock picks and macro research, which can be found in our FA Alpha Daily newsletters.