With oil prices rising at the pump, equipment and services companies such as NexTier Oilfield Solutions Inc. (NEX) are set to capitalize on massive industry tailwinds. Today’s FA Alpha Daily will dissect what rating agencies are misconceiving about NexTier Oilfield’s credit standing.

FA Alpha Daily:

Wednesday Credit

Powered by Valens Research

Consumers have largely been suffering as a result of the recent oil and natural gas price surges.

However, as we’ve talked about several times recently, like here and here, the surges mean there is the potential for one group of companies in particular to benefit as big winners…

Oil and gas equipment and services companies.

As prices remain high going forward, they will experience surging demand for their business offerings. The exploration companies will be digging out the oil to meet demand, which means these E&S companies are set to thrive supplying them.

One great example of this is NexTier Oilfield (NEX).

And yet, credit ratings seem to completely miss the tailwinds that the company is experiencing.

The credit rating agency S&P has rated it as a 25% risk of bankruptcy within the next five years.

However, we can figure out if there is a real risk for this company by leveraging the Credit Cash Flow Prime (CCFP) to understand the company’s obligations matched against its cash and cash flows.

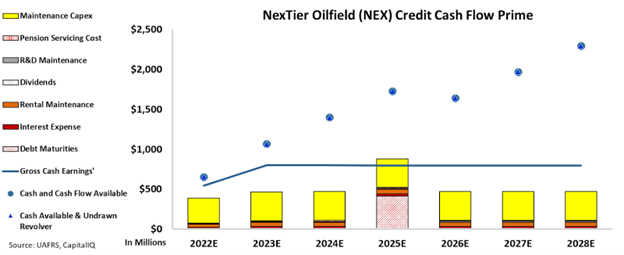

In the chart below, the stacked bars represent the firm’s obligations each year for the next seven years. These obligations are then compared to the firm’s cash flow (blue line) as well as the cash on hand available at the beginning of each period (blue dots) and available cash and undrawn revolver (blue triangles).

As evidenced by the following chart, NexTier Oilfield has plenty of cash flow and cash on hand to cover all of its obligations going forward. While cash flows alone don’t cover its debt in 2026, the cash it will be building over the next few years will allow the company to handily pay it off by 2027.

This is why, due to its plentiful cash flows that are consistently exceeding expectations, and limited the next three years until 2025, we have rated the company a much safer investment-grade IG3+ rating.

Rating agencies seem to be getting caught up in seeing their debt load maturing in 2025, instead of evaluating if the company has the ability to pay it off. By looking at the data, we can see that NextTier Oilfield will continue to be in a healthy position for years to come.

It is our goal to bring forward the real creditworthiness of companies, built on the back of better Uniform Accounting.

To see Credit Cash Flow Prime ratings for thousands of companies, click here to learn more about the various subscription options now available for the full Valens Database.

SUMMARY and NexTier Oilfield Solutions Inc. Tearsheet

As the Uniform Accounting tearsheet for NexTier Oilfield Solutions Inc. (NEX:USA) highlights, the Uniform P/E trades at 12.7x, which is below the global corporate average of 20.6x, but above its historical P/E of 3.1x.

Low P/Es require low EPS growth to sustain them. In the case of NexTier, the company has recently shown a 5% Uniform EPS growth.

Wall Street analysts provide stock and valuation recommendations that in general provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, NexTier’s Wall Street analyst-driven forecast is for a 164% EPS decline in 2022 and a 67% EPS growth in 2023.

Furthermore, the company’s return on assets was -22% in 2021, which is below the long-run corporate average. However, cash flows and cash on hand are almost 2x its total obligations—including debt maturities and capex maintenance. In addition, intrinsic credit risk is 230bps above the risk-free rate.

Overall, this signals a moderate credit and dividend risk.

Lastly, NexTier’s Uniform earnings growth is below its peer averages, and the company is trading below its average peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

This analysis of Oilfield Solutions Inc. (NEX) credit outlook is the same type of analysis that powers our macro research detailed in the FA Alpha Pulse.