The world’s energy systems have been doing their best to keep going despite energy prices going up or down at any time. Still, oil and gas companies make a lot of money, and Pioneer Natural Resources Company is one of the most successful (PXD). Its cash flow surpasses its operational requirements over the next seven years. In today’s FA Alpha, let’s look at PXD and see its real creditworthiness through the lens of Uniform Accounting.

FA Alpha Daily:

Wednesday Credit

Powered by Valens Research

Up, down, left, or right. It seems like energy prices could go in any direction on any given day. Since Russia invaded Ukraine, global energy systems have been trying to maintain continuity.

That hasn’t been possible everywhere. Europe, for example, is struggling to meet its energy needs. Elsewhere, even where the supply never stopped, prices have risen substantially.

Last year, West Texas Intermediate (WTI) crude oil prices ranged between about $60 and $80 per barrel. This year, prices rose as high as $123 per barrel and as low as $76.

Investors are concerned about the performance and profitability of oil and gas companies in this highly volatile environment. What rose in a hurry can come back down to earth just as fast. Especially, when many think we’re headed for a global recession.

This fear has equity and credit investors alike concerned for the energy market. While prices are high today, governments are doing their best to control prices. A major recession could send energy prices back to 2020 levels, where it wasn’t profitable to be in the oil and gas industry.

However, there are two important numbers, other than energy prices, that investors should look for to understand if oil and gas companies will remain profitable.

Those are the breakeven prices for new and existing wells.

According to Dallas Fed’s 2022 Energy survey, a WTI price of $34 per barrel on average is enough to cover operating expenses for existing wells while firms need $56 per barrel on average to profitably drill a new well.

Considering the lowest WTI price of $76 per barrel in 2022, the oil and gas companies are still highly profitable and among the most successful is Pioneer Natural Resources Company (PXD).

The company is engaged in the exploration, development, and production of oil, natural gas liquids (NGLs), and gas.

Pioneer saw record sales during the first half of 2022, when the company’s revenue increased by a whopping 80% year over year.

The credit rating agencies don’t think this is sustainable, though.

S&P fails to understand how sustainable Pioneer’s returns are, giving it a BBB rating, which is barely investment grade.

This is factoring in far too much risk for such a massive oil and gas company, especially with the shale renaissance unfolding on U.S. soil.

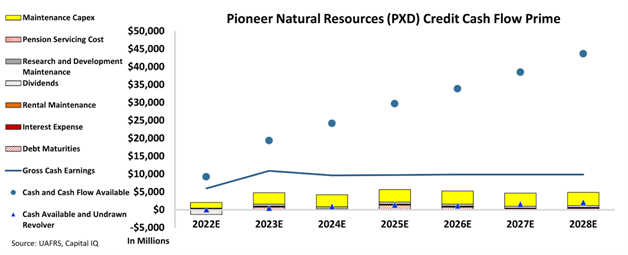

We can figure out if there is a real risk for this company by leveraging the Credit Cash Flow Prime (CCFP) to understand the company’s obligations matched against its cash and cash flows.

In the chart below, the stacked bars represent the firm’s obligations each year for the next five years. These obligations are then compared to the firm’s cash flow (blue line) as well as the cash on hand available at the beginning of each period (blue dots) and available cash and undrawn revolver (blue triangles).

The CCFP chart shows that Pioneer’s cash exceeds all of the company’s obligations and its cash flows are consistently above its operating obligations for the next seven years.

The company’s cash flow is more than two times its obligations each year and it does not have any significant debt that could hurt the company.

This means that it has negligible default risk.

That’s why Pioneer gets an IG2+ rating from Valens, which corresponds to a much safer credit rating considering the company’s high profitability and its successful history.

It is our goal to bring forward the real creditworthiness of companies, built on the back of better Uniform Accounting.

To see Credit Cash Flow Prime ratings for thousands of companies, click here to learn more about the various subscription options now available for the full Valens Database.

SUMMARY and Pioneer Natural Resources Company Tearsheet

As the Uniform Accounting tearsheet for Pioneer Natural Resources Company (PXD:USA) highlights, the Uniform P/E trades at 8.1x, which is below the global corporate average of 18.9x and its historical P/E of 53.0x.

Low P/Es require low EPS growth to sustain them. In the case of Pioneer, the company has recently shown a 6456% Uniform EPS growth.

Wall Street analysts provide stock and valuation recommendations that in general provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, Pioneer’s Wall Street analyst-driven forecast is for a 185% and -12% EPS growth in 2022 and 2023, respectively.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify Pioneer’s $257 stock price. These are often referred to as market embedded expectations.

Furthermore, the company’s earning power in 2021 is 2x the long-run corporate average. However, cash flows and cash on hand are more than 4x its total obligations—including debt maturities and capex maintenance. The company also has an intrinsic credit risk that is 70bps above the risk-free rate.

Overall, this signals a low credit and dividend risk.

Lastly, Pioneer’s Uniform earnings growth is above its peer averages and is trading below its average peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

This analysis of Pioneer Natural Resources Company (PXD) credit outlook is the same type of analysis that powers our macro research detailed in the member-exclusive FA Alpha Pulse.