The global supply chain supercycle is driving significant capital expenditures from companies across various industries. Terex Corporation (TEX) stands to benefit from this trend as its products are widely used in construction, maintenance, manufacturing, energy, and material management applications. However, credit agencies have a concerning view of the company. In today’s FA Alpha Daily, let us examine the company’s default risk where the rating agencies’ assessment is overly cautious.

FA Alpha Daily:

Wednesday Credit

Powered by Valens Research

For a while, we have been talking about how the supply chain supercycle will affect the U.S. economy and companies’ ability to benefit from it. Companies are investing back in their businesses to strengthen their supply chain, optimize operations, and renew their old properties and equipment.

There is no doubt that this spending will make businesses more efficient. But to invest into this trend, we also need to follow where this capital expenditure goes.

More investment means more equipment to work on to make that investment. One of the biggest beneficiaries of this is the equipment suppliers.

There is a lot of equipment that we never think of. But nearly every manufacturing company needs them.

Work platforms, utility equipment, telehandlers, and cranes are just a few of them.

This is where Terex Corporation (TEX) comes in.

The company finds itself at the heart of the supply chain supercycle. It provides various products that are used in construction, maintenance, manufacturing, energy, and material management applications.

It has manufacturing centers on four different continents and sells its products worldwide, creating a global footprint.

Terex’s “Aerial Work Platforms” and “Material Processing” segments cover a wide range of products and industries. These industries need to have the equipment to continue with their daily operations.

Unfortunately, credit agencies misunderstand a company like Terex that has such a vital position in the global manufacturing and construction industries.

They are overly concerned with the heavy machinery industry as a recession is looming. Economic downturns typically lead to reduced spending in construction and manufacturing sectors, primary consumers of heavy machinery.

This decrease in demand can result in lower sales and excess inventory for heavy machinery companies.

Secondly, companies in this industry might experience difficulties in securing financing for new projects or investments, as credit markets often tighten during recessions.

However, even with recessionary fears last year, the company’s uniform return on assets (“ROA”) reached the high-end of its historical returns in 2022.

Despite this, the stance of rating agencies hasn’t changed. Rating agencies like S&P think there is a 10% chance Terex will go bankrupt, rating the company BB-.

However, the company is in a solid position and has a healthy balance sheet. So, rating agencies are overly concerned about the company’s credit risk.

This rating makes no sense, which means it is better if we analyze the default risk of the company ourselves.

We can figure out if there is a real risk for this company by leveraging the Credit Cash Flow Prime (CCFP) to understand the company’s obligations matched against its cash and cash flows.

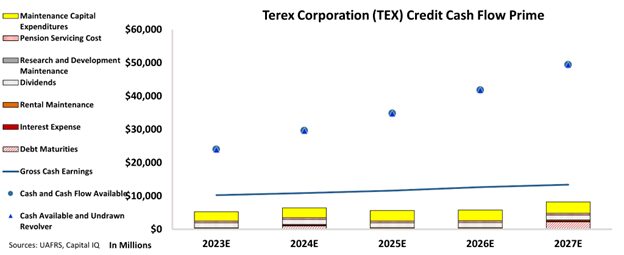

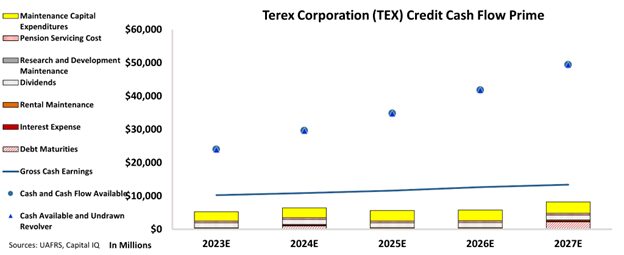

In the chart below, the stacked bars represent the firm’s obligations each year for the next five years. These obligations are then compared to the firm’s cash flow (blue line) as well as the cash on hand available at the beginning of each period (blue dots) and available cash and undrawn revolver (blue triangles).

The CCFP chart proves two main points. Terex has nothing to worry about meeting its obligations and credit agencies don’t understand the business at all.

Terex’s cash flows consistently exceed operating and financial obligations for the next six years.

This means that it can comfortably invest cash flows directly into the business and get ready for the supply chain supercycle.

As a result, Terex gets an IG3+ rating from Valens. This corresponds to a default risk of less than 1.5%, which makes much more sense considering the company’s cash flows and liabilities.

It is our goal to bring forward the real creditworthiness of companies, built on the back of better Uniform Accounting.

To see Credit Cash Flow Prime ratings for thousands of companies, click here to learn more about the various subscription options now available for the full Valens Database.

SUMMARY and Terex Corporation Tearsheet

As the Uniform Accounting tearsheet for Terex Corporation (TEX:USA) highlights, the Uniform P/E trades at 9.1x, which is below the global corporate average of 18.4x and its historical P/E of 10.6x.

Low P/Es require low EPS growth to sustain them. In the case of Terex, the company has recently shown a 29% Uniform EPS growth.

Wall Street analysts provide stock and valuation recommendations that in general provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, Terex’s Wall Street analyst-driven forecast is for a 45% and 1% EPS growth in 2023 and 2024, respectively.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify Terex’s $49 stock price. These are often referred to as market embedded expectations.

Furthermore, the company’s earning power in 2022 is 3x the long-run corporate average. However, cash flows and cash on hand are more than 3x its total obligations—including debt maturities and capex maintenance. The company also has an intrinsic credit risk that is 152bps above the risk-free rate.

Overall, this signals a moderate credit risk and low dividend risk.

Lastly, Terex’s Uniform earnings growth is above its peer averages, but is trading below its average peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

The battle between fundamental investors and technical investors rages on. Each camp swears on its methodology, and each has attributes that appeal to investors. What if we combined these methods and track performance? We did just that, and you need to see the results…

We are inviting you to attend our upcoming event this Wednesday, December 6, 2023 at 8:00 PM EST to help you succeed with your financial decisions.

This analysis of Terex Corporation (TEX)’s credit outlook is the same type of analysis that powers our macro research detailed in the member-exclusive FA Alpha Pulse.