Now that the United States is at the forefront of the natural gas race due to the shale renaissance and Europe’s decision to turn to the U.S. to meet their energy needs, American E&P companies such as Chesapeake Energy Corporation (CHK) are set to win big. However, credit rating agencies give Chesapeake Energy a BB- rating, despite the company’s 58% revenue growth in 2021 and its strategic positioning in the energy industry. Today’s FA Alpha Daily will examine the company’s real credit risk.

FA Alpha Daily:

Wednesday Credit

Powered by Valens Research

Over the past decade the world has been giving an increased focus to clean energy solutions.

Investments in wind and solar power have boomed in this period. Solar jobs in America have seen an increase of 167%, which is 5 times greater than job growth for the rest of the economy over the last decade.

But despite these investments into alternative energy, natural gas is still one of the most in demand energy sources.

While natural gas is not renewable like wind and solar, it does offer a cleaner solution than oil and coal.

Global natural gas consumption has been on the rise since 1960 and demand has remained strong in 2022.

The shale renaissance will only help strengthen the consumption capabilities of natural gas. The increase in shale mining has had a massive impact on the supply of natural gas in the United States, which is now the world’s largest producer of the energy source.

And demand for U.S. gas has only increased as a result of Russia’s invasion of Ukraine. European countries are refusing to do business with Russia and are turning to the U.S. to meet their energy needs.

This booming demand will benefit E&P companies across the energy sector.

One of these potential beneficiaries is Chesapeake Energy Corporation (CHK).

The Oklahoma City-based company engages in the acquisition, exploration, and production of oil and gas in the United States.

Natural gas accounted for 69% of the company’s production output in 2021.

And yet, despite the company posting 58% revenue growth in 2021, credit agencies are failing to understand the potential of a company in this industry.

S&P rates Chesapeake Energy a BB-, implying a 10% chance of bankruptcy for the company.

Given the company’s positioning in the natural gas sector and recent steps taken to clean up its balance sheet, this rating seems unrealistic.

We can figure out if there is a real risk for this company by leveraging the Credit Cash Flow Prime (CCFP) to understand the company’s obligations matched against its cash and cash flows.

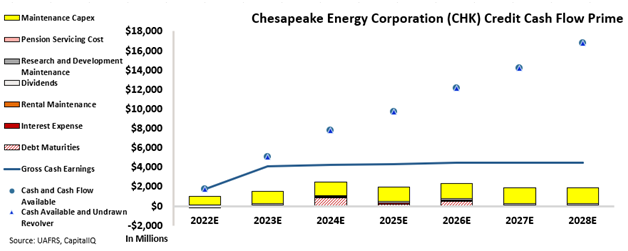

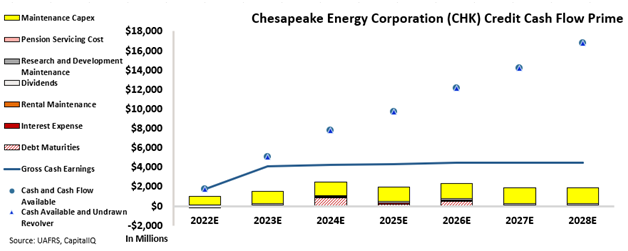

In the chart below, the stacked bars represent the firm’s obligations each year for the next five years. These obligations are then compared to the firm’s cash flow (blue line) as well as the cash on hand available at the beginning of each period (blue dots) and available cash and undrawn revolver (blue triangles).

The chart proves that Chesapeake Energy has a much safer credit profile than the credit agencies suggested. The CCFP shows that the company has limited debt headwalls in coming years and cash flows consistently exceed operating and financial obligations for the next six years.

The company should have no issues with its current obligations and will have flexibility to invest take on more debt to further drive growth.

As a result, Chesapeake Energy gets an IG3+ rating from Valens. This corresponds to a default risk which is less than 2%, which makes much more sense when we can see the company’s balance sheet in context.

It is our goal to bring forward the real creditworthiness of companies, built on the back of better Uniform Accounting.

To see Credit Cash Flow Prime ratings for thousands of companies, click here to learn more about the various subscription options now available for the full Valens Database.

SUMMARY and Chesapeake Energy Corporation Tearsheet

As the Uniform Accounting tearsheet for Chesapeake Energy Corporation (CHK:USA) highlights, the Uniform P/E trades at 9.6x, which is below the global corporate average of 19.3x, but above its historical P/E of 1.9x.

Low P/Es require low EPS growth to sustain them. In the case of Chesapeake Energy, the company has recently shown a 96% Uniform EPS shrinkage.

Wall Street analysts provide stock and valuation recommendations that in general provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, Chesapeake Energy’s Wall Street analyst-driven forecast is for a 158% EPS decline and 86% EPS growth in 2022 and 2023, respectively.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify Chesapeake Energy’s $96 stock price. These are often referred to as market embedded expectations.

Furthermore, the company’s earning power in 2021 is below the long-run corporate average. However, cash flows and cash on hand are more than 2x its total obligations—including debt maturities and capex maintenance. The company also has an intrinsic credit risk that is 130bps above the risk-free rate.

Overall, this signals a low credit and dividend risk.

Lastly, Chesapeake Energy’s Uniform earnings growth is below its peer averages, but is trading in line with its average peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

This analysis of Chesapeake Energy Corporation (CHK) credit outlook is the same type of analysis that powers our macro research detailed in the member-exclusive FA Alpha Pulse.