Despite a significant rise in speculative-grade debt refinancing and a slight decline in interest rates, banks continue to exercise caution in extending credit. In fact, even well-established companies are encountering challenges in securing refinancing. In today’s FA Alpha Daily, we delve into the findings of the Senior Loan Officer Opinion Survey (“SLOOS”), indicating a tightening of lending criteria.

FA Alpha Daily:

Monday Macro

Powered by Valens Research

Today’s business world is changing in ways we’ve seen in history, facing economic challenges and tighter credit conditions similar to past financial difficulties.

A key example from the past is Walt Disney’s (DIS) struggle to fund Disneyland during a recession, which mirrors the obstacles companies face today in securing financing.

Walt spent most of 1953 planning the park and trying to get funding. But the U.S. was in the middle of its third recession in a decade. Banks weren’t willing to take on the risk of such a big unknown during an economic slump… even for a company as established as Disney.

Walt was the founder and chief executive of a massive media company. If banks weren’t willing to work with him, it was bad news for the rest of corporate America.

This story is a small part of a bigger picture that shows how hard it is for companies to get credit today, as seen in the SLOOS.

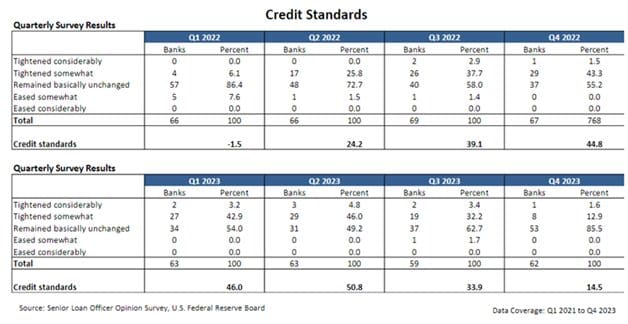

SLOOS is a poll conducted every quarter by Federal Reserve regulators… asking loan officers if their lending standards have tightened, loosened, or stayed the same over the past three months.

A negative number means that banks are making it easier to get credit overall. A positive number means they’re making it harder for customers to borrow.

The ratio has been extraordinarily high for much of the past few quarters. You almost never see a SLOOS reading above 40% without a recession… But it happened in both 2022 and 2023.

Take a look…

SLOOS data reveals it’s rare for banks to relax lending standards. Most banks have kept their strict criteria, showing widespread caution in the banking sector.

Despite a slight easing in lending standards recently, the overall situation has mostly stayed the same.

Banks are still treading cautiously and in the meantime, individuals and businesses will find it tough to borrow. Without access to credit, growth will struggle. Those who can’t refinance are running out of options.

Speculative-grade debt issuances began to pick up toward the end of 2023, as some businesses had to pay back maturing debt… even at unfavorable rates.

The five-year Treasury rate has been flirting with lows since last June… sitting at 3.8% in late December. As the 10-year sat at similar levels, companies finally embraced this might be the best they were going to get in terms of interest rates.

The result was a $125 billion spike in speculative-grade loan refinancing to start the year.

In January, total speculative loan issuances hit levels we haven’t seen since early 2020.

Companies issued more investment-grade bonds in January than in any month besides one in 2016 and one in 2020.

Companies have been fighting the idea of refinancing into significantly higher interest rates… until now.

In the past few months, we’ve seen a small drop in these rates. The 10-year Treasury now sits at 4.24%. That’s a material change from its 4.98% peak in October.

Rates are by no means low. But this small change has made companies think about refinancing.

Investors keep an eye on credit markets because they show how strong the economy is (or isn’t). This new refinancing activity has made them hopeful. They think it can help the U.S. economy avoid the coming recession.

But the SLOOS shows banks aren’t making it easier to get loans. Even though more companies are refinancing, it’s still going to be tough to get credit in 2024.

Businesses and investors alike are navigating a tricky financial environment. That’s not likely to change in the next few months. Strategic decision-making and careful planning are more crucial than ever.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

To see our best macro insights, become an FA Alpha and get access to FA Alpha Pulse.