The economy shows signs of improvement—low unemployment, cooling inflation, and potential interest rate cuts. Yet, a significant financial burden remains. In today’s FA Alpha Daily, we explore how student loan debt could weigh on the broader economy.

FA Alpha Daily

Powered by Valens Research

We’ve seen some encouraging data recently—unemployment is incredibly low relative to history at 4.1% and actually came down last month.

Inflation has largely started to cool off, with year-over-year CPI increases down to 2.4% last month.

On top of that, the potential for lower interest rates could give the economy a much-needed boost as we move into a rate-cutting cycle.

But even with this momentum, one issue remains unresolved. The student loan crisis is about to hit a major milestone.

Starting this month, student loan delinquencies will be reported to credit agencies again, meaning we’ll finally see the impact of this debt burden on the economy.

We talked last month about rising delinquency rates across other forms of consumer debt. Credit cards, auto loans, and personal loans are all seeing more and more people fall behind on their payments.

This trend began shortly after student loan repayments resumed last September, following the pandemic-era pause.

Although official reports on student loan delinquencies haven’t shown a significant spike yet, there are other signs that trouble is on the horizon.

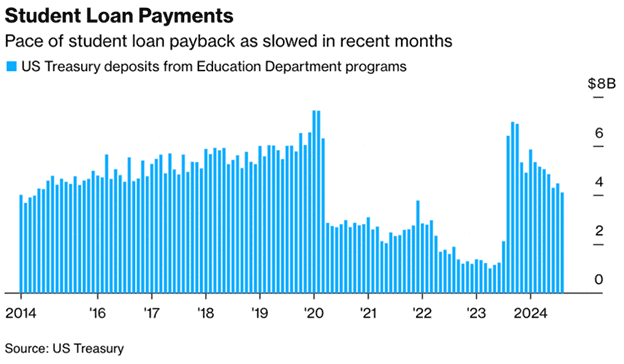

A key indicator comes from U.S. Treasury data, which tracks payments to the Department of Education, including Stafford Loans—federal loans that offer low-interest rates to help students pay for college.

Initially, when the forbearance period ended late last year, there was a surge in repayment activity.

Monthly payments jumped to about $7 billion, similar to pre-pandemic levels, as borrowers started catching up on what they owed.

For a brief moment, it seemed like things were stabilizing.

But that rebound didn’t last.

Payments have steadily declined over the past year, dropping to just $4 billion a month.

This sharp decrease suggests that a large number of borrowers are struggling to keep up with their obligations—likely due to financial strain as they juggle other rising costs.

Take a look…

Even though official data on student loan delinquencies hasn’t fully caught up, it’s clear that many people are finding it difficult to pay back their loans.

The pressure on consumers is mounting, and as this starts to show up in more reports, it’s likely to have a ripple effect across the broader economy.

The fact that student loan payments have fallen off so sharply is a flashing warning light.

As the official data starts to reflect these delinquencies, the financial pressure on consumers will become even clearer.

Despite some encouraging signs in the broader economy, the weight of student loan debt will keep dragging down households—and it’s only a matter of time before that pressure spreads to the market.

Investors need to pay attention. This is a sign that consumers are facing more stress than the headlines might suggest.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

To see our best macro insights, become an FA Alpha and get access to FA Alpha Pulse.