Participating in the landscaping business might lack potential unless pursued on a significant scale. Despite cyclical industry patterns, landscaping work remains steady year-round, spanning tasks from lawn care to snow services. Brightview (BV) exemplifies this approach, achieving consistently high returns by monopolizing regions through strategic acquisitions. In today’s FA Alpha Daily, let’s look at Brightview using Uniform Accounting to see its real earning power and determine how its M&A strategy drove its profitability.

FA Alpha Daily:

Thursday Uniform accounting analysis

Powered by Valens Research

Landscaping isn’t a great business — unless you can do it at scale.

Some landscaping companies manage to build themselves regional monopolies, at which point they have the scale to do it profitably.

Contrary to the cyclicality often associated with landscaping, the industry has proven to be a resilient and evergreen business model. Unlike crops that rely on favorable seasons, landscaping operates rain or shine, summer and winter alike.

While the sound of lawnmowers might be heard in the warmer months, the hum of snowplows takes over in winter. Moreover, it’s a mix of development and maintenance. Whether you are constructing new projects or nurturing established landscapes, you need landscaping services.

One name that towers over this verdant landscape of regional monopolies is BrightView (BV). It uses its scale in a unique way to generate high returns.

BrightView is the largest provider of commercial landscaping services in the U.S. Despite this, the company commands just a 2.5% share of the market.

It is not merely a landscaping business; it’s a force that reshapes the industry by acquiring smaller mom-and-pop landscape businesses at a fraction of their potential worth. This strategic move propels Brightview into the league of regional monopolies, where the acquired scale allows it to operate profitably across vast geographical expanses.

This isn’t a mere exercise in business expansion; it’s a sophisticated play that allows Brightview to maintain its stronghold and reap the benefits of monopoly-like returns.

It seems like the company’s profitability has been fading away in the past few years. The market seems to believe this trend will continue.

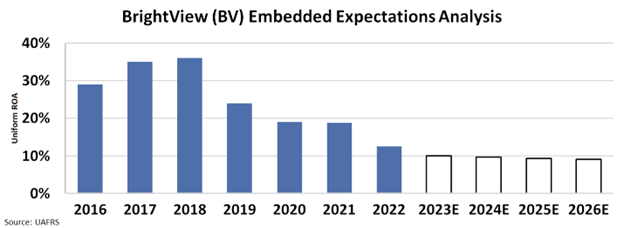

We can see this through our Embedded Expectations Analysis (“EEA”) framework.

The EEA starts by looking at a company’s current stock price. From there, we can calculate what the market expects from the company’s future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

At the current stock price, the market expects the company’s ROA to fall to 9%, which would be the lowest since 2016 when the company went public.

The market’s grim expectation is caused by faltering financials and macroeconomic headwinds. However, the market seems to not be aware of factors that make BrightView great…

The commercial landscaping industry presents a fragmented landscape offering both organic growth potential and opportunities for mergers and acquisitions.

With a mature business model backed by annual contracts that exhibit non-discretionary demand, BrightView showcases stability. Leveraging the power of scale, there’s room for operational enhancement and cost reduction.

The current strategic focus revolves around expanding their customer base, while simultaneously establishing a foothold in promising regions. Anticipating a 3%-4% revenue growth, the company aims to bolster margins through prudent expense reduction and role restructuring.

These factors will likely turn the company into a giant in a challenging industry…

The market’s pessimistic view of BrightView presents an opportunity for investors to invest in the company cheaply.

SUMMARY and BrightView Holdings Tearsheet

As the Uniform Accounting tearsheet for BrightView Holdings (BV:USA) highlights, the Uniform P/E trades at 22.3x, which is above its corporate average of 18.4x but around its historical P/E of 20.7x.

High P/Es require high EPS growth to sustain them. In the case of BrightView, the company has recently shown a 39% shrinkage in Uniform EPS.

Wall Street analysts provide stock and valuation recommendations that in general provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, BrightView’s Wall Street analyst-driven forecast is a 2% EPS growth in 2022 and a 27% EPS shrinkage in 2023.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify BrightView’s $8.30 stock price. These are often referred to as market embedded expectations.

The company is currently being valued as if Uniform earnings were to grow immaterial annually over the next three years. What Wall Street analysts expect for BrightView’s earnings growth is above what the current stock market valuation requires in 2022 but below its 2023 requirement.

Furthermore, the company’s earning power is 2x its long-run corporate average. Moreover, cash flows and cash on hand are below its total obligations—including debt maturities, capex maintenance, and dividends.

All in all, this signals average credit risk.

Lastly, BrightView’s Uniform earnings growth is above its peer averages and its average peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

The Uniform Accounting insights in today’s issue are the same ones that power some of our best stock picks and macro research, which can be found in our FA Alpha Daily newsletters.