The oil and gas industry has been on a roller coaster ride in recent years, plummeting during the pandemic and soaring to record highs amidst supply disruptions and surging demand. Permian Resources Corporation, a leading U.S. oil and gas producer, is capitalizing on this opportunity with an aggressive acquisition strategy. In today’s FA Alpha Daily, we will examine Permian Resources Corporation’s current risk rating and determine its true credit profile.

FA Alpha Daily:

Wednesday Credit

Powered by Valens Research

Cyclicality occurs when a sector’s business is closely tied to the macro environment. Commodity-exposed sectors such as oil and gas are generally cyclical as their prices are determined by supply and demand.

During economic expansions, demand for oil and gas increases, which drives up prices and profits for oil and gas companies. Consequently, during economic contractions, demand for oil and gas decreases, leading to lower prices and profits.

Exposure to the cyclical oil and gas sector means high returns during economic growth periods, but also high volatility. In rating agencies’ language, volatility typically means risk.

However, companies may also benefit from expansion periods by making wise investments that will mitigate the negative effects of future economic downturns.

Acquisitions can be a great example of such investments that allow a company to grow and survive financial hardships. Lots of companies expand their market by acquisitions of various sizes.

Permian Resources Corporation (PR) is a great example of such businesses. It is an independent oil and gas company focused on driving sustainable returns. The company’s assets are mostly located in Delaware and Midland sub-basins in the Southwest.

It was formed in September 2022 with a $4 billion merger deal between Centennial Resource Development and Colgate Energy Partners.

Permian Resources is known for its aggressive acquisition strategy, acquiring a number of high-quality assets and companies in the Permian Basin in the last few years.

Last month, the firm announced that it is planning another $4 billion acquisition of Earthstone Energy (ESTE), with the deal size being almost as big as the company’s own market capitalization.

Since the last merger deal, the company’s revenues have increased by 148% and gross margin has been up by 400 basis points. This indicates the company’s success in integrating its acquired firms and its ability to quickly and efficiently expand its operations.

Yet, rating agencies generally dislike aggressive growth strategies for cyclical companies as they can pose significant risks. The company’s recent large-scale acquisition adds to these risks, leading rating agencies to foresee a significant risk of default.

Due to these reasons, S&P has given Permian Resources a “B+” rating. This rating suggests a huge risk of default, around 24% over the next five years. It also places the company in the risky high-yield basket.

However, what rating agencies are also missing is that this recent large-scale acquisition was made as an all-stock transaction, meaning that Permian Resources is not paying that $4 billion in cash.

The only debt incurred is the acquired company’s net debt, which is not concerning at all compared to the free cash flow generation the combined company could reach going forward.

Here at Valens, we believe that the company deserves a more favorable credit rating, given its demonstrated success in acquisitions, and its strong financial outlook for the next five years.

We can figure out if there is a real risk for this company by leveraging the Credit Cash Flow Prime (“CCFP”) to understand how the company’s obligations match against its cash and cash flows.

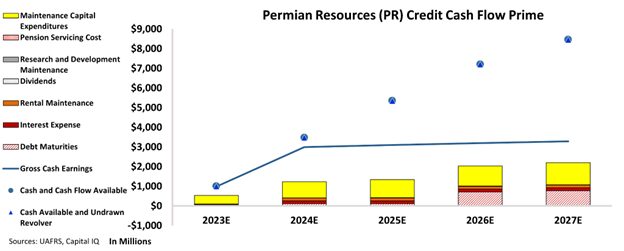

In the chart below, the stacked bars represent the firm’s obligations each year for the next five years. These obligations are then compared to the firm’s cash flow (blue line) as well as the cash on hand available at the beginning of each period (blue dots) and available cash and undrawn revolver (blue triangles).

The CCFP chart shows that Permian Resources’ cash flows are more than enough to serve all its obligations going forward.

The chart suggests that the company has a strong financial footing and should be able to meet its obligations without difficulty over the next five years.

The chart also takes into account the net debt incurred by Earthstone Energy, which amounts to slightly less than $1 billion.

To finance this debt, the company announced new senior notes which will be due in 2032. Additionally, it has secured a revolving credit facility to maintain ample liquidity going forward.

Considering that Permian Resources’ gross cash earnings alone reach over $2 billion and its cash flows have the potential to reach $8 billion by 2027, these obligations are easily manageable.

That’s why, we believe that Permian Resources is not facing a significant risk of default, as opposed to the rating agencies’ assessment.

Thus, we are giving an “IG3+” rating to the company. This rating ensures it is in the safer investment-grade basket and implies a risk of default of just around 1%.

It is our goal to bring forward the real creditworthiness of companies, built on the back of better Uniform Accounting.

To see Credit Cash Flow Prime ratings for thousands of companies, click here to learn more about the various subscription options now available for the full Valens Database.

SUMMARY and Permian Resources (PR:USA) Tearsheet

As the Uniform Accounting tearsheet for Permian Resources (PR:USA) highlights, the Uniform P/E trades at 7.5x, which is below the global corporate average of 18.4x but above its historical P/E of -65.5x.

Low P/Es require low EPS growth to sustain them. In the case of Permian Resources, the company has recently shown a 816% Uniform EPS shrinkage.

Wall Street analysts provide stock and valuation recommendations, that in general, provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, Permian Resources’ Wall Street analyst-driven forecast is for a 16% EPS shrinkage and a 135% EPS growth in 2023 and 2024, respectively.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify Permian Resources’ $13 stock price. These are often referred to as market-embedded expectations.

Furthermore, the company’s earning power in 2022 was 2x the long-run corporate average. Moreover, cash flows and cash on hand are 3x its total obligations—including debt maturities and capex maintenance.

Overall, this signals a low dividend risk.

Lastly, Permian Resources’ Uniform earnings growth is above its peer averages and is trading below its average peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

U.S. stocks are in CODE RED–and you’re about to learn why! We are inviting you to attend our upcoming event this Wednesday, October 4, 2023 at 12:00 PM CT to learn how to protect your wealth in the oncoming stock market crash.

This analysis of Permian Resources (PR)’s credit outlook is the same type of analysis that powers our macro research detailed in the member-exclusive FA Alpha Pulse.