Donald Trump’s return to the presidency signals a major shift in U.S. energy policy, with a renewed focus on fossil fuels and deregulation. Constellation Energy is poised to benefit from this shift, following its $27 billion acquisition of Calpine, which strengthens its natural gas and renewable energy portfolio. In today’s FA Alpha Daily, we examine whether this acquisition sets the stage for long-term growth or potential gains are already factored in its valuation.

FA Alpha Daily

Powered by Valens Research

The U.S. is set to see a significant shift in its energy policy with the return of Donald Trump to the presidency.

His administration is expected to prioritize traditional fossil fuels like oil and natural gas, rolling back several initiatives aimed at advancing renewable energy and electrification.

Trump’s plans include lifting restrictions on liquefied natural gas (LNG) exports, supporting domestic drilling, and possibly eliminating tax credits for electric vehicle purchases.

These changes align with his broader agenda of boosting energy independence, reducing regulatory burdens, and revitalizing the fossil fuel industry.

This policy direction, combined with Trump’s promise to declare an energy emergency to bypass Congressional hurdles, are great developments for E&P companies.

Constellation Energy (CEG) has announced its acquisition of Calpine in a $27 billion deal, combining cash, stock, and the assumption of Calpine’s debt.

This transformative move positions Constellation as one of the largest energy providers in the United States, strengthening its portfolio with low-emission natural gas generation and a broader mix of renewable energy sources.

Calpine, known for its efficient natural gas plants and leadership in geothermal energy, brings nearly 60 gigawatts of additional capacity to Constellation’s already robust operations.

The combined company will now span nuclear, natural gas, geothermal, hydro, solar, wind, and battery storage technologies, creating a balanced and reliable energy platform capable of meeting increasing demand across the country.

The U.S.’s energy exports to Europe have become more critical, particularly in light of ongoing geopolitical tensions.

With the prospect of a renewed focus on domestic energy independence under the incoming administration, Constellation is well-positioned to benefit from favorable policy.

Calpine’s expertise in carbon capture and sequestration technology further enhances the sustainability of its natural gas operations, ensuring that Constellation remains competitive as clean energy demand continues to grow.

The acquisition also strengthens the company’s geographic reach, particularly in Texas, which is experiencing some of the fastest-growing power demand in the United States.

By combining Constellation’s established nuclear energy expertise with Calpine’s low-emission natural gas and renewable energy capabilities, the company is better equipped to meet the challenges of the modern energy market.

Operationally, the acquisition is expected to deliver significant benefits. Constellation projects more than $2 billion in annual free cash flow from the transaction.

The addition of 2.5 million retail customers from Calpine further enhances the company’s ability to offer tailored energy solutions, helping customers manage costs and achieve their sustainability goals.

The market already reacted positively to the news with Constellation’s stock rising 30% since the start of the year.

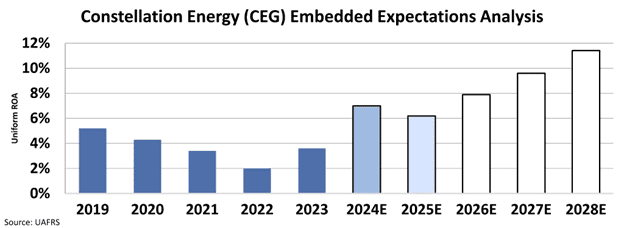

We can also see this through our Embedded Expectations Analysis (“EEA”) framework.

The EEA starts by looking at a company’s current stock price. From there, we can calculate what the market expects from the company’s future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

At the current stock price, the market predicts that the company’s Uniform return on assets ”ROA” will increase to around 11% from 4% last year.

While this acquisition positions Constellation Energy in a strong place, benefiting from the continued resilience of natural gas as a key energy source, our analysis shows that the company is projected to achieve ROA levels not seen since 2009.

Furthermore, the company currently trades at an all-time high Uniform P/E of 37.5x.

This paints a very optimistic picture of Constellation’s potential to deliver value in the coming years.

However, investors should remain cautious and consider upside from these developments may be already priced in with elevated valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Officer &

Director of Research

at Valens Research

Today’s analysis highlights the same insights we share with our FA Alpha Members. If you want to an get in-depth analysis of market trends and uncover undervalued stocks, become an FA Alpha Member today.