Following the Russian invasion of Ukraine in 2022, Atlas Energy Solutions (AESI) benefitted from the ensuing global energy crisis. As a result, the company generated significant growth in revenue and profitability. In today’s FA Alpha Daily, we explore how AESI strategically navigated the energy crisis, capitalizing on the surge in oil prices and positioning itself for sustained success.

FA Alpha Daily:

Wednesday Credit

Powered by Valens Research

The Russian invasion of Ukraine in 2022 triggered a major global energy crisis that continues to reshape international fuel markets.

By disrupting Russian natural gas exports to Europe, the conflict spurred sharp rises in the prices of oil, LNG, and other hydrocarbons. This crisis has significantly benefited leading energy services providers operating in key North American shale basins.

Atlas Energy Solutions (AESI) is one of the top firms capitalizing on opportunities arising from global energy market disruptions.

The company provides proppant, frac sand, and integrated logistics services to oil and gas producers throughout the Permian Basin in West Texas and New Mexico.

In the twelve months following the invasion, benchmark international oil prices averaged over $100/barrel, supporting increased drilling and completion activity in the Permian.

Atlas reported strong financial results, with full-year 2023 revenues of $614 million, up 250% since 2021. Net income grew to $162 million from $4 million over this period, while Uniform return on assets (”ROA”) jumped to 24% from 11%.

To further scale its integrated platform, in February 2024, Atlas acquired Hi-Crush for $450 million, adding substantial frac sand production assets and logistics infrastructure across multiple basins.

The deal expanded Atlas’ total proppant capacity to over 15 million tons per year and cemented its leadership position in the Permian.

Goldman Sachs analysts predict European oil demand could increase by over 1 million barrels per day through 2024 as the region seeks to replace lost Russian supply. This bodes well for continued drilling activity levels in key shale plays.

Going forward, Atlas is well-positioned to capitalize on projected multi-year strength in global hydrocarbon consumption and prices.

The company’s integrated Permian Basin platform provides essential energy services to top E&P operators, while its scale and low-cost assets generate significant free cash flow even at lower price points.

This positions Atlas to deliver strong returns for shareholders over the long term.

That is why it is a great FA Alpha 50 name.

Throughout financial market history, many of the world’s most successful investors have been candid in their belief that Generally Accepted Accounting Principles (“GAAP”) distort economic reality.

Warren Buffett, for example, once said investors should “concentrate on the world of companies, not arcane accounting mathematics.”

Investors who neglect the very real issues with as-reported accounting can find themselves caught up in investing with the crowd, blindly following hot “themes” without a thorough grasp of how to understand the businesses in question.

The only true way to focus on the “world of companies,” as Buffett suggests investors do, is to present a clear picture of how a business operates, something that can only be done by adjusting financial statements to reflect the arbitrary nature of certain accounting rules that leave much to discretion.

The world’s best investors understand the need to make these adjustments, which allows them to focus not on picking out the most popular companies but rather on looking for great names in sleepy areas that the market isn’t paying much attention to. From there, the goal is to then identify quality companies with significant growth potential at reasonable prices.

That’s exactly what we’ve set out to do with the FA Alpha, our monthly list of 50 companies that rank at the top for quality, high growth, and low valuations.

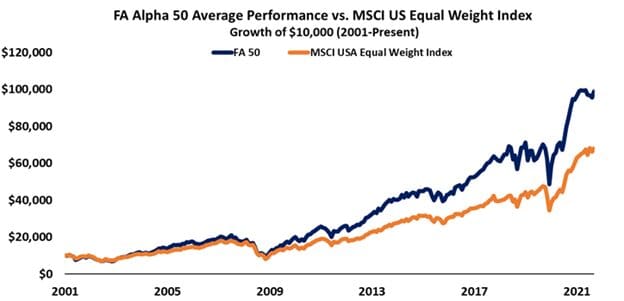

This list has outperformed the market by 300 basis points per year for over 20 years now, effectively doubling the performance of the market by focusing on the real fundamentals and valuations of companies with our proprietary Uniform Accounting framework.

See for yourself below.

To see the other 49 names on the list, click here.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

This analysis of Atlas Energy Solutions (AESI)’s credit outlook is the same type of analysis that powers our macro research detailed in the member-exclusive FA Alpha Pulse.