As digitalization continues, cashless payment systems are becoming increasingly important, and payment processing companies, like Shift4 Payments (FOUR), will benefit greatly from this trend. Despite being one of the most successful payment processors in the U.S., Shift4 has been given a high default risk rating by rating agencies that seem to be overlooking the benefits of the cashless trend. In today’s FA Alpha, let’s analyze Shift4 using Uniform Accounting to see if rating agencies are right about categorizing this company as a high-risk name.

FA Alpha Daily:

Wednesday Credit

Powered by Valens Research

The world is inevitably transitioning into becoming a cashless, paperless society due to the digitization of money and developing payment systems.

As we move into this transformation, we don’t only need banks or card networks like Visa (V) and Mastercard (MA). We also need payment processors that connect merchants, merchant banks, card networks, and consumers to make card payments possible.

This is where Shift4 Payments (FOUR), a niche payment processor, comes in.

Instead of dividing its focus for any industry that needs payment solutions, Shift4 primarily focuses on the lodging and restaurant industries.

The company makes around 40% of the transaction volume in the lodging industry and 16% in the restaurant industry.

Additionally, the company provides an all-in-one platform for businesses to manage their digital operations.

The offerings through the platform include a business intelligence dashboard, loyalty programs, waitlist and reservation management, and CRM tools.

Through the platform and its technology solutions, the company is transitioning its customers from its lower-margin gateway payment processing business to higher-margin end-to-end solutions. Doing so simplifies the customer’s business and cuts out the competition for Shift4.

The company is highly successful in this conversion too. The 3-year compounded annual growth rate (CAGR) for its end-to-end solutions volume is 47%, which is a remarkable growth.

Moreover, the company plans to expand into new but similar markets like retail, casinos, and sports and entertainment facilities to drive further revenue and profitability growth.

However, rating agencies like Moody’s do not recognize the tailwinds the company has and rate it “B2” which implies a 25% chance of bankruptcy. That is too much credit risk considered for Shift4.

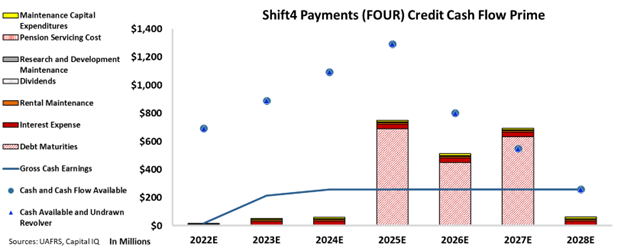

We can figure out if there is a real risk for this company by leveraging the Credit Cash Flow Prime (“CCFP”) to understand the company’s obligations matched against its cash and cash flows.

In the chart below, the stacked bars represent the firm’s obligations each year for the next five years. These obligations are then compared to the firm’s cash flow (blue line) as well as the cash on hand available at the beginning of each period (blue dots) and available cash and undrawn revolver (blue triangles).

The CCFP chart shows that Shift4 Payments’ cash flows are higher than its obligations going forward.

CCFP chart indicates that the company has sufficient cash and cash flows to cover its obligations. Only in 2027 do we see its cash flows are lower than its obligations, but until that time, the company can refinance and continue its growth trajectory.

On top of that, Shift4 is benefitting from a few huge tailwinds, including the digitization of money, its strong position in the restaurant and hospitality industries, transitioning its clients to higher-margin end-to-end solutions, and also its success in growing into new markets.

However, rating agencies such as Moody’s fail to see these tailwinds and rate the company with a 25% chance of default.

Here, at Valens, we think that this credit rating is not reasonable for the company and we’re rating it “XO” which implies a much safer credit risk.

It is our goal to bring forward the real creditworthiness of companies, built on the back of better Uniform Accounting.

To see Credit Cash Flow Prime ratings for thousands of companies, click here to learn more about the various subscription options now available for the full Valens Database.

SUMMARY and Shift4 Payments (FOUR:USA) Tearsheet

As the Uniform Accounting tearsheet for Shift4 Payments (FOUR:USA) highlights, the Uniform P/E trades at 21.6x, which is above the global corporate average of 18.4x but below its historical P/E of 28.9x.

High P/Es require high EPS growth to sustain them. In the case of Shift4 Payments, the company has recently shown a 33% Uniform EPS shrinkage.

Wall Street analysts provide stock and valuation recommendations that in general provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, Shift4 Payments’ Wall Street analyst-driven forecast is for a 44% and 36% EPS growth in 2022 and 2023, respectively.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify Shift4 Payments’ $66 stock price. These are often referred to as market embedded expectations.

Furthermore, the company’s earning power in 2021 was 5x the long-run corporate average. Moreover, cash flows and cash on hand are 2x its total obligations—including debt maturities and capex maintenance. The company also has an intrinsic credit risk that is 100bps above the risk-free rate.

Overall, this signals a moderate credit risk.

Lastly, Shift4 Payments’ Uniform earnings growth is in line with its peer averages and is trading above its average peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

This analysis of Shift4 Payments (FOUR) credit outlook is the same type of analysis that powers our macro research detailed in the member-exclusive FA Alpha Pulse.