The U.S. government has declared a decade-long investments in infrastructure and supply chain. This would drive demand for companies like Atkore’s (ATKR), a leading provider of electrical, safety, and infrastructure solutions. In today’s FA Alpha Daily, we will examine market’s expectations for Atkore and what makes it a great stock name.

FA Alpha Daily:

Tuesday Company Specific

Powered by Valens Research

For a while, the U.S. has been criticized for underinvesting in its infrastructure and supply chains, with aging roads, bridges, airports, and utilities often falling behind international standards.

This lack of investment not only posed safety concerns but also hindered economic growth and efficiency. This became increasingly apparent during the pandemic as orders got canceled, lead times got extended, and manufacturers could not find the raw materials essential for their processes.

However, in recent times, there’s been a notable shift. Recognizing the urgent need for modernization and the potential economic benefits, the U.S. government has begun to prioritize and ramp up infrastructure investments.

The government is aiming to restore the nation’s global competitive edge and ensure sustainable growth for the future.

Most notably, the U.S. government has passed significant legislative packages allocating billions of dollars toward infrastructure projects, such as the Infrastructure Investment and Jobs Act.

On top of this, there has also been a growing trend of nearshoring, where companies are relocating their manufacturing and production operations closer to their primary markets.

We are only at the beginning of a decade-long investment period in infrastructure and supply chains.

There are a few companies that stand to benefit from these investments and Atkore (ATKR) is one of them.

Atkore is a leading provider of cables and products to protect them including conduits and pipes.

Cables are needed everywhere, from the most technologically advanced solutions to basic warehouses. Each infrastructure project needs them, meaning that the heightened infrastructure investments and nearshoring are likely to translate to high demand for Atkore.

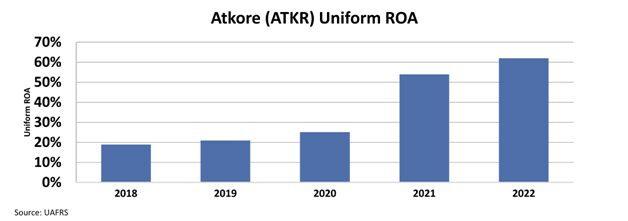

This high demand has already started as investments started to ramp up. Atkore’s Uniform return on assets (“ROA”) jumped from 25% in 2020 to 54% in 2021 and then to 62% in 2022.

The chart shows that the company performed incredibly well as infrastructure spending and reshoring trends have grown. Clearly, as these trends continue, Atkore should continue performing well.

And yet, the market fails to recognize this opportunity.

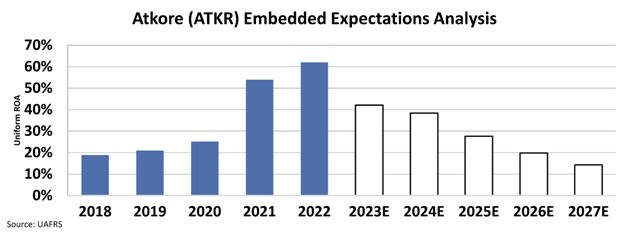

We can see this through our Embedded Expectations Analysis (“EEA”) framework.

The EEA starts by looking at a company’s current stock price. From there, we can calculate what the market expects from the company’s future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

At the current stock price, the market expects the company’s ROA to fall below 20%, assuming the demand will collapse.

Given the growth of infrastructure spending from the U.S. government, expansion of nearshoring, and the company’s essential position among these trends, these expectations seem overly pessimistic.

Atkore has substantial potential to continue growing its capabilities and continue benefiting from the continuous growth in infrastructure spending and nearshoring.

That is why Atkore showed up on our screen. The company makes a great FA Alpha 50 name due to its potential for high returns and low expectations from the market.

Throughout financial market history, many of the world’s most successful investors have been candid in their belief that Generally Accepted Accounting Principles (“GAAP”) distort economic reality.

Warren Buffett, for example, once said investors should “concentrate on the world of companies, not arcane accounting mathematics.”

Investors who neglect the very real issues with as-reported accounting can find themselves caught up in investing with the crowd, blindly following hot “themes” without a thorough grasp of how to understand the businesses in question.

The only true way to focus on the “world of companies,” as Buffett suggests investors do, is to present a clear picture of how a business operates, something that can only be done by adjusting financial statements to reflect the arbitrary nature of certain accounting rules that leave much to discretion.

The world’s best investors understand the need to make these adjustments, which allows them to focus not on picking out the most popular companies but rather on looking for great names in sleepy areas that the market isn’t paying much attention to. From there, the goal is to then identify quality companies with significant growth potential at reasonable prices.

That’s exactly what we’ve set out to do with the FA Alpha, our monthly list of 50 companies that rank at the top for quality, high growth, and low valuations.

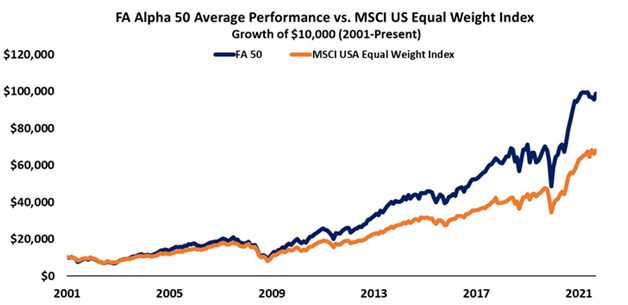

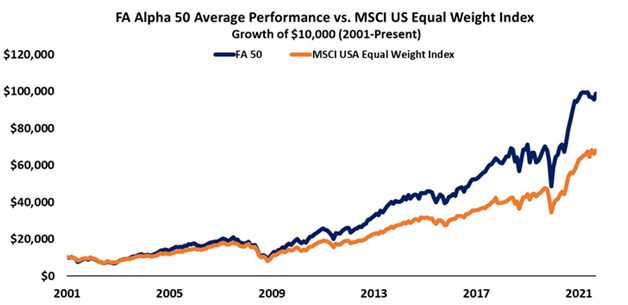

This list has outperformed the market by 300 basis points per year for over 20 years now, effectively doubling the performance of the market by focusing on the real fundamentals and valuations of companies with our proprietary Uniform Accounting framework.

See for yourself below.

To see the other 49 names on the list, click here.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

We are inviting you to attend FA Alpha’s upcoming CAIA Hong Kong event on Wednesday, 11/1, at 6:30 PM HKT to learn about the latest macroeconomic trends affecting the global economy.

Today’s highlight, Atkore (ATKR) is one of the top stock picks from FA Alpha 50 this month. To see more stock picks like this, become an FA Alpha and get access to FA Alpha 50.