Amid economic worries, investors favor recession-resistant companies with essential products. ResMed (RMD), a global leader in respiratory health solutions, remains a key player in the healthcare sector. Despite potential economic challenges, its stable revenues and post-pandemic recovery make it an appealing choice for investors seeking stability in uncertain times. In today’s FA Alpha Daily, we’ll analyze ResMed’s resilience and strategic positioning in the challenging market environment.

FA Alpha Daily:

Thursday Uniform accounting analysis

Powered by Valens Research

With many economists forecasting an increased likelihood of a recession in the coming year, investors are understandably growing more risk-averse.

In periods of economic uncertainty, it pays to focus on “recession-proof” companies offering essential products and services that continue seeing strong demand even during downturns.

There are a few key attributes that make certain businesses more defensive during recessions.

Demand for their offerings is non-discretionary, meaning customers must buy regardless of their broader financial situation.

Revenue streams exhibit high visibility and are recurring in nature. The companies also typically hold strong competitive positions in their industries.

One sector that often fits this defensive profile is healthcare.

With an aging population and recurring medical needs, many healthcare businesses enjoy revenue streams that hold steady regardless of the broader economy.

One such business is ResMed (RMD), a global leader in digital health and medical device solutions for respiratory disorders like sleep apnea and chronic obstructive pulmonary disease (“COPD”).

ResMed develops and markets a wide range of medical devices, masks, and other equipment that patients rely on to treat their conditions. It also offers cloud-based software platforms that enable remote patient monitoring and management of care.

Conditions like sleep apnea and COPD require ongoing management, as patients can face serious health consequences if left untreated.

This means demand for ResMed’s products and solutions is non-discretionary in nature. Regardless of the economic environment, patients will continue using the company’s products to receive the treatment they need.

In addition, ResMed enjoys high revenue visibility through recurring income streams that provide stability.

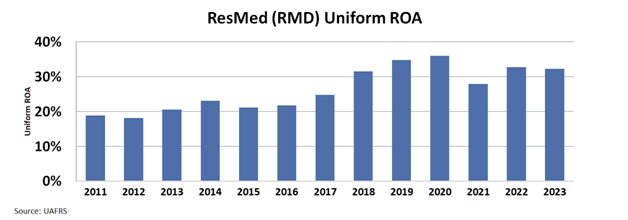

The company has managed to increase its profitability consistently over the last decade. While it struggled in 2021 right after the pandemic, Uniform ROA recovered fast and reached above 30%.

However, the market is concerned about weight loss drugs decreasing the number of patients significantly. Obesity narrows the airway and is one of the big causes of sleep apnea. Losing weight can help patients suffering from this condition.

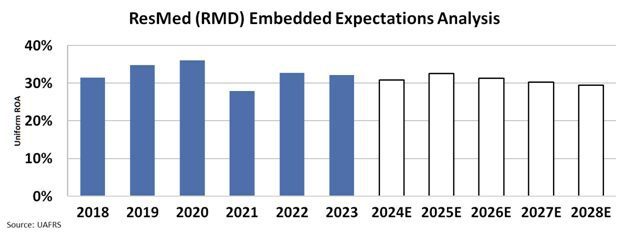

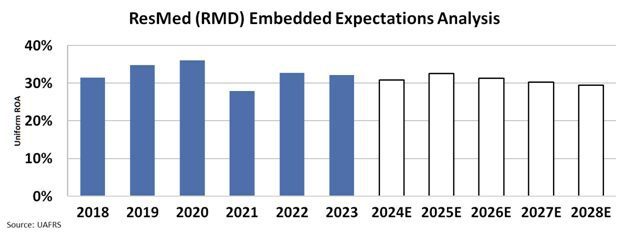

We can see what the market thinks through our Embedded Expectations Analysis (“EEA”) framework.

The EEA starts by looking at a company’s current stock price. From there, we can calculate what the market expects from the company’s future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

At the current stock price, the market expects the company’s ROA to slightly fall from 32% in 2023 to 29%.

While obesity is indeed a big cause of sleep apnea, it will take a long time for the weight loss drugs to significantly affect the number of these patients.

In the meantime, ResMed continues to service existing patients and enjoy high profitability.

While no business is entirely recession-proof, ResMed looks well-positioned to weather an economic storm relative to more cyclical names.

For investors seeking shelter, ResMed may deserve a closer look.

SUMMARY and ResMed Inc Tearsheet

As the Uniform Accounting tearsheet for ResMed Inc (RMD:USA) highlights, the Uniform P/E trades at 22.3x, which is above its global corporate average of 18.4x but below its historical P/E of 30.7x.

High P/Es require high EPS growth to sustain them. In the case of ResMed, the company has recently shown a 9% growth in Uniform EPS.

Wall Street analysts provide stock and valuation recommendations that in general provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, ResMed’s Wall Street analyst-driven forecast is a 5% and 11% EPS growth in 2024 and 2025, respectively.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify ResMed’s $162.87 stock price. These are often referred to as market embedded expectations.

The company is currently being valued as if Uniform earnings were to grow 2% annually over the next three years. What Wall Street analysts expect for ResMed’s earnings growth is above what the current stock market valuation requires through 2025.

Furthermore, the company’s earning power is 5x its long-run corporate average. Moreover, cash flows and cash on hand are 2x its total obligations—including debt maturities, capex maintenance, and dividends. Also, the company’s intrinsic credit risk is 80bps above the risk-free rate.

All in all, this signals low credit risk.

Lastly, ResMed’s Uniform earnings growth is below its peer averages but above its average peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

The Uniform Accounting insights in today’s issue are the same ones that power some of our best stock picks and macro research, which can be found in our FA Alpha Daily newsletters.