The demand for healthy snacks has greatly expanded as working from home has gained popularity throughout the world. Businesses like BellRing Brands (BRBR) benefitted from meeting this demand. In today’s FA Alpha, we’ll see how the company’s profitability measures up against total obligations.

FA Alpha Daily:

Wednesday Credit

Powered by Valens Research

The pandemic has changed our lives in many ways, and arguably the most important thing that came into our lives was the increasing popularity of working from home.

For most people, it is good to work from home to be in your comfort zone and to arrange your daily routine without the stress of going to the office.

However, there are challenges to working from home as well. For instance, you need to prepare or order some food while you have strict deadlines and online meetings.

People soon found a solution to this challenge through healthy snacks and ready-to-drink beverages.

With its increasingly popular protein and sports nutrition products, BellRing has given what people needed.

The company significantly benefited from this surge in demand. It has seen a massive jump in its profitability. In 2020 BellRing’s return on assets (ROA) was around 70% while in 2021, its ROA rose above 107%.

Yet, the credit rating agencies seem to miss the soaring demand and improved profitability the company has seen in the last two years as they give a rating that implies a 25% chance of bankruptcy.

This would be too much risk considered for BellRing. For some reason, perhaps misunderstanding the company’s actual market cap due to Post Holdings (POST) closely held shares or other reasons, rating agencies don’t recognize how safe it is.

We can figure out if there is a real risk for this company by leveraging the Credit Cash Flow Prime (“CCFP”) to understand the company’s obligations matched against its cash and cash flows.

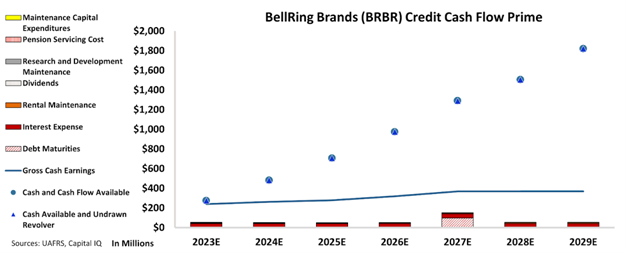

In the chart below, the stacked bars represent the firm’s obligations each year for the next five years. These obligations are then compared to the firm’s cash flow (blue line) as well as the cash on hand available at the beginning of each period (blue dots) and available cash and undrawn revolver (blue triangles).

The CCFP chart shows that BellRing’s cash flows are much higher than its obligations going forward.

CCFP chart indicates that the company has growing gross earnings and stable cash flows that maintain a healthy balance sheet.

In addition, it has no obligations and significant debt headwalls that could stress the company’s capital structure and its creditors.

Considering its rising profitability and demand, coupled with its balance sheet health implies a much safer credit risk for the company.

That is why, we are giving an IG4 rating to the company, which states a slightly below 2% chance of default.

It is our goal to bring forward the real creditworthiness of companies, built on the back of better Uniform Accounting.

To see Credit Cash Flow Prime ratings for thousands of companies, click here to learn more about the various subscription options now available for the full Valens Database.

SUMMARY and BellRing Brands (BRBR:USA) Tearsheet

As the Uniform Accounting tearsheet for BellRing Brands (BRBR:USA) highlights, the Uniform P/E trades at 13.7x, which is below the global corporate average of 18.4x, and its historical P/E of 16.5x.

Low P/Es require low EPS growth to sustain them. In the case of BellRing, the company has recently shown a 38% Uniform EPS shrinkage.

Wall Street analysts provide stock and valuation recommendations that in general provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, BellRing’s Wall Street analyst-driven forecast is for a 0% and 16% EPS growth in 2023 and 2024, respectively.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify BellRing’s $25 stock price. These are often referred to as market embedded expectations.

Furthermore, the company’s earning power in 2022 was 11x the long-run corporate average. Moreover, cash flows and cash on hand are 6x its total obligations—including debt maturities and capex maintenance. The company also has an intrinsic credit risk that is 320bps above the risk-free rate.

Overall, this signals a moderate credit risk.

Lastly, BellRing’s Uniform earnings growth is in line with its peer averages and is trading below its average peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

This analysis of BellRing Brands (BRBR) credit outlook is the same type of analysis that powers our macro research detailed in the member-exclusive FA Alpha Pulse.