Amid economic uncertainty and potential interest rate cuts, Karat Packaging (KRT) stands out in consumer staples. Despite market concerns, Karat’s resilience and essential products make it a compelling choice for stability. In today’s FA Alpha Daily, we will delve into Karat’s strength, market outlook, and its potential as a long-term investment.

FA Alpha Daily:

Thursday Uniform accounting analysis

Powered by Valens Research

While the Federal Reserve is signaling that it will likely cut interest rates in 2024, the economic outlook remains uncertain.

Many experts are questioning whether the Fed will be able to achieve a soft landing – slowing growth just enough to bring inflation down without causing a recession.

Both the stock market and economic output continue to exhibit volatility, making it difficult to predict the near-term trajectory.

The Fed’s policy decisions are influenced by various factors, including inflation rates, geopolitical events, and economic indicators like unemployment and consumer confidence.

Currently, the U.S. unemployment rate stands at 3.7%, a slight increase from when the Fed began raising rates. This suggests a relatively stable job market, which could influence the Fed’s rate decisions. Moreover, the composition of the Federal Reserve’s voting members in 2024 may lead to different policy decisions compared to previous years.

Given this uncertainty, investors are seeking companies that can withstand a downturn and continue generating cash flows even if broader conditions weaken.

One industry that often holds up well is consumer staples – producers of everyday goods that people continue to purchase regardless of the economic climate.

One good example is Karat Packaging (KRT). It is a leading manufacturer of disposable food service products, and is well positioned as a defensive stock during a potential slowdown.

The company produces single-use items like food containers, bags, cutlery, cups, and lids made from plastic, paper, biopolymers, and other compostable materials. These products are used in restaurants, cafeterias, grocery stores, and other food service settings.

Karat has strong relationships with major restaurant chains and food retailers.

Its wide selection of products allows customers to source all of their disposable ware needs from a single provider. This stickiness makes it difficult for competitors to gain market share, even during downturns. The non-discretionary nature of Karat’s product portfolio provides downside protection.

We can see these factors already in effect…

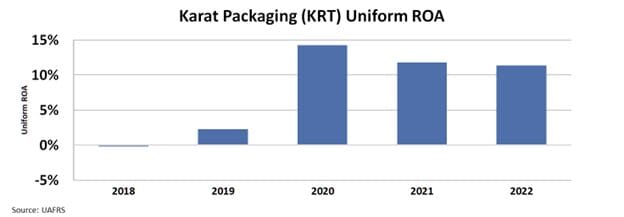

While the company struggled in 2018 and 2019, the Uniform ROA recovered fast from 0% and stayed above 10% in the last three years.

During the economic downturn caused by the pandemic in 2020, Karat showed stellar performance with a 14% ROA. This is proof of the company’s resilience during troubling times.

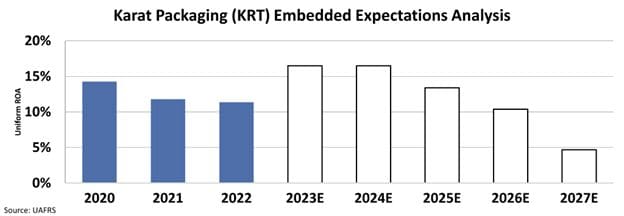

However, the market expectations for Karat look very pessimistic.

We can see what the market thinks through our Embedded Expectations Analysis (“EEA”) framework.

The EEA starts by looking at a company’s current stock price. From there, we can calculate what the market expects from the company’s future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

At the current stock price, the market expects the company’s ROA to fall to below 5%.

Despite all the negative expectations, Karat presents a compelling long-term investment opportunity for weathering an economic slowdown.

As the pivotal player in an essential industry, it combines defensive characteristics like recession-proof demand, pricing power, and cost advantages and still offers shareholders upside from ongoing growth initiatives.

Karat may be the right name for investors looking for protection from recession.

SUMMARY and Karat Packaging Tearsheet

As the Uniform Accounting tearsheet highlights, the Uniform P/E trades at 13.4x, which is below its global corporate average of 18.4x but around its historical P/E of 11.8x.

Low P/Es require low EPS growth to sustain them. In the case of Karat Packaging, the company has recently shown a 26% growth in Uniform EPS.

Wall Street analysts provide stock and valuation recommendations that in general provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, Karat Packaging’s Wall Street analyst-driven forecast is a 54% and 2% EPS growth in 2023 and 2024, respectively.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify Karat Packaging’s $23.74 stock price. These are often referred to as market embedded expectations.

The company is currently being valued as if Uniform earnings were to grow 4% annually over the next three years. What Wall Street analysts expect for Karat Packaging’s earnings growth is above what the current stock market valuation requires in 2023 but below its 2024 requirement.

Furthermore, the company’s earning power is 2x its long-run corporate average. Moreover, cash flows and cash on hand are 3x its total obligations—including debt maturities, capex maintenance, and dividends.

All in all, this signals low dividend risk.

Lastly, Karat Packaging’s Uniform earnings growth is above its peer averages but in line with its average peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

The Uniform Accounting insights in today’s issue are the same ones that power some of our best stock picks and macro research, which can be found in our FA Alpha Daily newsletters.