Inflation has been a buzzword for some time and has impacted industries in various ways. However, labor cost inflation is detrimental to all industries, particularly those in the restaurant and retail sectors that rely on low-wage groups. Cracker Barrel Old Country Store (CBRL) is a prime example of a company struggling with post-pandemic recovery due to increased labor costs. Despite this, the market remains overly optimistic about its profitability. In today’s FA Alpha Daily, we’ll delve deeper into CBRL to assess whether it can meet the market’s high expectations.

FA Alpha Daily:

Thursday Uniform accounting analysis

Powered by Valens Research

We have been dealing with inflation for quite some time.

There are different views on why this happened, but it seems the quantitative easing actions, the Russian invasion of Ukraine, and the scarcity of demanded goods all had impacts.

The Fed has been increasing rates as a response to this rising inflation and seems determined to beat it.

While this could mean a return to normal in the long run, different industries have either benefited from or been impacted negatively by it.

In general, companies providing goods and services that customers must buy regardless of the change in prices were happy. Consumer staples companies, for example, prospered as their gross margins skyrocketed.

However, there is one part of inflation that hurts all industries… That is labor cost inflation.

The last two years of labor scarcity have been great for low-end wage growth as they have finally gotten pricing power.

But it has also meant serious challenges for the profits of companies that rely on them. That has been the case in particular in the restaurant and retail space.

A great example of that is Cracker Barrel Old Country Store (CBRL). The company operates restaurants with gift shops.

It was one of the companies that were severely impacted by the lockdowns, as no one could go out to spend time in its stores for a long time.

It has hoped to recover from the pandemic hits it took as people started going out again, only to see margins continue to be under pressure because of labor cost inflation.

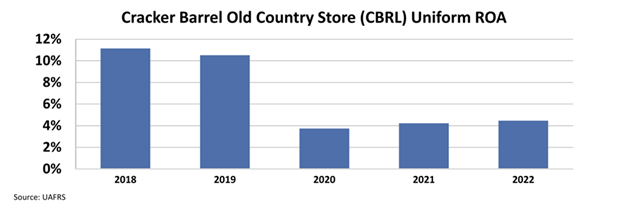

Its Uniform return on assets (“ROA”) fell immensely from above 10% in 2019 to below 4% in 2020. The recovery they expected was much stronger, but returns have only increased to just above 4% through 2022.

The company has had difficult times. However, this doesn’t necessarily mean it is a bad investment.

On the contrary, some investors like these stories when companies have taken a big hit and are recovering.

We need to understand what the market thinks about the company to be able to say if there could be upside opportunities.

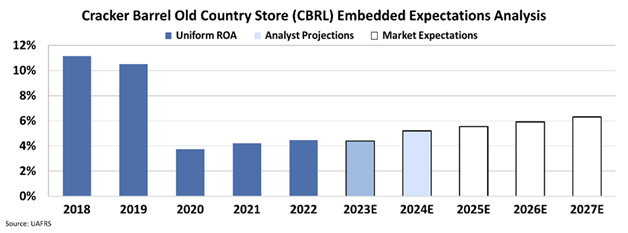

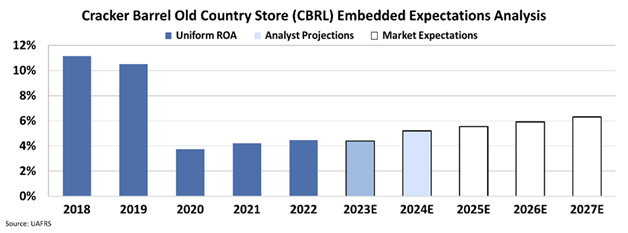

We can see this through our Embedded Expectations Analysis (“EEA”) framework.

The EEA starts by looking at a company’s current stock price. From there, we can calculate what the market expects from the company’s future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

At around $112 per share, the market expects the company’s ROA to surge to above 6%.

While the expected ROA is far below what Cracker Barrel generated pre-pandemic, it still looks over-optimistic considering the inflationary pressures.

The problem that has prevented a full recovery is only worse, and labor cost inflation is higher.

That has kept returns weak after the pandemic and is likely to continue to hurt any recovery.

Investors should be careful investing in the stock and observe what the company is doing to mitigate the impacts of rising inflation.

SUMMARY and Cracker Barrel Old Country Store, Inc. Tearsheet

As the Uniform Accounting tearsheet for Cracker Barrel Old Country Store, Inc. (CBRL:USA) highlights, the Uniform P/E trades at 29.1x, which is above the corporate average of 18.4x but below its historical P/E of 32.2x.

High P/Es require high EPS growth to sustain them. In the case of Cracker Barrel, the company has recently shown a 102% growth in Uniform EPS.

Wall Street analysts provide stock and valuation recommendations that in general provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, Cracker Barrel’s Wall Street analyst-driven forecast is a 5% and 24% EPS growth in 2023 and 2024, respectively.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify Cracker Barrel’s $113 stock price. These are often referred to as market embedded expectations.

The company is currently being valued as if Uniform earnings were to grow by 9% annually over the next three years. What Wall Street analysts expect for Cracker Barrel’s earnings growth is below what the current stock market valuation requires in 2023 but above its 2024 requirement.

Furthermore, the company’s earning power is below its long-run corporate average. Moreover, cash flows and cash on hand are below its total obligations—including debt maturities, capex maintenance, and dividends. Also, the company’s intrinsic credit risk is 230bps above the risk-free rate.

All in all, this high dividend risk.

Lastly, Cracker Barrel’s Uniform earnings growth is in line with its peer averages and its average peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

The Uniform Accounting insights in today’s issue are the same ones that power some of our best stock picks and macro research, which can be found in our FA Alpha Daily newsletters.