People are bringing back proper hygiene routines as they return to doing outdoor activities. Premium hair care companies like Olaplex Holdings (OLPX) greatly benefit from the returning demand for hygienic products. Today’s FA Alpha, we will uncover the company’s growth potential and profitability that the market failed to recognize.

FA Alpha Daily:

Tuesday Company Specific

Powered by Valens Research

Sadly, not everyone kept such good hygiene during the pandemic. Daily showers became every other day, clothes went unironed and less frequently washed, and many of us simply weren’t looking our best.

People have been just getting by on taking care of themselves and ignoring how they looked or how clean they were.

However, the world is returning to normal again. People have to return to the office, and we can freely meet friends at bars and go on vacations.

Especially as we head into the holidays, that means a lot of people are going to rush to return to their normal hygiene routines.

That means booming demand and more money for companies like Olaplex Holdings (OLPX). The company makes premium hair care products such as shampoos and conditioners. The product portfolio also includes solutions for skin care and nail health.

It is a relatively new company, which was founded in 2014. It went public in September 2021 and got on the radar of many investors and consumers alike.

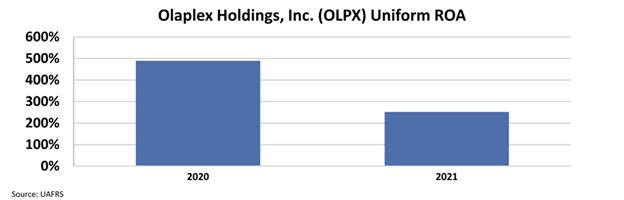

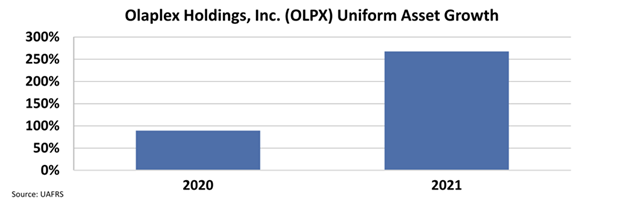

The company’s profitability is off the charts. Its Uniform return on assets (“ROA”) dropped from 490% in 2020 to 250% in 2021, but this is because of the massive asset growth it had. In 2021, Olaplex’s assets grew by 268%.

This asset growth helped Uniform earnings double in only a year from 2020 to 2021.

However, the market has been ignoring this massive growth, huge profitability, and the back-to-normal trend that would affect the business very positively.

Instead, investors are focused on questions about consumption, resulting in unrealistically low valuations.

The high quality, high growth, impressive returns, and low valuation means that Olaplex Holdings was a great company to become an FA Alpha name.

Throughout financial market history, many of the world’s most successful investors have been candid in their belief that Generally Accepted Accounting Principles (“GAAP”) distort economic reality.

Warren Buffett, for example, once said investors should “concentrate on the world of companies, not arcane accounting mathematics.”

Investors who neglect the very real issues with as-reported accounting can find themselves caught up in investing with the crowd, blindly following hot “themes” without a thorough grasp of how to understand the businesses in question.

The only true way to focus on the “world of companies,” as Buffett suggests investors do, is to present a clear picture of how a business operates, something that can only be done by adjusting financial statements to reflect the arbitrary nature of certain accounting rules that leave much to discretion.

The world’s best investors understand the need to make these adjustments, which allows them to focus not on picking out the most popular companies but rather on looking for great names in sleepy areas that the market isn’t paying much attention to. From there, the goal is to then identify quality companies with significant growth potential at reasonable prices.

That’s exactly what we’ve set out to do with the FA Alpha, our monthly list of 50 companies that rank at the top for quality, high growth, and low valuations.

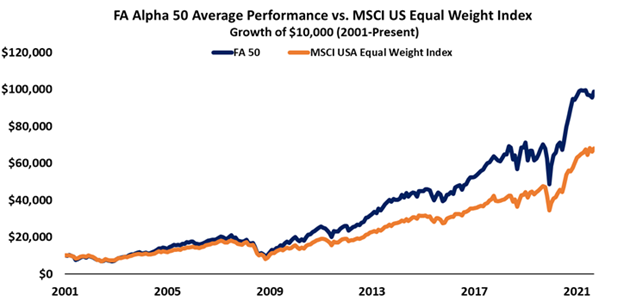

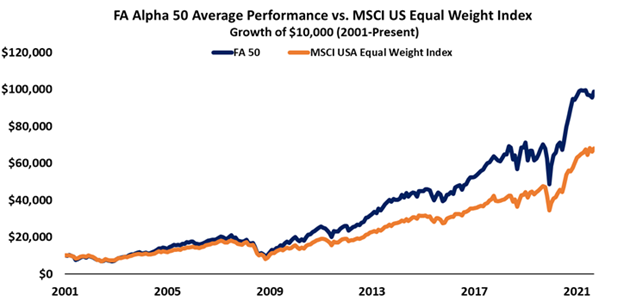

This list has outperformed the market by 300 basis points per year for over 20 years now, effectively doubling the performance of the market by focusing on the real fundamentals and valuations of companies with our proprietary Uniform Accounting framework.

See for yourself below.

To see the other 49 names on the list, click here.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

Today’s highlight, Olaplex Holdings (OLPX) is one of the top stock picks from FA Alpha 50 this month. To see more stock picks like this, become an FA Alpha and get access to FA Alpha 50.