With a renewed investment focus on the United States’ supply chain and infrastructure, Alpha Metallurgical Resources (AMR) finds itself in an advantageous position. As a key supplier of metallurgical coal, it is poised to benefit from the surging demand for steel in construction and industrial projects. In today’s FA Alpha, we will explore market’s expectations for AMR’s future performance and its pivotal role in the ongoing supply chain supercycle.

FA Alpha Daily:

Thursday Uniform accounting analysis

Powered by Valens Research

The U.S. has underinvested in its supply chain and infrastructure for a long time. The problems were unearthed during the pandemic when orders got canceled, lead times got extended, and manufacturers couldn’t find the raw materials they desperately needed.

Now, the U.S. companies and the government are working together to solve this. While the government provides funding to certain areas, companies are at the forefront of projects.

Rising infrastructure investments represent an important aspect of economic development, the need for the construction of new networks of roads, resilient bridges, facilities and advanced equipment.

A common thread connecting all these crucial elements of modern infrastructure is the indispensable need for steel, a foundational material in construction and manufacturing.

At the heart of steel production lies the critical component known as metallurgical (‘‘met’’) coal.

Met coal is prized for its specific properties, including its high carbon content, low ash content, low sulfur content, and good coking properties.

These properties make it well-suited for the creation of metallurgical coke, which is a high-quality carbon source used in the steelmaking process.

This is why we are talking about Alpha Metallurgical Resources (AMR) today.

Alpha Metallurgical’s strategic position as a met coal miner is pivotal in supplying this essential raw material for steel production.

Because of the substantial focus on infrastructure projects, Alpha Metallurgical is well-positioned to ride the wave of increased demand for steel, as a multitude of construction and industrial projects rely on this vital material.

The company has already experienced a notable upswing in its fortunes due to the heightened demand for steel, a trend that is poised to persist and possibly intensify as infrastructure investments gain momentum.

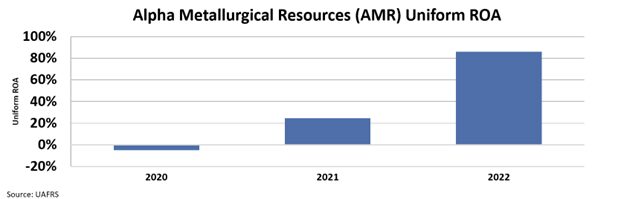

The company’s Uniform return on assets (“ROA”) jumped from -5% in 2020 to 86% in 2022.

Take a look…

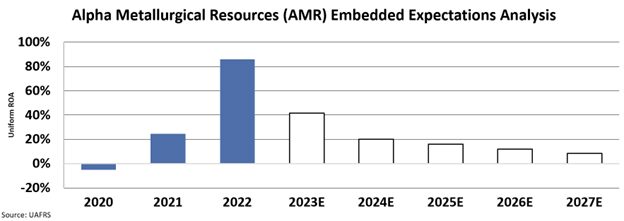

Despite the promising outlook, it appears that the broader market remains skeptical about the sustainability of this growth trajectory.

We can see what the market thinks through our Embedded Expectations Analysis (“EEA”) framework.

The EEA starts by looking at a company’s current stock price. From there, we can calculate what the market expects from the company’s future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

At the current stock price, the market expects the company’s ROA to fall to around 8%, a big fall from the 86% in 2022.

The market thinks that high steel demand isn’t sustainable.

The U.S. is in a supply chain supercycle and this cycle doesn’t look like stopping any time soon.

This anticipated long-term demand for steel should work in favor of Alpha Metallurgical Resources, positioning the company for sustained growth and success in the years to come.

SUMMARY and Alpha Metallurgical Resources Tearsheet

As the Uniform Accounting tearsheet for Alpha Metallurgical (AMR:USA) highlights, the Uniform P/E trades at 5.9x, which is below its global corporate average of 18.4x but above its historical P/E of 3.8x.

Low P/Es require low EPS growth to sustain them. In the case of Alpha Metallurgical, the company has recently shown a 408% growth in Uniform EPS.

Wall Street analysts provide stock and valuation recommendations that in general provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, Alpha Metallurgical’s Wall Street analyst-driven forecast is a 41% EPS shrinkage for both 2023 and 2024.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify Alpha Metallurgical’s $218.27 stock price. These are often referred to as market embedded expectations.

The company is currently being valued as if Uniform earnings were to shrink 35% annually over the next three years. What Wall Street analysts expect for Alpha Metallurgical’s earnings growth is below what the current stock market valuation requires through 2024.

Furthermore, the company’s earning power is 14x its long-run corporate average. Moreover, cash flows and cash on hand are 4x its total obligations—including debt maturities, capex maintenance, and dividends.

All in all, this signals low dividend risk.

Lastly, Alpha Metallurgical’s Uniform earnings growth is in line with its peer averages but below its average peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

We are inviting you to attend FA Alpha’s upcoming CAIA Hong Kong event on Wednesday, 11/1, at 6:30 PM HKT to learn about the latest macroeconomic trends affecting the global economy.

The Uniform Accounting insights in today’s issue are the same ones that power some of our best stock picks and macro research, which can be found in our FA Alpha Daily newsletters.