As interest rates soar, companies struggle to refinance debt, leading to bankruptcies and a rising demand for restructuring services. FTI Consulting, a leader in this field, stands to benefit significantly from this challenging economic climate. In today’s FA Alpha Daily, let us look into the possible future of FTI and the restructuring services industry.

FA Alpha Daily:

Thursday Uniform accounting analysis

Powered by Valens Research

Rising interest rates pose significant challenges for many companies by driving up their borrowing costs.

Very few firms benefit from higher rates, with the main exceptions being those that earn higher yields on cash and investment holdings. For the vast majority of businesses, elevated rates restrict access to affordable capital and hamper growth opportunities.

Companies that took on sizable debt loads in recent years now face greater difficulties refinancing that debt as rates are significantly higher.

According to data from Moody’s Investors Service, the number of corporate defaults has more than doubled in the first half of 2023 compared to the same period in 2022. That shows companies’ inability to refinance their debt in this environment.

Looking ahead, most analysts expect interest rates to remain elevated through 2024 as central banks fight high inflation. As a result, the bankruptcy wave is likely to intensify over the coming quarters.

Those with weak cash flows and balance sheets may default if unable to refinance at favorable rates. Industries facing slowing demand growth due to inflation and higher rates, such as the housing and automotive industries, could see sharp rises in bankruptcies.

The rapid increase of distressed companies creates opportunities for professional services firms specializing in turnarounds, restructurings, and bankruptcies.

One of those beneficiaries is FTI Consulting (FCN), a global business advisory leader in corporate finance and restructuring services.

FTI provides a wide range of advisory solutions to help distressed companies, including interim management, turnaround plans, bankruptcy preparation, and M&A support during divestitures.

The company’s restructuring practice is a market leader advising on large, complex bankruptcy cases. Notable recent engagements include advising creditors in the bankruptcies of crypto exchange FTX and retailers Brooks Brothers and Pier 1 Imports.

The firm is also involved in a high number of out-of-court restructurings and has advised on billions of dollars in debt restructurings over the past year.

While a recession could negatively impact demand for some of FTI’s other consulting services, the firm has historically demonstrated resilience during downturns thanks to countercyclical restructuring work.

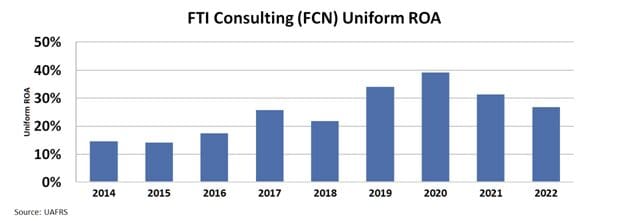

With increasing demand for its services, the company managed to almost triple its profitability since 2014, reaching peak Uniform return on assets (ROA) of almost 40% in 2020.

While FTI’s ROA seems to have normalized in the last two years, increased corporate defaults and a troubling macro environment should boost ROAs to peak levels seen in 2020 once again.

However, despite positive tailwinds from increased restructuring activity, the market remains wary given broader economic uncertainties.

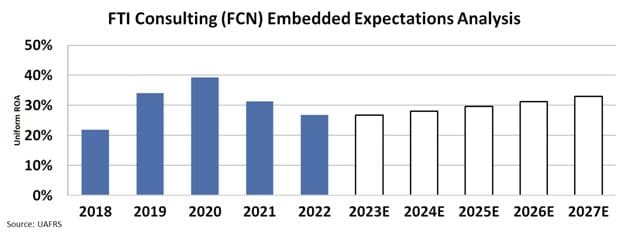

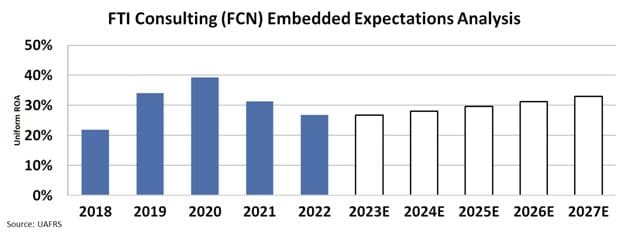

We can see what the market thinks through our Embedded Expectations Analysis (“EEA”) framework.

The EEA starts by looking at a company’s current stock price. From there, we can calculate what the market expects from the company’s future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

At the current stock price, the market expects the company’s ROA to stay around 30%, missing out on the potential growth opportunity FTI has in this macro environment.

The market views FTI cautiously as growth slows across many industries amid aggressive central bank tightening. These factors can affect FTI’s other consulting services.

FTI has a leadership position in the countercyclical restructuring business that allows it to benefit from rising defaults even if a recession materializes.

With a large backlog of debt maturities coming due over the next two years, the pipeline of future restructuring work looks strong.

SUMMARY and FTI Consulting Tearsheet

As the Uniform Accounting tearsheet for FTI Consulting (FCN:USA) highlights, the Uniform P/E trades at 23.5x, which is around its global corporate average of 22.4x but above its historical P/E of 19.1x.

Average P/Es require average EPS growth to sustain them. In the case of FTI Consulting, the company has recently shown a 1% growth in Uniform EPS.

Wall Street analysts provide stock and valuation recommendations that in general provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, FTI Consulting’s Wall Street analyst-driven forecast is a 4% and 14% EPS growth in 2023 and 2024.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify FTI Consulting’s $194.51 stock price. These are often referred to as market embedded expectations.

The company is currently being valued as if Uniform earnings were to grow 6% annually over the next three years. What Wall Street analysts expect for FTI Consulting’s earnings growth is below what the current stock market valuation requires in 2023 but above its 2024 requirement.

Furthermore, the company’s earning power is 4x its long-run corporate average. Moreover, cash flows and cash on hand are 1.4x its total obligations—including debt maturities, capex maintenance, and dividends. Also, the company’s intrinsic credit risk is 110bps above the risk-free rate.

All in all, this signals a moderate credit risk.

Lastly, FTI Consulting’s Uniform earnings growth is in line with its peer averages and its average peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

The Uniform Accounting insights in today’s issue are the same ones that power some of our best stock picks and macro research, which can be found in our FA Alpha Daily newsletters.