TD Synnex (SNX) has evolved from an IT distributor into a global solutions aggregator. This transition towards comprehensive IT solutions, combined with a focus on digital and cloud computing, has bolstered TD Synnex’s profitability. In today’s FA Alpha Daily, we explore TD Synnex’s transformative journey, which positioned the company for enduring success despite short-term volatility.

FA Alpha Daily:

Wednesday Credit

Powered by Valens Research

TD Synnex (SNX) was traditionally an IT distributor, playing the role of connecting original equipment manufacturers (OEMs) like HP, Dell, and Lenovo to corporate customers and resellers.

However, through a series of strategic acquisitions over the past decade, the company has transformed itself into a leading global solutions aggregator for the IT ecosystem.

As a distributor, TD Synnex’s core business involved distributing hardware from OEMs and selling it primarily to other companies and resellers. With the rise of cloud computing, software, and digital technologies, the market has shifted towards integrated solutions that combine both hardware and software.

Recognizing this trend, TD Synnex embarked on an acquisition strategy in the 2010s. Major acquisitions included Westcon Group in 2017, and Tiger Parent in 2021.

This transformed TD Synnex into a one-stop-shop solutions provider that could integrate different products from its vendor partners like Intel and Samsung into comprehensive technology solutions.

As a solutions aggregator, TD Synnex brings together the best technology vendors and uses its scale and expertise to integrate their individual products into optimized solutions.

This provides significant value to end customers by creating efficiently functioning IT ecosystems tailored to their needs. TD Synnex’s digital platforms and services also help partners deliver these integrated solutions faster.

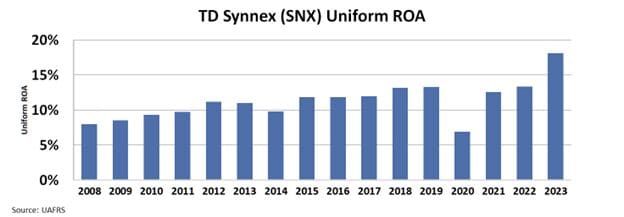

TD Synnex’s transformation has paid dividends, with its Uniform return on assets (‘‘ROA’’) increasing thanks to the higher-margin solutions business.

Take a look…

The company has also shifted its focus towards digital solutions, cloud computing, and related services – industries experiencing accelerated growth.

While some emphasize short-term factors like revenue declines, TD Synnex appears well-positioned for long-term success through its evolution into a global solutions aggregator.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

This analysis of TD Synnex (SNX)’s credit outlook is the same type of analysis that powers our macro research detailed in the member-exclusive FA Alpha Pulse.