The Bipartisan Infrastructure Bill, passed in 2021, aims to fund a broad spectrum of infrastructure projects, highlighting the critical role of concrete in construction. Concrete Pumping Holdings (BBCP) stands to benefit from this trend by providing essential concrete pumping services and environmental management, crucial for the effective and economical completion of these projects. In today’s FA Alpha Daily, we will delve into BBCP’s true potential in contrast to market skepticism.

FA Alpha Daily:

Thursday Uniform accounting analysis

Powered by Valens Research

The Bipartisan Infrastructure Bill that passed in 2021 allocates a whopping $1.2 trillion in infrastructure projects.

The bill is expected to fund a wide range of projects, including roads, bridges, buildings, and other types of infrastructure. All these projects have one need in common, concrete…

Concrete is the backbone of infrastructure projects. Its durability, versatility, and strength make it the ideal material choice for building.

It is not an easy material to handle and its applications are far from straightforward. It requires precise, efficient, and specialized services to meet the extensive demands of large-scale construction projects.

This is where Concrete Pumping Holdings (BBCP) comes in.

As the leading player in the concrete business, Concrete Pumping offers a comprehensive suite of services that address the multifaceted challenges of working with concrete.

The company’s main business is concrete pumping, an essential process that ensures concrete is delivered and placed precisely where needed, whatever the complexity or scale of the project.

This service not only enhances efficiency but also significantly reduces labor costs and construction time, making it a critical component in the execution of infrastructure projects.

In addition to pumping, Concrete Pumping is an expert at managing the aftermath of concrete application.

Cleanup and containment are integral to maintaining environmental standards and ensuring project sites are safe and ready for the following construction phases.

By handling these aspects, Concrete Pumping reduces the burden on construction companies, allowing them to focus on other critical areas of the project.

The company was already on track to improving business, far before the infrastructure bill…

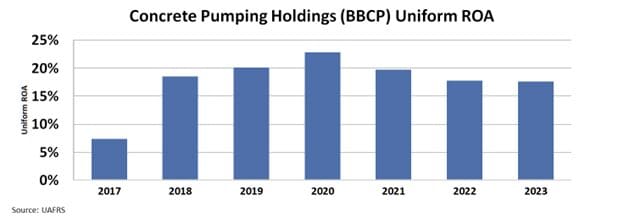

Concrete Pumping managed to improve its Uniform return on assets (“ROA”) from 8% in 2017 to 18% in 2023.

In the last few years, the company struggled to maintain the peak ROA it reached in 2020. However, we can expect to see even higher peaks in the coming years when the bill’s provisions begin to materialize.

Despite these promising tailwinds, there seems to be a cloud of pessimism hanging over the company in the market.

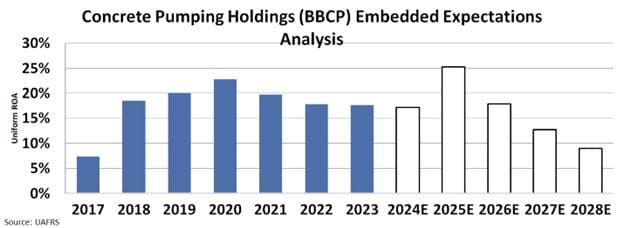

We can see what the market thinks through our Embedded Expectations Analysis (“EEA”) framework.

The EEA starts by looking at a company’s current stock price. From there, we can calculate what the market expects from the company’s future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

At the current stock price, the market expects the company’s ROA to fall to 9%, similar to the 2017 levels.

The market’s pessimistic view is caused by the fear of construction spending slowing down because of the economy, decreasing the demand for concrete.

As America embarks on this historic infrastructure overhaul, demand for concrete will continue to increase in the coming years, which means higher cash flows for Concrete Pumping Holdings.

With a solid foundation and strategic foresight, Concrete Pumping is poised to play a central role in shaping the future of American infrastructure.

SUMMARY and Concrete Pumping Holdings, Inc Tearsheet

As the Uniform Accounting tearsheet for Concrete Pumping Holdings (BBCP:USA) highlights, the Uniform P/E trades at 13.0x, which is below its global corporate average of 18.4x and its historical P/E of 12.2x.

Low P/Es require low EPS growth to sustain them. In the case of Concrete Pumping, the company has recently shown a 26% growth in Uniform EPS.

Wall Street analysts provide stock and valuation recommendations that in general provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, Concrete Pumping’s Wall Street analyst-driven forecast is a 9% EPS growth in 2023 and a 2% EPS shrinkage in 2024.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify Concrete Pumping’s $8.20 stock price. These are often referred to as market embedded expectations.

The company is currently being valued as if Uniform earnings were to shrink 5% annually over the next three years. What Wall Street analysts expect for Concrete Pumping’s earnings growth is above what the current stock market valuation requires through 2024.

Furthermore, the company’s earning power is 3x its long-run corporate average. Moreover, cash flows and cash on hand are below its total obligations—including debt maturities, capex maintenance, and dividends. Also, the company’s intrinsic credit risk is 600bps above the risk-free rate.

All in all, this signals high credit risk.

Lastly, Concrete Pumping’s Uniform earnings growth is above its peer averages but below its average peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

The Uniform Accounting insights in today’s issue are the same ones that power some of our best stock picks and macro research, which can be found in our FA Alpha Daily newsletters.