FA Alpha Daily:

Thursday Uniform accounting analysis

Powered by Valens Research

The $1.2 trillion Bipartisan Infrastructure Law passed in 2021 keeps fueling the supply chain supercycle and infrastructure investing.

This represents the largest infrastructure investment program by the U.S. government in decades.

The funds will be directed towards modernizing America’s aging infrastructure including transportation, energy, water, broadband, and other public works over the next decade.

This surge in infrastructure investments is expected to boost related industries like manufacturing, construction, engineering, and technology. New manufacturing facilities, production lines, transportation assets, communications networks, and more will be built to support the infrastructure upgrade.

A major focus area within the infrastructure program is deploying high-speed broadband nationwide. The law allocates $65 billion specifically for expanding broadband access. This involves building extensive new fiber optic cable networks as well as upgrading wireless and cellular infrastructure with 5G and small cells.

To extend the 5G wireless rollout to previously underserved markets and close the access gap, this investment is expected to have a far-reaching impact, with over 40,000 projects already awarded funding.

Being one of the leading communications equipment companies, Ciena Corporation (CIEN) is well-positioned to capture significant opportunities arising from this infrastructure supercycle.

Ciena provides networking hardware, software, and services that underpin the global communications infrastructure industry.

As the #1 or #2 vendor in major optical networking segments, Ciena has established itself as an industry leader through continuous investment exceeding 15% of annual revenues in research and development.

With the large-scale build-out of fiber and wireless networks underway driven by both public and private investments, demand is surging for Ciena’s portfolio of optical networking solutions.

While Ciena stands to capture outsized gains, the market has so far undervalued its direct leverage to decades of overdue infrastructure investment.

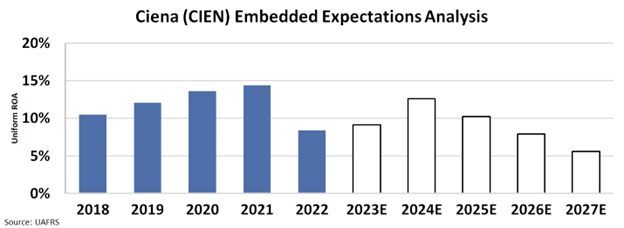

We can see what the market thinks through our Embedded Expectations Analysis (“EEA”) framework.

The EEA starts by looking at a company’s current stock price. From there, we can calculate what the market expects from the company’s future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

At the current stock price, the market expects the company’s ROA to fall to around 6%.

While current market expectations for Ciena may be pessimistic, the multi-year infrastructure investment cycle presents significant opportunities.

With demand surging, Ciena’s financial growth prospects could be better than anticipated given these macro tailwinds. The company is well-positioned to drive continued market share gains and revenue expansion over the coming years through this infrastructure supercycle.

SUMMARY and Ciena Corporation Tearsheet

As the Uniform Accounting tearsheet for Ciena Corporation (CIEN:USA) highlights, the Uniform P/E trades at 11.4x, which is below its global corporate average of 18.4x and its historical P/E of 14.1x.

Low P/Es require low EPS growth to sustain them. In the case of Ciena, the company has recently shown a 25% shrinkage in Uniform EPS.

Wall Street analysts provide stock and valuation recommendations that in general provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, Ciena’s Wall Street analyst-driven forecast is a 29% and 46% EPS growth in 2023 and 2024, respectively.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify Ciena’s $45.85 stock price. These are often referred to as market embedded expectations.

The company is currently being valued as if Uniform earnings were to shrink 3% annually over the next three years. What Wall Street analysts expect for Ciena’s earnings growth is above what the current stock market valuation requires through 2024.

Furthermore, the company’s earning power is 1x its long-run corporate average. Moreover, cash flows and cash on hand are 3.5x its total obligations—including debt maturities, capex maintenance, and dividends. Also, the company’s intrinsic credit risk is 116bps above the risk-free rate.

All in all, this signals average credit risk.

Lastly, Ciena’s Uniform earnings growth is above its peer averages but in line with its average peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

The Uniform Accounting insights in today’s issue are the same ones that power some of our best stock picks and macro research, which can be found in our FA Alpha Daily newsletters.