The U.S. is leading the tech sector in growth, with semiconductor manufacturers like Lattice Semiconductor (LSCC) expecting even greater gains. However, rating agencies are raising concerns about the cyclical nature of the semiconductor industry. In today’s FA Alpha, we analyze LSCC’s creditworthiness using Uniform Accounting and determine if these concerns are warranted.

FA Alpha Daily:

Wednesday Credit

Powered by Valens Research

Technology is developing at a faster pace than ever before.

The global distribution of startups shows that most of them operate in the technology sector. The number of startups continues to climb thanks to the ‘innovation dynamo’ that is going on in the United States.

Business and government spending on technology continues to surge. Worldwide IT rose from $1.2 trillion in 2012 to $4.7 trillion in 2023. And AI spending is ramping up fast, causing demand for fully programmable chips to surge.

U.S.-based technology companies are happy with this trend, but there is one set of companies that will benefit from it even more: semiconductor companies…

They constitute an essential part of the modern economy, supplying most of the major innovators.

One big and seemingly misunderstood company in the semiconductor space is Lattice Semiconductor Corporation (LSCC).

The company specializes in the design and manufacturing of low-power, field programmable gate arrays (“FPGA”), needed components in communications, computing, industrial, automotive, and consumer markets.

Lattice has shown a remarkable improvement in its Uniform return on assets (“ROA”) over the years. The company managed to increase its Uniform ROA from 4% in 2018 to 33% in 2022.

The products that Lattice supplies are critical for these industries, but it seems that the credit agencies fail to understand this reality.

Rating agencies are concerned about the cyclicality of the semiconductor demand hurting the company going forward.

S&P gave the company a “BB” rating, indicating a significant risk of default at nearly 10% over the next five years. It also puts the company in the high-yield basket.

Given its solid financial standing, we believe Lattice deserves a more secure rating.

We can figure out if there is a real risk for this company by leveraging the Credit Cash Flow Prime (“CCFP”) to understand how the company’s obligations match against its cash and cash flows.

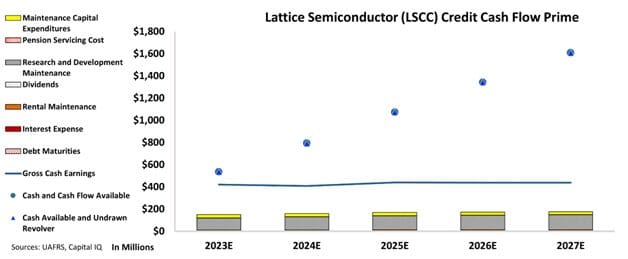

In the chart below, the stacked bars represent the firm’s obligations each year for the next five years. These obligations are then compared to the firm’s cash flow (blue line) as well as the cash on hand available at the beginning of each period (blue dots) and available cash and undrawn revolver (blue triangles).

The CCFP chart shows that Lattice’s cash flows alone are more than enough to serve all its obligations going forward.

The chart indicates that the company is on solid financial ground and is very likely to fulfill its obligations with ease in the next five years.

The company has no debt maturities in the next 5 years and it can easily handle its obligations with its massive cash flows.

Moreover, with the continuing growth in IT spending, Lattice also has opportunities to sustain and even increase its high profitability levels over the long run.

Our review of Lattice shows that the company has a low risk of default, contrary to what rating agencies indicate.

Therefore, we are assigning an “IG3+” rating to the company, which places it in the investment-grade basket, with a risk of default of about 1%.

It is our goal to bring forward the real creditworthiness of companies, built on the back of better Uniform Accounting.

To see Credit Cash Flow Prime ratings for thousands of companies, click here to learn more about the various subscription options now available for the full Valens Database.

SUMMARY and Lattice Semiconductor (LSCC:USA) Tearsheet

As the Uniform Accounting tearsheet for Lattice Semiconductor (LSCC:USA) highlights, the Uniform P/E trades at 91.2x, which is above the global corporate average of 22.9x, and its historical P/E of 56.5x.

High P/Es require high EPS growth to sustain them. In the case of Lattice, the company has recently shown a 33% Uniform EPS growth.

Wall Street analysts provide stock and valuation recommendations, that in general, provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, Lattice’s Wall Street analyst-driven forecast is for a 59% EPS shrinkage and 63% EPS growth in 2024 and 2025, respectively.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify Lattice’s $73 stock price. These are often referred to as market-embedded expectations.

Furthermore, the company’s earning power in 2023 was 6x the long-run corporate average. Moreover, cash flows and cash on hand are 2x its total obligations—including debt maturities and capex maintenance. The company also has an intrinsic credit risk that is 80bps above the risk-free rate.

Overall, this signals a low credit risk.

Lastly, Lattice’s Uniform earnings growth is below its peer averages and is trading above its average peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

This analysis of Lattice Semiconductor (LSCC)’s credit outlook is the same type of analysis that powers our macro research detailed in the member-exclusive FA Alpha Pulse.