October 2023 witnessed the lowest borrowing over the past decade, raising concerns about companies’ inability to secure financing that could lead to a surge in corporate bankruptcies. In today’s FA Alpha Daily, we’ll explore the current hurdles, including high interest rates, diminished borrowing, and an upswing in business failures, which collectively contribute to a troubling landscape of financial uncertainty.

FA Alpha Daily:

Monday Macro

Powered by Valens Research

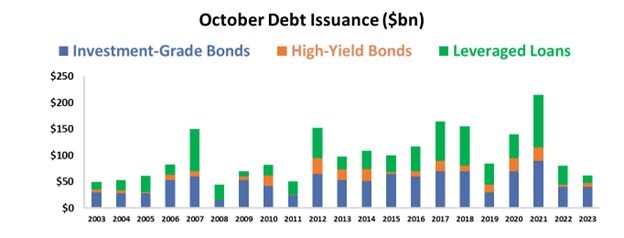

October was the slowest borrowing month of the entire year. And it’s not just that it was the worst month this year… it was the worst October since 2011.

Across investment grade, high-yield, and even riskier leveraged loans, U.S. companies only borrowed about $70 billion.

Take a look.

It was also the lowest number of monthly transactions in 20 years.

Now, by itself, this isn’t all that concerning. Remember, if companies don’t need to borrow, we don’t care if they borrow or not.

That’s why we need to look at corporate America’s upcoming debt maturities.

U.S. companies have about $100 billion of debt due this year.

In the next two years, the pressure intensifies. Companies have $250 billion due next year and $389 billion in 2025.

Already, we’re seeing an uptick in defaults on this high-risk debt, climbing from 2.5% in March to 4% in October.

The situation could deteriorate further…

High-interest rates have created higher corporation borrowing costs. These high costs are steering companies away from issuing debt.

This is a pressing issue, as starting from next year, meeting all their financial commitments will become even more daunting.

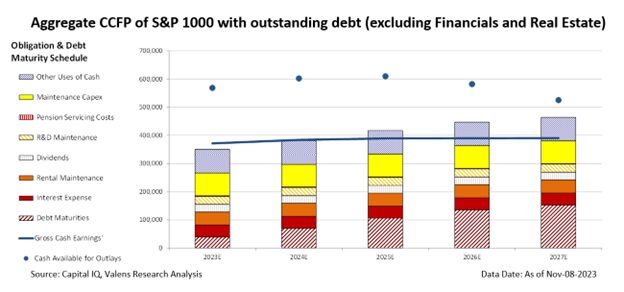

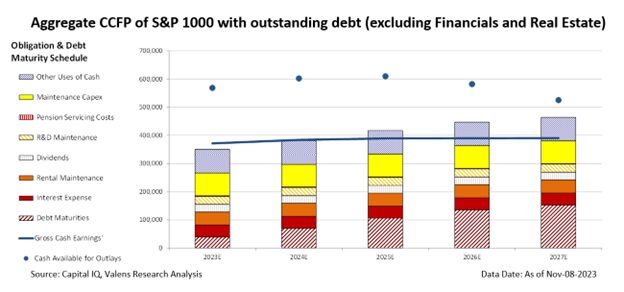

To gauge how well corporate earnings can meet debt commitments, we employ a comprehensive Credit Cash Flow Prime (“CCFP”) analysis.

Our macro-level CCFP assesses the uniform cash flow and cash on hand for U.S. companies outside the banking and real estate sectors, weighing them against their annual obligations.

Below is the aggregate CCFP for the S&P 1000, which includes the 1,000 companies just outside the S&P 500.

This chart provides a clearer picture of which companies may face hardship during an economic downturn than the S&P 500 does. Generally, banks prefer lending to larger companies as they have more options to generate capital.

As a result, this is a better representation of real corporate America. Smaller firms are at higher risk when economic conditions worsen.

Over the coming years, we’ll see debt maturities surge to a level that corporate earnings alone will not be able to sustain all the obligations of these companies.

Take a look.

Beginning next year, cash flows alone (the blue line) will not be sufficient to meet all the financial commitments for the S&P 1000 companies.

As banks notice this trend, they may become even less willing to lend in the future.

This could lead to even more widespread defaults.

Right now, we’re getting close to the moment when companies need to refinance, based on when debt maturities come due.

And our S&P 1,000 CCFP shows that debt maturities step up significantly in 2024 and in 2025, just when the Fed warned rates will remain high.

Companies need to borrow soon… and it doesn’t seem like they’ll be able to.

Bankruptcies are already starting, and we have a long way to go. It’s not a good time to own stocks with a lot of debt coming due in the next year or so.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

To see our best macro insights, become an FA Alpha and get access to FA Alpha Pulse.