Rating agencies are often hesitant to provide high credit ratings to companies in cyclical industries, such as semiconductors. This is because these industries are prone to periods of high volatility and low profitability. Synaptics Incorporated (SYNA), a semiconductor company with a stable track record of profitability followed by a significant increase last year, has been unfairly maligned by rating agencies despite its cyclical industry. In today’s FA Alpha Daily, let’s assess Synaptics Incorporated using Uniform Accounting to see its true credit risk and compare it with what the rating agencies suggest.

FA Alpha Daily:

Wednesday Credit

Powered by Valens Research

For the last few weeks, we have been talking about how rating agencies disfavor commoditized businesses due to their cyclical nature.

The cyclical nature of the semiconductor industry has caused rating agencies to be highly concerned, despite the sector’s impressive performance year to date.

The important thing here is that even if an industry is cyclical, companies’ credit risk assessments should be made individually instead of putting them all in the same basket.

Rating agencies’ take on Synaptics (SYNA) is a valuable example of this.

Basically, the company gets lumped in with the broader semiconductor market, which is for the most part, a volatile and commoditized business.

Synaptics is a little different though. For a while, the company mostly made chips that supported touch screen technology in smartphones, and it was also known for its audio chips.

However, as Apple (AAPL) has expanded its dominance in the phone market, and as the phone market has gotten more saturated, the company’s profitability started to fade.

Credit markets quickly thought that it would mean Synaptics’ business was doomed.

However, there were a few things that credit markets were missing…

Even as the phone market has become saturated over time, Synaptics’ Uniform return on assets (ROA) has stayed quite stable around 11%.

In addition, the company gave its best efforts to be innovative and entered into new markets to boost its profitability.

With that strategy, Synaptics pivoted its business to work more with IoT, gaming, and virtual reality companies.

Thanks to this shift in focus, the company had one of its best years last year in the past decade and substantially increased its Uniform ROA from 11% to a whopping 27%.

Yet, this incredible performance wasn’t enough for rating agencies to convince rating agencies. Moody’s gives it a Ba2 rating and S&P gives it a BB- rating, both implying a chance of default of around 10% over the next few years.

Considering the boost in profitability and the company’s stability in returns, this is too much risk taken into account for the company and it does not make any sense.

At Valens, we think that Synaptics deserves a much safer rating.

We can figure out if there is a real risk for this company by leveraging the Credit Cash Flow Prime (“CCFP”) to understand how the company’s obligations match against its cash and cash flows.

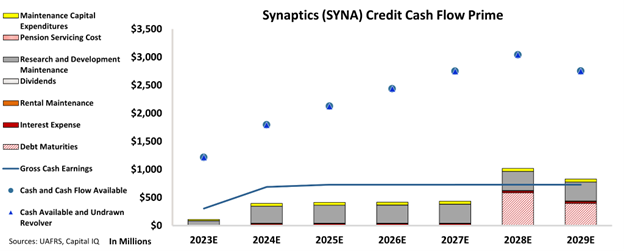

In the chart below, the stacked bars represent the firm’s obligations each year for the next five years. These obligations are then compared to the firm’s cash flow (blue line) as well as the cash on hand available at the beginning of each period (blue dots) and available cash and undrawn revolver (blue triangles).

The CCFP chart shows that Synaptics’ cash flows are more than enough to serve all its obligations going forward.

The chart shows that the company does not have any debt maturities until 2028 and its massive cash flows are a sign that it will have no problem servicing that debt.

Even in a case when the business cannot maintain the record high levels of profitability and falls back to its average 11% returns, it’ll still have no problems in meeting all of its obligations. This gives the company significant flexibility.

Additionally, when thinking about the impressive growth in the new markets Synaptics entered, the company has a high chance to do even better than what it currently has.

Due to these factors, at Valens, we rate the company “IG4+”. This rating implies a chance of default around 1%, as opposed to Moody’s and S&P’s 10%.

It is our goal to bring forward the real creditworthiness of companies, built on the back of better Uniform Accounting.

To see Credit Cash Flow Prime ratings for thousands of companies, click here to learn more about the various subscription options now available for the full Valens Database.

SUMMARY and Synaptics Incorporated (SYNA:USA) Tearsheet

As the Uniform Accounting tearsheet for Synaptics Incorporated (SYNA:USA) highlights, the Uniform P/E trades at 20.9x, which is above the global corporate average of 18.4x and its historical P/E of 16.0x.

High P/Es require high EPS growth to sustain them. In the case of Synaptics, the company has recently shown a 180% Uniform EPS growth.

Wall Street analysts provide stock and valuation recommendations, that in general, provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, Synaptics’ Wall Street analyst-driven forecast is for a -52% and 9% EPS growth in 2023 and 2024, respectively.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify Synaptics’ $85 stock price. These are often referred to as market-embedded expectations.

Furthermore, the company’s earning power in 2022 was 4x the long-run corporate average. Moreover, cash flows and cash on hand is 4x its total obligations—including debt maturities and capex maintenance. The company also has an intrinsic credit risk that is 140bps above the risk-free rate.

Overall, this signals a moderate credit risk.

Lastly, Synaptics’ Uniform earnings growth is in line with its peer averages and is trading in line with its average peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

This analysis of Synaptics Incorporated (SYNA)’s credit outlook is the same type of analysis that powers our macro research detailed in the member-exclusive FA Alpha Pulse.