China’s “Zero Covid” policy, which hurt its economy, has now been lifted and the country’s growth outlook is looking strong. As China reopens, it will need raw materials to build anew. This will benefit miners like Southern Copper Corporation, a company that mines and sells copper and other minerals globally. In today’s FA Alpha, we will look into the company’s true profitability and what it means for investors.

FA Alpha Daily:

Thursday Uniform accounting analysis

Powered by Valens Research

For nearly three years, China stuck to its “Zero Covid” policy that included taking abnormal measures to make sure that the pandemic was contained.

Extended lockdowns, individual quarantines, closing borders to visitors, and tracking phone signals and travel histories are only some of the measures taken.

While the rest of the world reopened and recovered, this policy in China caused huge economic damage and widespread frustration.

This has also affected U.S. companies operating or working with a supplier in China, increasing costs and extending lead times.

However, nobody has suffered more than the people there. There have been lots of protests and the government has been lifting the most severe parts of its policy since December.

And now, China is coming roaring back after abandoning Zero Covid. Manufacturing posted its biggest improvement in more than a decade, services activity climbed, and the housing market is stabilizing.

The Purchasing Managers’ Index (“PMI”), which tracks the month-over-month change in economic activity in manufacturing by surveying the private sector, recorded its highest since April 2012.

Thanks to the reopening, the demand is back and lots of the indices beat economists’ expectations.

All this means is that China is back in the market, and they will continue to invest and build. Combined with the Supply Chain Supercycle we observe, that means more demand for raw materials.

This will benefit miners in particular, such as the copper miner Southern Copper Corporation (SCCO).

The company mines, explores and sells copper and other minerals all around the world.

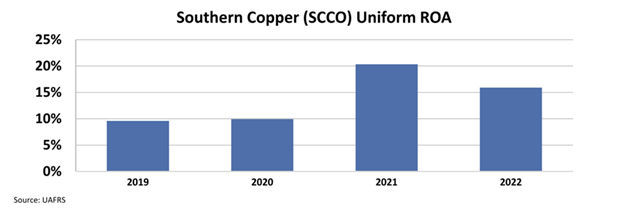

After having stable years, its profitability jumped in 2021 due to increasing demand for copper and soaring prices. The return on assets (“ROA”) jumped from 10% to 20% that year, before slightly falling to 16% as prices reverted.

Copper has been gaining increased attention and the price has been rising since mid-2022.

With China’s reopening, Southern Copper’s expansion in 2021 could stay stronger and longer.

This is attractive news for investors, but if the market is already thinking the same, it might be too late. Therefore, we need to understand what the market is pricing in.

We can see this through our Embedded Expectations Analysis (“EEA”) framework.

The EEA starts by looking at a company’s current stock price. From there, we can calculate what the market expects from the company’s future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

At $75 per share, the market expects ROA to very slightly increase and stay below 17%, which is way lower than the 2021 levels.

With China’s strong-looking economy and the Supply Chain Supercycle, miners seem to have a good couple of years ahead, and Southern Copper is one of them.

If the company can utilize its already strong market position to benefit from these developments, it could be possible for them to reach higher levels of ROA for longer.

This would mean more upside for the stock relative to what the market is pricing.

SUMMARY and Southern Copper Corporation Tearsheet

As the Uniform Accounting tearsheet for Southern Copper Corporation (SCCO:USA) highlights, the Uniform P/E trades at 22.4x, which is above the corporate average of 18.4x and its historical P/E of 20.1x.

High P/Es require high EPS growth to sustain them. In the case of Southern Copper, the company has recently shown a 147% growth in Uniform EPS.

Wall Street analysts provide stock and valuation recommendations that in general provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, Southern Copper’s Wall Street analyst-driven forecast is a 25% EPS shrinkage in 2022 and a 2% EPS growth in 2023.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify Southern Copper’s $76 stock price. These are often referred to as market embedded expectations.

The company is currently being valued as if Uniform earnings were to shrink by 3% annually over the next three years. What Wall Street analysts expect for Southern Copper’s earnings growth is below what the current stock market valuation in 2022 but above its requirement in 2023.

Furthermore, the company’s earning power is 3x its long-run corporate average. Moreover, cash flows and cash on hand are below its total obligations—including debt maturities, capex maintenance, and dividends. Also, the company’s intrinsic credit risk is 70bps above the risk-free rate.

All in all, this signals average dividend risk.

Lastly, Southern Copper’s Uniform earnings growth is in line with its peer averages and its average peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

The Uniform Accounting insights in today’s issue are the same ones that power some of our best stock picks and macro research, which can be found in our FA Alpha Daily newsletters.