As cars have become more and more integrated with the world, software companies like Cerence (CRNC), whose technology is found in 50% of cars, have exploded. Today’s FA Alpha Daily will highlight FA Alpha 50 name Cerence’s profitability.

FA Alpha Daily:

Tuesday Company Specific

Powered by Valens Research

In recent years, cars have become more integrated with the world, with advanced technology providing live navigation, alongside dashboards that connect with our phones. Modern cars allow us to listen to podcasts, take phone calls, read out text messages, find gas stations along your route, and much more.

Meanwhile, all of these additive distractions need to be managed so they are safe for the driver and others on the road. This means having a solution onboard that can handle all these things is essential.

That’s where Cerence (CRNC) comes into play.

Cerence is the software company behind the technology that helps cars with tasks like navigation, hands-free communication, and early autonomous vehicle (AV) technology. The company designs AI-powered virtual assistants that simplify all the technology in cars that is needed today.

Today, Cerence’s products can be found in 50% of the new cars shipped globally, including brands like BMW (BMWYY), Ford (F), and General Motors (GM).

Yet, as-reported metrics seem to miss how essential Cerence is to making today’s cars run.

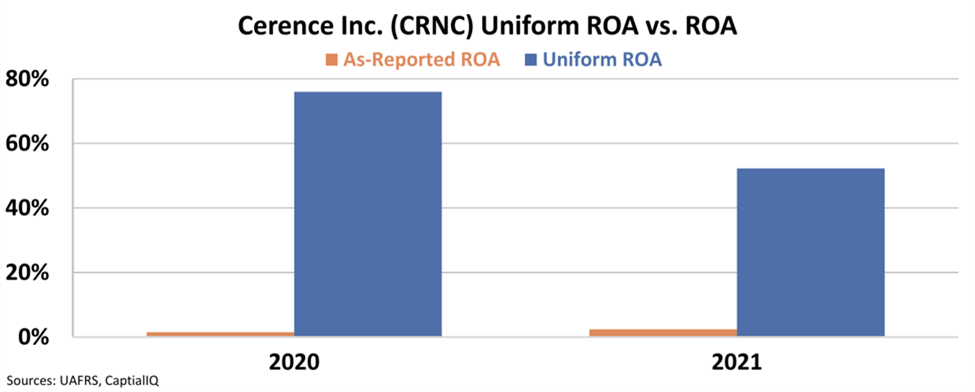

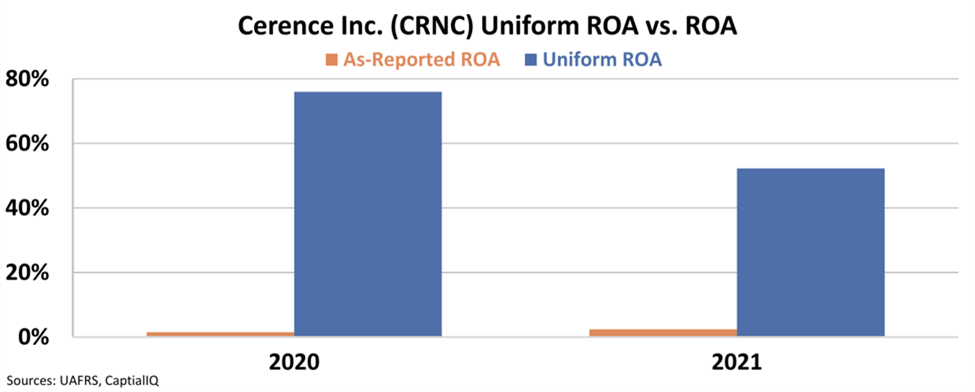

As-reported metrics make it appear that return on assets (“ROA”) has been below cost-of-capital levels, at just 2%, for the past three years. This suggests to investors that even as more and more cars are using Cerence’s technology, it can still barely turn a profit.

For a company at the center of vehicle technology and a leader in the market, investors would hope for much greater profitability.

However, Uniform Accounting shows us a very different picture.

Looking at the right numbers, we can see that Cerence is actually massively profitable. In 2020, its ROA was 76%, and while it declined a bit in 2021 due to supply chain disruptions, it was still quite comfortable at 52%.

Thanks to its position as a market leader in an essential industry, Cerence is seeing robust returns.

Uniform metrics see the value Cerence brings to the car market by being a leader in technology integration.

Even as it sees this high profitability, it’s still growing fast, with assets growing at 44% in 2021.

Yet, due to distorting as-reported metrics, the market still isn’t clued into the power of the firm, with the company seeing a 13.3x Uniform P/E.

But you can only see this impressive performance if you look at the right Uniform Accounting data.

As-reported metrics hide Cerence’s strong ROA, which combined with its explosive growth in 2021 and low valuations today, makes it a compelling company and an interesting FA Alpha 50 name.

Throughout financial market history, many of the world’s most successful investors have been candid in their belief that Generally Accepted Accounting Principles (“GAAP”) distort economic reality.

Warren Buffett, for example, once said investors should “concentrate on the world of companies, not arcane accounting mathematics.”

Investors who neglect the very real issues with as-reported accounting can find themselves caught up investing with the crowd, blindly following hot “themes” without a thorough grasp of how to understand the businesses in question.

The only true way to focus on the “world of companies,” as Buffett suggests investors do, is to present a clear picture of how a business operates, something that can only be done by adjusting financial statements to reflect the arbitrary nature of certain accounting rules that leave much to discretion.

The world’s best investors understand the need to make these adjustments, which allows them to focus not on picking out the most popular companies, but rather on looking for great names in sleepy areas that the market isn’t paying much attention to. From there, the goal is to then identify quality companies with significant growth potential at reasonable prices.

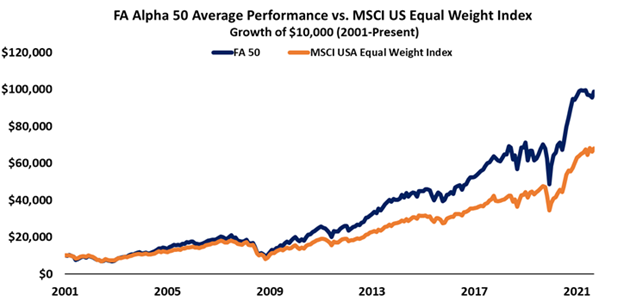

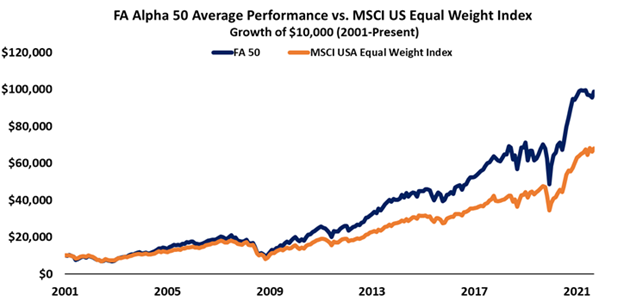

That’s exactly what we’ve set out to do with the FA Alpha, our monthly list of 50 companies that rank at the top for quality, high growth, and low valuations.

This list has outperformed the market by 300 basis points per year for over 20 years now, effectively doubling the performance of the market by focusing on the real fundamentals and valuations of companies with our proprietary Uniform Accounting framework.

See for yourself below.

To see the other 49 names on the list, click here.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

Today’s highlight, Cerence Inc. (CRNC) is one of the top stock picks from FA Alpha 50 this month. To see more stock picks like this, get access to FA Alpha 50.