The Bipartisan Infrastructure Law’s response to water infrastructure challenges is set to boost industry investments. Northwest Pipe Company, with its established tenure and dominance in the water sector, is strategically positioned to capitalize on this opportunity. In today’s FA Alpha Daily, we delve into Northwest’s potential for robust revenues and profitability.

FA Alpha Daily:

Thursday Uniform accounting analysis

Powered by Valens Research

The passage of the $1.2 trillion Bipartisan Infrastructure Law in November 2021 marked an important moment for water infrastructure in the United States.

By allocating over $60 billion specifically for improving drinking water, wastewater, and water resilience projects, the legislation represents the single largest federal investment in water systems in the country’s history.

This unprecedented level of funding is desperately needed to reverse decades of chronic underinvestment that has left much of America’s water infrastructure in a st ate of disrepair.

The American Society of Civil Engineers estimates it would take $105 billion annually through 2029 just to address all urgent upgrades required across drinking water, wastewater, dams, and levees nationwide. As a result, aging pipes have led to over two trillion gallons of treated water lost each year from leaks.

At the same time, public health risks from contaminated water supplies have grown more severe. Over 10 million American households still receive water through lead pipes and service lines that can leach toxic levels of heavy metal into tap water. Meanwhile, emerging unregulated contaminants like PFAS “forever chemicals” have been detected in water sources serving hundreds of millions of people across the country.

The Bipartisan Infrastructure Law directly addresses these challenges through targeted funding allocations. This includes $11.7 billion to the Drinking Water State Revolving Fund, $15 billion specifically for replacing lead service lines, and $4 billion dedicated to addressing emerging contaminants like PFAS. The EPA estimates these investments will allow communities serving over 86 million people to improve their water infrastructure over the next five years.

As the single largest producer of engineered steel water transmission infrastructure in North America, Northwest Pipe Company (NWPX) offers unique exposure to the massive multi-year water resurgence unfolding across the United States.

With strategic manufacturing assets and a full suite of solutions for water projects, Northwest is optimally positioned to maximize opportunities as infrastructure funding enables overdue renewal of aging systems nationwide.

The company operates a network of pipe production facilities located in regions with critical water needs. This includes facilities serving drought-stricken California and flood-prone Texas. This local presence ensures Northwest can efficiently supply the surge in projects across the Sun Belt and Pacific Northwest where water stresses have grown most severe.

Beyond steel pipe, Northwest’s product portfolio includes concrete, plastic, and composite water mains, as well as trenchless sewer rehabilitation and pump station equipment obtained through strategic acquisitions totaling over $200 million since 2013. This expanded array allows Northwest to address the full spectrum of customer requirements from project planning through construction and post-commissioning support.

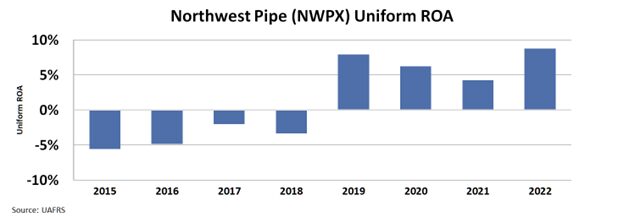

These developments massively boosted the profitability and recovered business. The company’s Uniform return on assets (“ROA”) jumped from -5.5% in 2015 to 9% in 2022.

Take a look…

The company’s total addressable market potential from water infrastructure spending in North America alone measures an enormous $5 billion annually. Yet, Northwest currently holds less than 10% market share, leaving massive room for growth as aging systems are replaced and capacity expanded nationwide. With a record $400 million backlog and 15%-20% full-year revenue growth guidance, momentum is building.

While Northwest stands to capture outsized gains, the market has so far undervalued its direct leverage to decades of overdue water renewal.

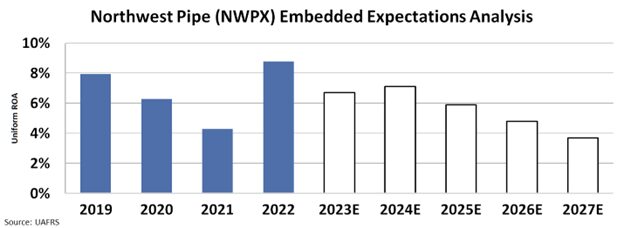

We can see what the market thinks through our Embedded Expectations Analysis (“EEA”) framework.

The EEA starts by looking at a company’s current stock price. From there, we can calculate what the market expects from the company’s future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

At the current stock price, the market expects the company’s ROA to fall to around 4%.

The market severely underappreciated the company’s position in the coming years for water investment.

As water infrastructure spending ramps up over the next decade, Northwest is poised for a period of strong revenue and profitability growth.

For investors seeking exposure to America’s multi-year, multi-billion dollar water resurgence, the company represents a compelling opportunity.

SUMMARY and Northwest Pipe Tearsheet

As the Uniform Accounting tearsheet highlights, the Uniform P/E trades at 14.7x, which is below its global corporate average of 18.4x, but around its historical P/E of 14.1x.

Low P/Es require low EPS growth to sustain them. In the case of Northwest Pipe, the company has recently shown an 141% growth in Uniform EPS.

Wall Street analysts provide stock and valuation recommendations that in general provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, Northwest Pipe’s Wall Street analyst-driven forecast is a 32% EPS shrinkage in 2023 but a 9% EPS growth in 2024.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify Northwest Pipe’s $27.60 stock price. These are often referred to as market embedded expectations.

The company is currently being valued as if Uniform earnings were to shrink 9% annually over the next three years. What Wall Street analysts expect for Northwest Pipe’s earnings growth is below what the current stock market valuation requires in 2023 but above its 2024 requirement.

Furthermore, the company’s earning power is 1x its long-run corporate average. Moreover, cash flows and cash on hand are 1.7x its total obligations—including debt maturities, capex maintenance, and dividends. Also, the company’s intrinsic credit risk is 620bps above the risk-free rate.

All in all, this signals high credit risk.

Lastly, Northwest Pipe’s Uniform earnings growth is in line with its peer averages and its average peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

The Uniform Accounting insights in today’s issue are the same ones that power some of our best stock picks and macro research, which can be found in our FA Alpha Daily newsletters.