Many businesses across various industries benefitted from America’s continuous investments in innovation. One that stood out, in particular, is Cisco Systems (CSCO), a communications equipment company. However, as-reported metrics make it appear that the company has low profitability despite being at the center of technological improvement. Today’s FA Alpha will show Cisco System’s true earning power using Uniform Accounting.

FA Alpha Daily:

Thursday Uniform accounting analysis

Powered by Valens Research

America is built on creative destruction and the “Innovation Dynamo” of constant reinvention and evolution of products.

This is visible just by looking at venture capital investments alone. These investments amounted to approximately $330 billion in the U.S. in 2021, nearly twice as much as the previous year.

More than half of the global venture capital investments were in the U.S., showing how important innovation is for the country.

Venture capitalists invest most of their funds in startups looking to create out of the box solutions. These companies drive innovation, improving existing products or inventing new ones.

There is one company in internet technology that has successfully kept ist dominance because it understands the importance of constant innovation.

That company is Cisco Systems (“CSCO”), a famous communications equipment company supplying hardware and software in connectivity in the U.S. and other parts of the world.

It kept investing massive amounts of its money in research and development, funding ventures, and acquiring smart innovators.

This is one of the reasons the company has been and will be on top of the roost as a true innovation dynamo.

However, investors would never know looking at just as-reported metrics.

Investors would expect a company at the very center of technological improvement to have very high profitability.

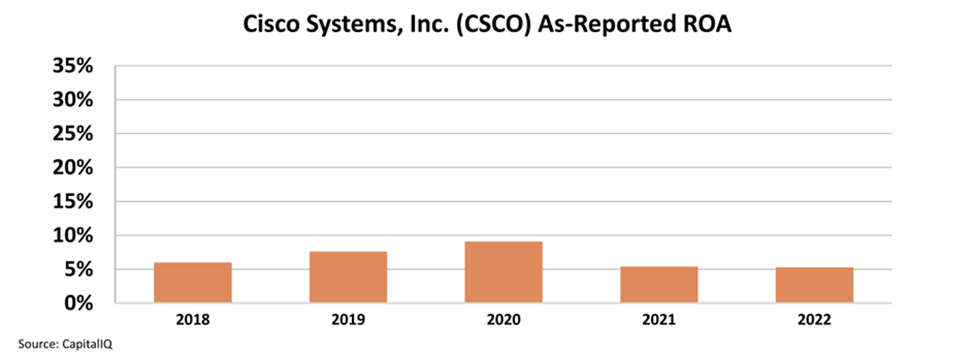

The as-reported metrics make it seem like this is not the case. The as-reported return on assets (“ROA”) of the company ranged between 9% and 5% from 2018 to 2022. It was at the lower end of that range in 2022.

This chart indicates that Cisco generates just above the cost of capital level of profitability.

But this picture of Cisco’s profitability is inaccurate. This is due to distortions in as-reported accounting. We can fix it by doing the over 130 adjustments needed under Uniform Accounting.

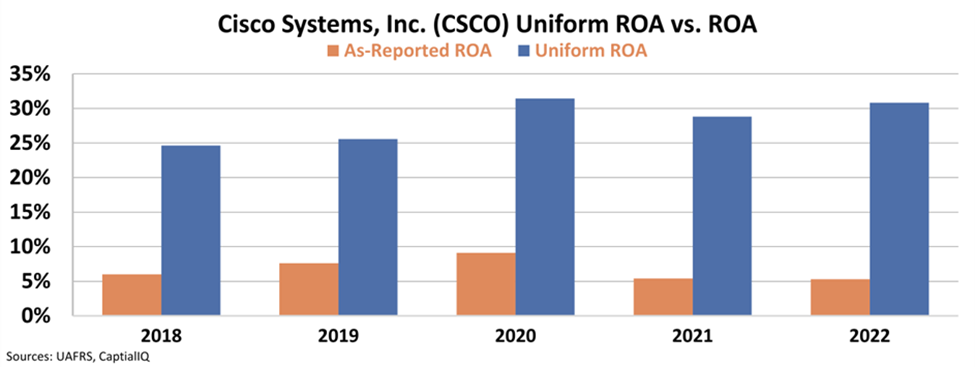

When we clear the numbers, we see a very different picture.

In reality, Cisco has been much more profitable than what the as-reported numbers suggest.

The Uniform ROA of the company has been ranging between 25% and 31% from 2018 to 2022.

In addition, Uniform ROA was at the higher end of this range in 2022, showing improving returns unlike GAAP metrics.

Cisco is a cash-generating machine, and it is getting more and more profitable.

As-reported metrics fail to explain how a company supplying innovation in the U.S. is performing.

Uniform Accounting clears the numbers and shows exactly how innovation works, making it clear that the business is making a lot of money.

SUMMARY and Cisco Systems, Inc. Tearsheet

As the Uniform Accounting tearsheet for Cisco Systems, Inc. (CSCO:USA) highlights, the Uniform P/E trades at 13.6x, which is below the global corporate average of 19.3x and its own historical P/E of 16.3x.

Low P/Es require low EPS growth to sustain them. In the case of Cisco Systems, Inc., the company has recently shown a 2% growth in Uniform EPS.

Wall Street analysts provide stock and valuation recommendations that in general provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, Cisco Systems, Inc.’s Wall Street analyst-driven forecast is a 11% and 7% EPS growth in 2022 and 2023, respectively.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify Cisco Systems, Inc’s $45 stock price. These are often referred to as market embedded expectations.

The company is currently being valued as if Uniform earnings were to shrink by 7% annually over the next three years. What Wall Street analysts expect for Cisco Systems, Inc.’s earnings growth is above what the current stock market valuation requires through 2023.

Furthermore, the company’s earning power in 2021 is 5x the long-run corporate average. Moreover, cash flows and cash on hand are 3x its total obligations—including debt maturities, capex maintenance, and dividends. Also, the company’s intrinsic credit risk is 30bps above the risk-free rate.

All in all, this signals low dividend risk.

Lastly, Cisco Systems, Inc.’s Uniform earnings growth is below its peer averages and average peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

The Uniform Accounting insights in today’s issue are the same ones that power some of our best stock picks and macro research, which can be found in our FA Alpha Daily newsletters.