The U.S. economy is on the brink of recession, but consulting is a resilient industry. Amdocs Limited (DOX) is a stable consulting company well-positioned to weather recessions, offering services and niche tools to telecom companies for over 15 years. However, the market does not seem to believe that Amdocs has sustainable returns by working with all kinds of industries, and it is pricing the stock accordingly. In today’s FA Alpha Daily, let’s examine using Uniform Accounting how Amdocs Limited has been mispriced by the market and how it is an opportunity for investors.

FA Alpha Daily:

Thursday Uniform accounting analysis

Powered by Valens Research

A recession is long looming over the U.S. economy.

Among the many indicators people are watching, the most important of them might be interest rates.

The Fed has been aggressively increasing rates to battle high inflation. That seems to be working, and the Fed paused for now, but with messages saying they might continue to surge them.

High interest rates mean it is more expensive for companies to find funding for their growth and maintenance plans, and for consumers to get credit for spending.

It is very difficult not to be exposed to this. Any company with a risky balance sheet is now at more risk. Consumer-facing industries fear they might see falling demand as the consumer weakens. Landlords are losing tenants and revenues are in sharp decline.

There are some hidden gems though… These companies are not as sensitive to recession scenarios.

One example of these is the consumer staples companies. As they sell products that people need in their daily lives regardless of the state of the economy, these companies hope to see at least stable demand.

A problem with them is that they are mostly fairly priced. The market knows they are resilient, and prices them that way.

There is another set of resilient companies that does not attract much attention. Those are consulting companies, working with all kinds of industries.

One example of those is Amdocs Limited (DOX). It provides IT consulting. More specifically, it consults and provides niche tools to the telecom industry.

The one and maybe the biggest advantage they have is that they do not really have any competitors. It is operating in a niche field and is dominating it.

This business model is highly resilient to economic downturns. Telecom companies need these services no matter what is going on in the broad markets.

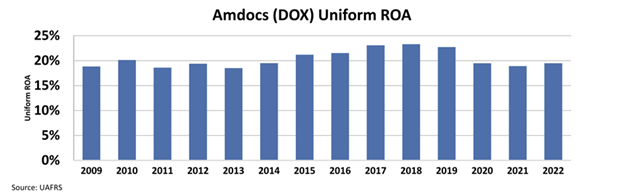

This has been apparent in the company’s profitability as well. Its return on assets (“ROA”) has been very stable, staying around 20% for the last one and a half decades.

And yet, despite these stable returns, the market does not seem to think Amdocs is going to be able to sustain this business model going forward.

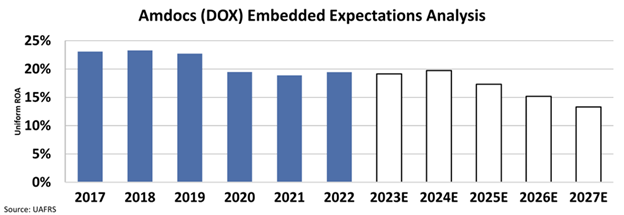

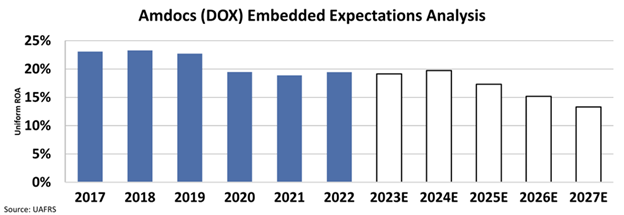

We can see this through our Embedded Expectations Analysis (“EEA”) framework.

The EEA starts by looking at a company’s current stock price. From there, we can calculate what the market expects from the company’s future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

At the current stock price, the market expects the company’s ROA to collapse to 13%, which would be the lowest level in the company’s public history.

These expectations seem overly pessimistic.

The company’s customers are incredibly stable, and Amdocs’ services are essential to what they are doing.

Even if the U.S. economy heads into a recession, the business should be resilient and continue to generate high returns.

This story is not well understood by the market, causing the company’s stock to be undervalued. This means it could outperform the market in the near term.

SUMMARY and Amdocs Limited Tearsheet

As the Uniform Accounting tearsheet for Amdocs Limited (DOX:USA) highlights, the Uniform P/E trades at 15.5x, which is below the corporate average of 18.4x but around its historical P/E of 14.2x.

Low P/Es require low EPS growth to sustain them. In the case of Amdocs, the company has recently shown a 25% growth in Uniform EPS.

Wall Street analysts provide stock and valuation recommendations that in general provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, Amdocs’ Wall Street analyst-driven forecast is a 5% EPS growth in 2023 and a 9% EPS growth in 2024.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify Amdocs’ $95.58 stock price. These are often referred to as market embedded expectations.

The company is currently being valued as if Uniform earnings were to shrink by 3% annually over the next three years. What Wall Street analysts expect for Amdocs’ earnings growth is above what the current stock market valuation requires through 2024.

Furthermore, the company’s earning power is 3x its long-run corporate average. Moreover, cash flows and cash on hand are 3x its total obligations—including debt maturities, capex maintenance, and dividends. Also, the company’s intrinsic credit risk is 90bps above the risk-free rate.

All in all, this signals low dividend risk.

Lastly, Amdocs’ Uniform earnings growth is in line with its peer averages and its average peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

The Uniform Accounting insights in today’s issue are the same ones that power some of our best stock picks and macro research, which can be found in our FA Alpha Daily newsletters.