The “Mark-to-Market” accounting concept made it appear that Berkshire Hathaway (BRK.A) lost $44 billion within a quarter, even though its Q2 results indicate that it made over $9 billion with almost a 40% year-over-year growth. Today’s FA Alpha Daily will investigate the actual profitability and performance of Berkshire Hathaway under the lens of Uniform Accounting.

FA Alpha Daily:

Friday Portfolio Analysis

Powered by Valens Research

Many investors are shocked as Berkshire Hathaway announced its second-quarter results with a $44 billion loss.

It sounds crazy that one of the best investors in the world lost a big lump sum in just three months.

However, this loss is not what it seems.

In 2016, the Financial Accounting Standards Board (FASB) passed new measures to make generally accepted accounting principles (GAAP) more transparent for investors.

One of these measures was aimed at equity investments of companies to be measured at fair value through the “Mark-to-Market” method.

Mark-to-market calculates fluctuations in the value of Berkshire’s investment portfolio between the closing price of its investments in the first quarter and the second quarter.

Due to this accounting methodology, it looks like the Oracle of Omaha lost $44 billion within a quarter, as the stock market was highly volatile during that period.

However, these paper losses are in fact deceiving, as Buffett has not sold these investments yet. Yet, it is recorded as unrealized losses that directly impact the profitability of the company, all according to as-reported metrics.

Looking into the company outside of this mark-to-market adjustment, the second quarter results showed a great improvement. The company made just over $9 billion with almost a 40% year-over-year growth.

Buffett continued to do what he does best — buying the dip. He bought $4 billion more in equities this quarter and has been a net buyer of $45 billion so far in 2022.

As the legendary investor remains bullish, let’s take a look at his portfolio using Uniform Accounting and examine if he’s bullish in the right places.

Economic productivity is massively misunderstood on Wall Street. This is reflected by the 130+ distortions in the Generally Accepted Accounting Principles (GAAP) that make as-reported results poor representations of real economic productivity.

These distortions include the poor capitalization of R&D, the use of goodwill and intangibles to inflate a company’s asset base, a poor understanding of one-off expense line items, as well as flawed acquisition accounting.

It is no surprise that once many of these distortions are accounted for, it becomes apparent which companies are in real robust profitability and which may not be as strong of an investment.

See for yourself below.

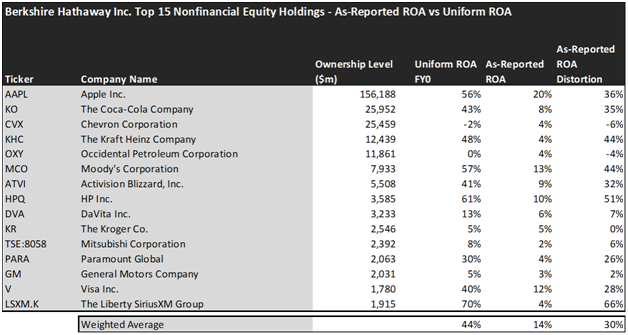

Using as-reported accounting, investors would think investing in Berkshire Hathaway is not really rewarding.

On an as-reported basis, many of these companies are average performers in terms of profitability and operating with an average as-reported ROA of just 14%, which is slightly above the corporate averages in the United States of 12%.

However, once we make Uniform Accounting (UAFRS) adjustments to accurately calculate earning power, we can see that the returns of the companies in Berkshire Hathaway are much more robust.

The average company in the portfolio displays an impressive average Uniform ROA of 44%, which is almost 4 times higher than corporate average returns.

Once the distortions from as-reported accounting are removed, we can realize that HP Inc. (HPQ) doesn’t have a ROA of 10%, but returns of 61%.

Similarly, The Liberty SiriusXM Group’s (LSXM.K) ROA is actually 70%, not 4%. The company engages in the entertainment business through its subsidiary Sirius XM Holdings.

Moody’s Corporation (MCO) is another great example of as-reported metrics misrepresenting the company’s profitability. With a Uniform ROA of 57%, an as-reported of 13% is wholly misleading and misses the story.

To find companies that can deliver alpha beyond the market, just finding companies where as-reported metrics misrepresent a company’s real profitability is insufficient.

To really generate alpha, any investor also needs to identify where the market is significantly undervaluing the company’s potential.

Once we account for Uniform Accounting adjustments, we can see that many of these companies are strong stocks but have already realized most of their potential.

These dislocations demonstrate that most of these firms are in a different financial position than GAAP may make their books appear. But there is another crucial step in the search for alpha. Investors need to also find companies that are performing better than their valuations imply.

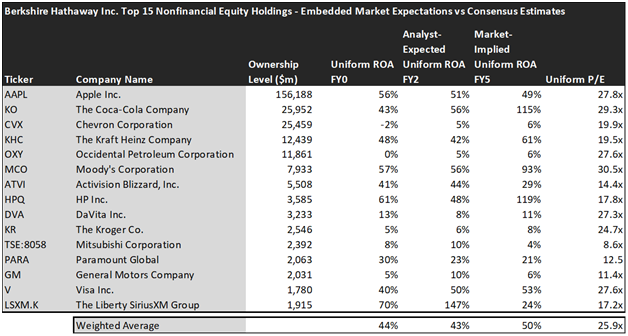

Valens has built a systematic process called Embedded Expectations Analysis to help investors get a sense of the future performance already baked into a company’s current stock price. Take a look:

This chart shows four interesting data points:

- The Uniform ROA FY0 represents the company’s current return on assets, which is a crucial benchmark for contextualizing expectations.

- The analyst-expected Uniform ROA represents what ROA is forecasted to do over the next two years. To get the ROA value, we take consensus Wall Street estimates and convert them to the Uniform Accounting framework.

- The market-implied Uniform ROA is what the market thinks Uniform ROA is going to be in the three years following the analyst expectations, which for most companies here are 2023, 2024, and 2025. Here, we show the sort of economic productivity a company needs to achieve to justify its current stock price.

- The Uniform P/E is our measure of how expensive a company is relative to its Uniform earnings. For reference, the average Uniform P/E across the investing universe is roughly 22x.

Embedded Expectations Analysis of Berkshire Hathaway paints a clear picture. Over the next few years, Wall Street analysts expect the companies in Berkshire Hathaway to slightly improve profitability, and the market agrees.

Analysts forecast the industry to see Uniform ROA increase to 43% over the next two years, and the market is also pricing the industry to see returns rise to approximately the same levels as analysts, which may imply that Berkshire’s holdings are on average being correctly priced by the market.

However, there are a couple of companies that may lead investors to be cautious.

The markets are expecting Visa’s (V) Uniform ROA to rise to 53%. Meanwhile, analysts are projecting the company’s returns to increase to 50%, perhaps disappointing investors.

The Coca-Cola Company (KO) may further disappoint investors as analysts expect their returns to slightly improve to 56% Uniform ROA, while the market expects them to increase their returns to 115%.

Even though the Q2 results show a massive loss for Berkshire Hathaway due to as-reported distortions, the portfolio is composed of historically strong performers and quality names. But to continue generating alpha, investors should always consider the valuation of the companies.

This just goes to show the importance of valuation in the investing process. Finding a company with strong growth is only half of the process. The other, just as important part, is attaching reasonable valuations to the companies and understanding which have upside which has not been fully priced into their current prices.

To see a list of companies that have great performance and stability also at attractive valuations, the Valens Conviction Long Idea List is the place to look. The conviction list is powered by the Valens database, which offers access to full Uniform Accounting metrics for thousands of companies.

Click here to get access.

Read on to see a detailed tearsheet of one of Berkshire Hathaway’s largest holdings.

SUMMARY and Apple Inc. Tearsheet

As one of BRK.A’s largest individual stock holdings, we’re highlighting Apple Inc. (AAPL:USA) tearsheet today.

As the Uniform Accounting tearsheet for Apple highlights, its Uniform P/E trades at 25.3x, which is above the global corporate average of 19.3x and around its historical average of 20.2x.

High P/Es require high EPS growth to sustain them. In the case of Apple, the company has recently shown 72% Uniform EPS growth.

Wall Street analysts provide stock and valuation recommendations that, in general, provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, Apple’s Wall Street analyst-driven forecast is for EPS to grow by 8% in 2022 and 1% in 2023.

Furthermore, the company’s return on assets was 45% in 2021, which is above the long-run corporate averages. Cash flows and cash on hand are 2.5x its total obligations—including debt maturities and CAPEX maintenance. Moreover, its intrinsic credit risk is 10bps above the risk-free rate. Together, these signal low credit risks.

Lastly, Apple’s Uniform earnings growth is in line with peer averages but is trading in well-above peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

This portfolio analysis highlights the same insights we share with our FA Alpha Members. To find out more, visit our website.