FA Alpha Daily

Powered by Valens Research

Breaking into an established industry is no small feat, especially when the market is dominated by a few major players.

For example, Google’s (GOOGL) Chrome accounted for over 65% of the global market for internet browser usage while Apple’s (AAPL) Safari was the second most popular around the world, accounting for about 19% of market share.

Apart from these two, no other browser has more than five percent of overall market share.

However, there is still hope for companies that try to focus on the niche parts of the market and gain a competitive advantage.

One of these companies is Opera (OPRA)…

While most browsers like Chrome, Edge, and Safari aim for a broad market, Opera has carved out a space for itself by catering to gamers, blockchain enthusiasts, and those interested in artificial intelligence.

This targeted approach has allowed Opera to build a loyal user base that values specialized features and a more personalized browsing experience.

At its core, the company makes money in much the same way as its competitors. It earns revenue through partnerships with search engines and digital advertising.

Where Opera differs from the other browsers is its focus on specialized products.

Opera GX is designed specifically for gamers. It gives users the ability to control how much of their computer’s resources are used by the browser, a feature that appeals to gamers who need to maximize performance.

Also, it acts as a place to discover games, build profiles and connect with communities.

Furthermore, users have the ability to customize the browser in depth both aesthetically and functionally.

Over 33 million people use it monthly, and engagement keeps rising.

Opera has also been aggressive about integrating artificial intelligence into its product. The company’s Aria AI assistant isn’t just a gimmick—it’s built right into the browser, offering real-time search and interaction tools that feel more natural than traditional browsing.

AI plays a quiet but critical role in the browser. Instead of flashy chatbots, Opera integrates tools that solve specific problems.

Agentic Browsing, for example, summarizes articles or organizes tabs to save time. Image recognition helps users identify products in photos, linking them directly to purchase options.

These features are about making the browser more useful. For advertisers, Opera’s AI sharpens targeting, ensuring ads align with what users actually care about.

Furthermore, the company has been particularly strategic about expanding into high-value markets.

In just four years, they’ve increased their presence in North America and Europe from 9% to 19% of their user base.

This might sound like a small number, but it’s translated into a 33% increase in average revenue per user—reaching nearly $2 per user.

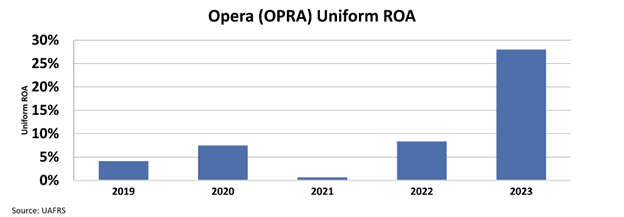

All these factors combined enabled the company to achieve 28% Uniform return on assets ‘‘ROA’’ last year.

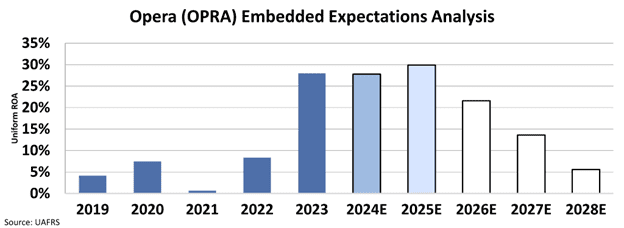

Despite this strong performance, the market has concerns about Opera failing to maintain its impressive growth.

We can see what the market thinks through our Embedded Expectations Analysis (“EEA”) framework.

The EEA starts by looking at a company’s current stock price. From there, we can calculate what the market expects from the company’s future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

At the current stock price, the market expects the company’s ROA to drop to around 6% instead of improving.

Opera’s focus on specialized markets may sustain its growth and competitive advantage.

Rather than trying to appeal to everyone, the company has doubled down on what makes its products unique.

This strategy not only helps retain existing users but also attracts new ones who are searching for a browser that aligns more closely with their interests and lifestyle.

If the company keeps delivering for its niche audiences and finding ways to monetize them without alienating them, it could offer a substantial upside.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Officer &

Director of Research

at Valens Research

Today’s analysis highlights the same insights we share with our FA Alpha Members. If you want to an get in-depth analysis of market trends and uncover undervalued stocks, become an FA Alpha Member today.