The FA Alpha Daily provides you with insights and tools to help you build your business.

Our portfolio analysis highlights strategies for your clients’ portfolios and important talking points for your client discussions – points that the mainstream financial media almost always miss.

We hope you find today’s useful.

FA Alpha Daily:

Friday Portfolio Analysis

Powered by Valens Research

The end of 2021 saw the market reach new heights. Investors were excited and rushing to invest in stocks across a wide variety of sectors as the economy was opening back up.

As we saw companies explode in popularity over the start of the pandemic due to their innovative ways to change how we approach our daily habits and activities, their valuations did as well.

Even more established companies that are naturally exposed to trends around working or playing at home saw a huge boom, along with firms that are able to pivot into these tailwinds.

Now, the strength of the market as we enter the new year can be seen by the sharp increase in economic activity seen in recent years as well as the sharp increase in market expectations.

The chart below shows the Uniform economic profit of the entire U.S. Market in billions over the past twenty years. As you can see, there is a projected doubling of economic profit from 2020 to 2022.

Furthermore, we don’t have to compare the numbers to just 2020 troughs. The 2021 expected economic profit comes in at more than twice the activity of 2010 through 2015 as the economy was recovering from the Great Recession.This huge expansion in corporate profits is the underlying engine underneath the aggressive bull market of the past decade.

Investors looking to understand the whole picture may wonder if these increased profits have come at the expense of efficiency. However, this isn’t the case.

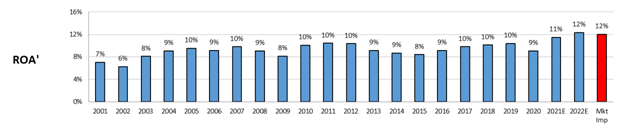

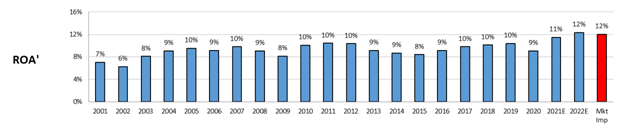

The chart below shows the return on assets for the U.S. market as a whole, along with market expectations for the future.

The market is seeing returns hitting all time highs in 2021 and 2022, with the market expecting returns to stay flat into perpetuity.

This continuous growth in both raw earnings and returns means the S&P 500 has been undergoing an unprecedented bull run. In such an environment, it’s only natural investors are looking for ways to beat the already impressive average returns.

As we enter the new year, Bloomberg announced a list of fifty firms which they think are going to be major players to continue to power 2022 around innovation and disruption.

These are firms that have the potential to grow due to a variety of factors, yet they all share a narrative in common.

They are firms that have positioned themselves to be market drivers due to their efforts over the past year due to the spending shifts around the pandemic.

In order to identify if these are in fact companies, which in aggregate, are positioning themselves to lead that way, we have to take a look at their performance through a Uniform lens.

Similar to the market as a whole, let’s take a look at the aggregate ROA for the 50 companies Bloomberg has highlighted.

Bloomberg’s companies are stronger performers than the U.S. average, with returns of 22% in 2021 after seeing record high returns of 45% during the pandemic itself. This makes sense considering Bloomberg was looking at companies that will continue to excel in a post-pandemic environment.

However, the market has also caught onto this pandemic success as well. To be worth their current value, these companies in aggregate need to see returns rise by at least 3% to 25%.

With the market only earning an ROA of 12%, we can see that these 50 investments are not only outperforming their peers, but expected to continue outperforming as well.

Delving a bit deeper into the picks, we can take a look at a few companies from different sectors.

On the weaker end, a name like General Motors, despite potential promise in a car industry moving back to normal, may be a little too optimistic.

While returns have appeared artificially deflated over the last few years, its ROA has also steadily declined since 201 to just 5%, around cost-of-capital levels.

As a result, while its true earnings power is higher than in reality, it goes to show that not all of the picks are great selections.

On the other hand, there is a firm like Lululemon (LULU).

As the world potentially prepares itself to return to a new normal, athleisure is here to stay and Lululemon’s innovations in keeping their clothing a part of consumer’s wardrobe in this new environment and creating an immersive in-store experience have made it a stand out firm to invest in.

This means, historically, Lululemon has been a strong performer even through 2021 when it saw supply chain struggles. In 2021 the company earned a 23% return on assets.

This discrepancy just goes to show the importance of valuation in the investing process. Finding high growth and quality firms is only half of the process. The other part, which is just as important, is attaching reasonable valuations to the companies.

To see a list of companies that have great performance and innovation, with attractive valuations, the Valens Conviction Long List is the place to look. The conviction list is powered by the Valens database, which offers access to full Uniform Accounting metrics for thousands of companies.

Click here to get access.

Read on to see a detailed tearsheet of an interesting name from the Bloomberg 50 list.

SUMMARY and Tencent Holdings Limited Tearsheet

Today, we’re highlighting Tencent’s tearsheet.

As the Uniform Accounting tearsheet for Tencent (700:HKG) highlights, its Uniform P/E trades at 16.4x, which is below the global corporate average of 24.0x, but around historical average of 18.5x.

Low P/Es require low EPS growth to sustain them. In the case of Tencent, the company has recently shown a 23% Uniform EPS growth.

Wall Street analysts provide stock and valuation recommendations that, in general, provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, Tencent’s Wall Street analyst-driven forecast is for EPS to grow by 25% in 2021 and shrink by 1% in 2022.

Meanwhile, the company’s earning power is 17x the long-run corporate averages. However, cash flows and cash on hand are more than 4x total obligations—including debt maturities and capex maintenance. This signals a low credit risk.

Lastly, Tencent’s Uniform earnings growth is above peer averages, and the company is trading well above its average peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

This portfolio analysis highlights the same insights we use to power our FA Alpha product. To find out more visit our website.