Despite higher interest rates, the housing market for newly constructed homes has surpassed expectations. This trend has benefited companies like eXp World Holdings, a cloud-based real estate brokerage firm as it consistently produces high returns. However, the market believes that the company’s success is only temporary and, as a result, undervalues its potential profitability. In today’s FA Alpha, we will discuss how eXp World Holdings will benefit from the effects of rising interest in the housing market and how the market’s bearish outlook on this company can create an opportunity for investors.

FA Alpha Daily:

Tuesday Company Specific

Powered by Valens Research

The newly constructed housing market has overgrown expectations in the last six months.

Everyone thought the industry would go down with increasing interest rates as mortgages get more and more costly.

However, these expectations have not become real.

We have been talking about how homebuilders are still strong, contrary to public opinion.

This is because high-interest rates affect sellers and buyers alike.

Homeowners do not want to sell their homes. Replacing it would mean buying either a similar one with a more expensive mortgage or a smaller one with the same cost. That does not make sense to them.

With existing homes out of the market, all the demand for housing is carried on the shoulders of homebuilders.

The demand may be lower than before, but so is the supply. That is why homebuilders have been resilient to increasing rates.

There is another set of companies benefiting from the same story. Those are real estate brokers like eXp World Holdings (EXPI).

Having launched right after the housing crisis around 2008, the company provides cloud-based real estate brokerage services for residential homeowners and homebuyers.

While most of its operations are in the U.S., it has a presence worldwide, including Australia, South Africa, India, Mexico, and many more.

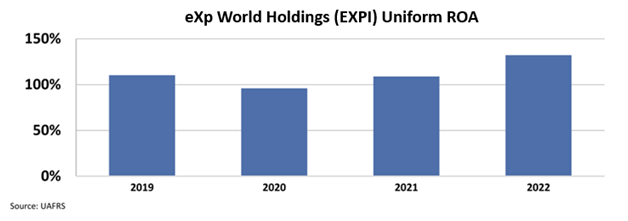

The asset-light business generated an incredible return on assets (“ROA”) over the last 4 years. Its ROA was around 100% between 2019 and 2021 before jumping to 132% as a result of the scarcity of supply.

However, the market thinks this is only a temporary jump and prices the company to be less profitable going forward.

During this period of high returns, the price-to-earnings (“P/E”) ratio of eXp World Holdings’ stock was around 25x. Investors enjoyed high returns and reflected that in the price in 2020 and 2021.

However, current valuations seem bizarre. Even though the company showed its profitability is sustainable, the stock currently trades at an 8.1x P/E multiple.

Considering the supply-demand dynamics in the market and the company’s key position in matching demand with supply and vice versa, the valuations are overly pessimistic.

That is why eXp World Holdings is a great FA Alpha 50 name. Its high and sustainable ROA and key positioning make it interesting.

Throughout financial market history, many of the world’s most successful investors have been candid in their belief that Generally Accepted Accounting Principles (“GAAP”) distort economic reality.

Warren Buffett, for example, once said investors should “concentrate on the world of companies, not arcane accounting mathematics.”

Investors who neglect the very real issues with as-reported accounting can find themselves caught up in investing with the crowd, blindly following hot “themes” without a thorough grasp of how to understand the businesses in question.

The only true way to focus on the “world of companies,” as Buffett suggests investors do, is to present a clear picture of how a business operates, something that can only be done by adjusting financial statements to reflect the arbitrary nature of certain accounting rules that leave much to discretion.

The world’s best investors understand the need to make these adjustments, which allows them to focus not on picking out the most popular companies but rather on looking for great names in sleepy areas that the market isn’t paying much attention to. From there, the goal is to then identify quality companies with significant growth potential at reasonable prices.

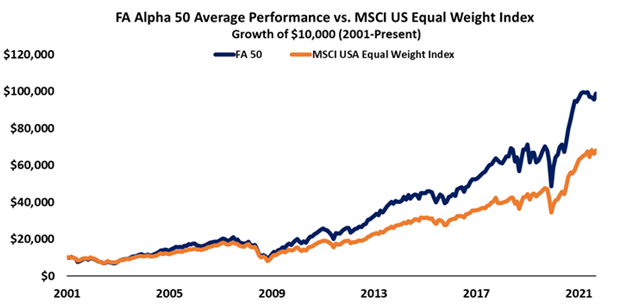

That’s exactly what we’ve set out to do with the FA Alpha, our monthly list of 50 companies that rank at the top for quality, high growth, and low valuations.

This list has outperformed the market by 300 basis points per year for over 20 years now, effectively doubling the performance of the market by focusing on the real fundamentals and valuations of companies with our proprietary Uniform Accounting framework.

See for yourself below.

To see the other 49 names on the list, click here.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

Today’s highlight, eXp World Holdings, Inc. (EXPI) is one of the top stock picks from FA Alpha 50 this month. To see more stock picks like this, become an FA Alpha get access to FA Alpha 50.