Despite the crucial role they play in supporting larger industries, some essential businesses that may not seem exciting go unnoticed. One prime example is Janus International (JBI), a company that provides doors for self-storage units. JBI generates significant returns with its simple business model, yet the market undervalues it, leading to lower stock multiples. In today’s FA Alpha Daily, we will explore Janus International to help investors better understand the true value of this underrated business.

FA Alpha Daily:

Tuesday Company Specific

Powered by Valens Research

Sometimes, boring businesses are the best.

There are a lot of relatively small and niche companies that have only one business. However, that one business may turn the wheels for many more.

And the fact that business is a necessity means that even if things get tough for the industry overall, these niche businesses can stay resilient.

For instance, the real estate sector has been struggling as interest rates increase. High mortgage rates make housing less affordable and accessible, decreasing the demand for it.

However, it is not crashing as a whole. One of the only parts of the real estate market that is still holding up okay is storage rentals.

That industry has very different dynamics than the overall sector. Offices, housing, and storage rentals are affected by different tailwinds and headwinds.

People may be having problems financing housing, but bought a lot of different stuff during the pandemic, and they need somewhere to put it all.

That is part of why self-storage occupancy rates are hanging strong.

While that is good for the companies that own self-storage units, it is even better for their arms dealers like Janus International (JBI).

All Janus does is make the doors that go on self-storage units. It’s one of a small group of companies that does.

That might seem incredibly sleepy, but Janus has the luxury of not caring who wins in self-storage space. As long as the industry survives and demand grows, companies will need to keep buying doors every so often.

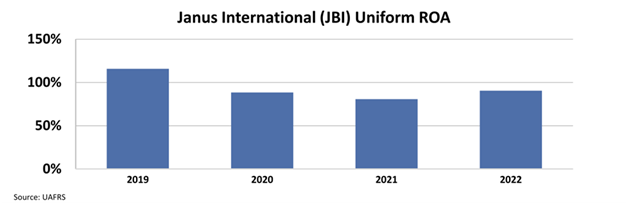

Every year, the company mints cash. It is such a simple business, but it also has an incredibly high margin, which is why its Uniform return on assets (“ROA”) is always high.

Janus’ ROA fell from 116% in 2019 to 88% in 2020 during the pandemic. However, as occupancy rates stood strong and demand did too, Janus managed to keep its ROA at 90%.

However, the market still doesn’t seem to get the story. Despite Janus’ strong position in an undying market, multiples are well below market averages.

The stock trades at a price-to-earnings ratio (“P/E”) of only 10.9x and a price-to-book ratio (“P/B”) of 10.6x.

For a growing business with an incredibly high ROA, these multiples do not seem fair.

That is why Janus International is a great FA Alpha 50 name. Its high and sustainable ROA and key positioning make it interesting.

Throughout financial market history, many of the world’s most successful investors have been candid in their belief that Generally Accepted Accounting Principles (“GAAP”) distort economic reality.

Warren Buffett, for example, once said investors should “concentrate on the world of companies, not arcane accounting mathematics.”

Investors who neglect the very real issues with as-reported accounting can find themselves caught up in investing with the crowd, blindly following hot “themes” without a thorough grasp of how to understand the businesses in question.

The only true way to focus on the “world of companies,” as Buffett suggests investors do, is to present a clear picture of how a business operates, something that can only be done by adjusting financial statements to reflect the arbitrary nature of certain accounting rules that leave much to discretion.

The world’s best investors understand the need to make these adjustments, which allows them to focus not on picking out the most popular companies but rather on looking for great names in sleepy areas that the market isn’t paying much attention to. From there, the goal is to then identify quality companies with significant growth potential at reasonable prices.

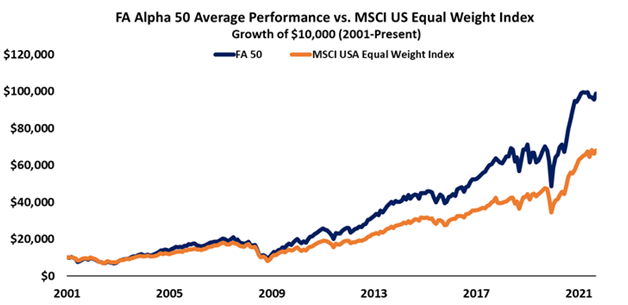

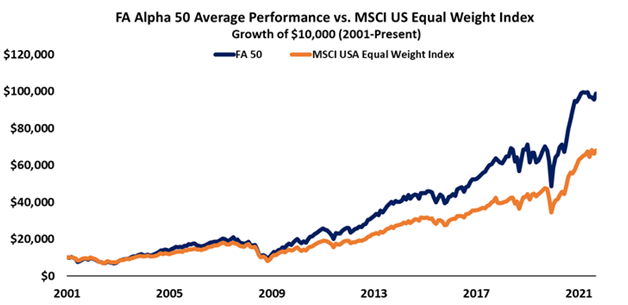

That’s exactly what we’ve set out to do with the FA Alpha, our monthly list of 50 companies that rank at the top for quality, high growth, and low valuations.

This list has outperformed the market by 300 basis points per year for over 20 years now, effectively doubling the performance of the market by focusing on the real fundamentals and valuations of companies with our proprietary Uniform Accounting framework.

See for yourself below.

To see the other 49 names on the list, click here.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

Today’s highlight, Janus International (JBI) is one of the top stock picks from FA Alpha 50 this month. To see more stock picks like this, become an FA Alpha get access to FA Alpha 50.