Banks are starting to ease lending standards after years of restrictive credit that weighed heavily on corporations and investors alike. As lenders adapt to tariffs, a long-feared credit crunch may be giving way to stability. In today’s FA Alpha Daily, we explore how stabilizing lending conditions could reshape market sentiment and what it means for investors.

FA Alpha Daily:

Powered by Valens Research

Credit has been a shadow hanging over the market for years as banks spent 2022 and 2023 tightening their lending standards. Corporations scrambled to refinance looming maturities.

As a result, investors worried that, eventually, the squeeze would spill into earnings.

Even at the start of this year, credit was still the story. For the first time in 10 quarters, net tightening had dropped to zero toward the end of 2024. It looked like banks were done pulling back.

Then came “Liberation Day.”

Investors worried tariffs would break balance sheets, damage cash flows and restart the credit crunch.

That fear showed up in the second quarter, when banks went right back to tightening. For a moment, it looked like they had slammed the brakes all over again.

But these days, the data shows that banks are becoming more comfortable lending in today’s tariff environment..

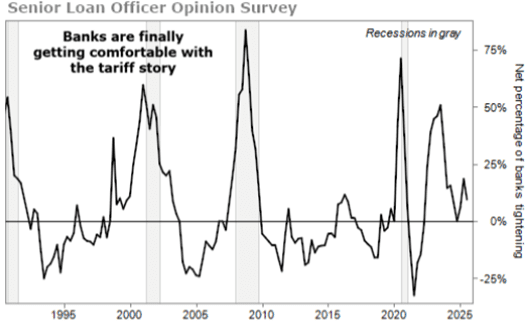

The changing stance towards bank lending standards can be measured through the Senior Loan Officer Opinion Survey (“SLOOS”).

The SLOOS is a poll conducted every quarter by Federal Reserve regulators. It asks loan officers if their lending standards have tightened, loosened, or stayed the same over the past three months.

Said another way, it shows how willing banks are to make loans and how easy or difficult it is for corporations and consumers to access credit.

In the wake of Liberation Day, net tightening soared to 18.5%. But in the latest SLOOS reading, that number was down to just 9.5%.

While those numbers still signal a cautionary stance, these indicate that banks are acclimating to the constant presence of tariffs.

The same trend can also be observed in other credit indicators. Investment-grade and high-yield spreads remain near their tightest levels of the cycle. Companies are refinancing debt at favorable terms.

As earnings keep growing, the fear of a credit-driven slowdown is fading.

This is how credit cycles tend to move. Banks are slow. But lending standards and credit spreads say the backdrop is improving.

More will be known once mid-September rolls around as that’s when the central bank’s next rate decision is expected. And all signals point to Fed Chair Jerome Powell cutting rates by at least 0.25%.

While this possible rate cut seems promising, that doesn’t mean the market is in the clear. Valuations are still stretched and sentiment remains elevated.

Still, credit standards are easing. Earnings remain strong. Those are the real long-term drivers of the market. And both are moving in the right direction. Positive changes should keep supporting stocks beneath the surface.

To sum up, the mood on Wall Street has shifted from fear to relief.

Not long ago, credit markets looked like they were heading straight into crisis mode But cracks of light are beginning to show.

The latest signals suggest banks are finding their footing in this new environment. Lending conditions are still cautious. But they’re no longer in freefall.

In other words, the credit market that once seemed like a ticking time bomb may finally be stabilizing.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Officer &

Director of Research

at Valens Research

Today’s analysis highlights the same insights we share with our FA Alpha Members. If you want to an get in-depth analysis of market trends and uncover undervalued stocks, become an FA Alpha Member today.