Tesla (TSLA) is struggling to keep up with sky-high expectations. While working to lead the future of autonomous driving, it’s now facing real challenges in both technology and international markets. In today’s FA Alpha Daily, we look at why Tesla’s current performance may not justify the market’s high hopes and what that means for investors.

FA Alpha Daily

Powered by Valens Research

Autonomous driving is leaving the realm of science fiction and is becoming a reality, marking a pivotal development in the transportation sector.

Once every feature is ironed out, this technology has the potential to change how people travel, enabling them to go from one place to another without ever having to touch a steering wheel.

Automation also brings with it the promise of reduced traffic congestion, better safety features, a lower number of accidents, and new services leveraging the use of self-driving cars.

While fulfilling these promises sound like a tall order, Tesla (TSLA) has been hard at work for the past several years to turn these possibilities into reality.

However, the company is currently navigating a difficult year, facing concrete problems in its technology rollout, international sales, and internal leadership.

Tesla’s attempt to launch its robotaxi service in Austin ran into trouble on its very first day, with its autonomous vehicles being filmed for violating traffic laws. At the same time, sales in Europe have been in a steep decline for five consecutive months.

In response to this poor performance, the company has fired key executives, signaling significant dissatisfaction from the top.

The issues with the robotaxi launch in Austin surfaced quickly and were publicized immediately. This service was meant to be the first real-world test of customers paying for rides in Tesla’s self-driving cars.

However, videos quickly appeared online showing the vehicles breaking the law. In one instance, a robotaxi was seen exceeding the speed limit, and in another, it swerved into the wrong lane.

These incidents were serious enough to attract federal attention. The U.S. National Highway Traffic Safety Administration (NHTSA) confirmed it was aware of the reports and was in contact with Tesla to gather more information.

The agency stressed that it does not pre-approve new vehicle technologies but investigates potential safety defects as they arise.

This is a setback for a critical piece of Tesla’s long-term strategy: its Full Self-Driving software, which relies on a camera-based system without the support of lidar or radar sensors common in other autonomous vehicles.

While its autonomous driving technology is facing hiccups in the U.S., the company’s business is struggling significantly in Europe. For five months in a row, Tesla has lost ground in this crucial market.

According to the European Automobile Manufacturers Association, new car registrations for Tesla plummeted by 40% in May compared to the same month last year.

This drastic drop slashed its market share in the European Union from 1.6% down to just 0.9%.

A major reason for this decline is the growing preference among European consumers for more affordable electric cars from Chinese manufacturers.

Even the introduction of a refreshed Model Y did little to stop the bleeding, failing to reverse the company’s fortunes in the region.

Facing these mounting problems, CEO Elon Musk took direct action on the leadership front. He reportedly fired the head of the company’s North American and European operations, Omead Afshar.

Afshar, a longtime executive, was reportedly held accountable for the company’s underperformance, especially the continued decline in European sales.

The move is a clear signal that the poor results will not be tolerated and that major changes are being made in an attempt to correct course.

All of this is happening while the company is under intense pressure from the market to deliver extraordinary growth.

There is a vast difference between Tesla’s recent performance and what investors expect. Last year, the company generated an 11% Uniform return on its assets.

However, the market is pricing its stock as if it will achieve returns of more than 50% in the near future.

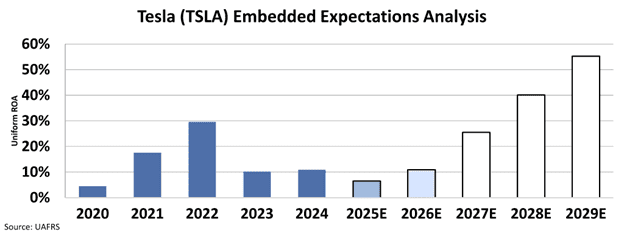

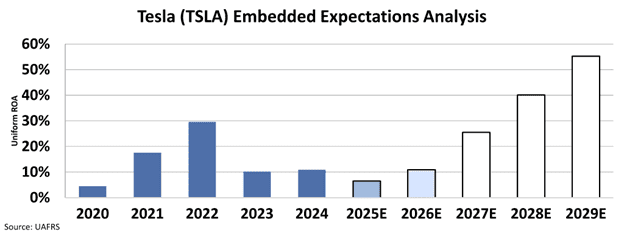

We can see what the market thinks through our Embedded Expectations Analysis (“EEA”) framework.

The EEA starts by looking at a company’s current stock price. From there, we can calculate what the market expects from the company’s future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

At the current stock price, the market predicts that Tesla’s Uniform ROA will rise to around 55% from 11% last year.

This expectation is nearly double the company’s all-time best performance. This puts Tesla in a tough spot, as it’s forced to fix fundamental issues with its technology and sales while chasing a level of growth that Wall Street analysts do not expect it to achieve.

The company’s current reality of product stumbles and falling sales in a key market is clashing with the immense expectations built into its stock price.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Officer &

Director of Research

at Valens Research

Today’s analysis highlights the same insights we share with our FA Alpha Members. If you want to an get in-depth analysis of market trends and uncover undervalued stocks, become an FA Alpha Member today.