History seems to repeat itself with rating agencies repeating the same mistake they made with Amazon in the early 2000s. Despite being a cash-generating $60bn company, MercadoLibre (MELI), the Amazon of South America, has been rated with a high chance of bankruptcy due to distorted financial data. In today’s FA Alpha Daily, let’s analyze MercadoLibre using Uniform Accounting to see its true profitability and credit risk.

FA Alpha Daily:

Wednesday Credit

Powered by Valens Research

It’s amazing how history repeats itself. In the early 2000s, the rating agencies couldn’t make sense of Amazon (AMZN) when it issued debt.

Due to the distortions in as-reported accounting that hid the true profitability of the company, rating agencies rated Amazon like it was going to go bankrupt in 2 years…

The reality though was that Amazon was already printing money impressively.

Now, rating agencies are making the same mistake with the Amazon of South America.

MercadoLibre (MELI), the massive e-commerce powerhouse in Latin America, is rated “BB+” by S&P. With this rating, S&P is saying it thinks the company’s chance of bankruptcy in the next few years is as high as 10%.

MercadoLibre is a $60bn company that throws off a ton of cash. With those traits, it is unlikely that default risk is that high.

You almost can’t blame the credit rating agencies though. As-reported metrics show the company’s return on assets (ROA) was barely above the cost of capital by around 5% last year.

According to as-reported metrics, MercadoLibre was making below cost-of-capital levels of returns in 2020 and 2021, with 1% and 3% ROA respectively.

It looks like a crummy business, and the rating agencies are treating it as such.

On the other hand, Uniform Accounting removes the distortions caused by as-reported accounting and shows us how profitable the company actually is.

The company’s Uniform ROA has improved from 8% in 2020 to 24% by 2022. It boosted its returns and has been printing cash in the last two years. And for much of the past 20 years, its returns were well above 15%.

However, rating agencies were misled by as-reported metrics and because of that, they couldn’t really understand the business.

Hence, they gave an unbelievable credit rating for MercadoLibre, overstating its risk of default.

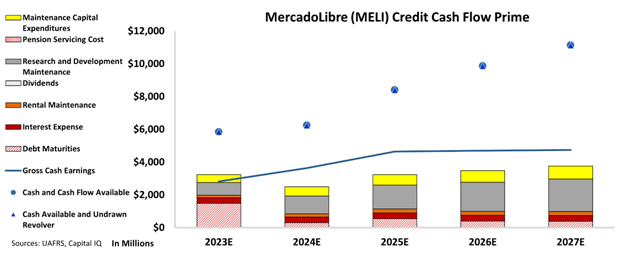

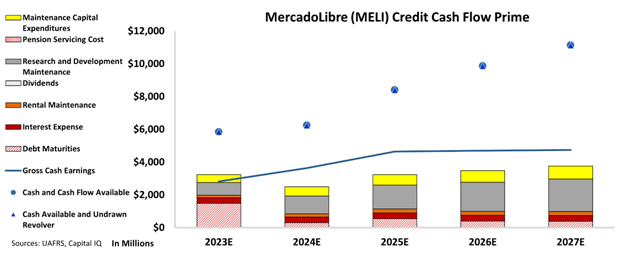

We can figure out if there is a real risk for this company by leveraging the Credit Cash Flow Prime (“CCFP”) to understand how the company’s obligations match against its cash and cash flows.

In the chart below, the stacked bars represent the firm’s obligations each year for the next five years. These obligations are then compared to the firm’s cash flow (blue line) as well as the cash on hand available at the beginning of each period (blue dots) and available cash and undrawn revolver (blue triangles).

The CCFP chart clearly shows that MercadoLibre’s cash flows are more than enough to cover all of its obligations going forward.

The chart shows the company does not have any significant debt headwalls over the next five years that its cash flows and cash on hand can’t cover. Moreover, its earnings alone could easily be enough to pay all its operating obligations going forward.

Additionally, the company’s huge cash flows and sizable cash on hand buffer give it flexibility in case of a downturn in the near future.

Taking these factors into consideration and adding the fact that it is a $60bn company with substantially improving returns, the “BB+” rating from S&P does not make sense at all.

That is why we are giving an “IG3” rating to MercadoLibre. This rating implies around a 1% risk of default and puts the company back into the investment-grade basket, where it actually belongs.

It is our goal to bring forward the real creditworthiness of companies, built on the back of better Uniform Accounting.

To see Credit Cash Flow Prime ratings for thousands of companies, click here to learn more about the various subscription options now available for the full Valens Database.

SUMMARY and MercadoLibre (MELI:USA) Tearsheet

As the Uniform Accounting tearsheet for MercadoLibre (MELI:USA) highlights, the Uniform P/E trades at 48.1x, which is above the global corporate average of 18.4x but below its historical P/E of 92.8x.

High P/Es require high EPS growth to sustain them. In the case of MercadoLibre, the company has recently shown a 274% Uniform EPS growth.

Wall Street analysts provide stock and valuation recommendations that in general provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, MercadoLibre’s Wall Street analyst-driven forecast is for a 29% and 32% EPS growth in 2023 and 2024, respectively.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify MercadoLibre’s $1,245 stock price. These are often referred to as market embedded expectations.

Furthermore, the company’s earning power in 2022 was 4x the long-run corporate average. Moreover, cash flows and cash on hand are 4x its total obligations—including debt maturities and capex maintenance. The company also has an intrinsic credit risk that is 60bps above the risk-free rate.

Overall, this signals a low credit risk.

Lastly, MercadoLibre’s Uniform earnings growth is in line with its peer averages and is trading above its average peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

This analysis of MercadoLibre (MELI)’s credit outlook is the same type of analysis that powers our macro research detailed in the member-exclusive FA Alpha Pulse.