If you are familiar with the phrase “promises are made to be broken” then you should look into the stock market as there are a lot of publicly listed companies, especially small-tech ones, that have great ideas, yet profitability is nowhere to be found. An example of this is Lyft (LYFT), a company that had problems with profitability, and things aren’t looking to turn around anytime soon forcing it to take drastic measures just to survive. In today’s FA Alpha, we will discuss what investors should learn from Lyft using uniform accounting analysis.

FA Alpha Daily:

Thursday Uniform accounting analysis

Powered by Valens Research

If you have been looking for investment opportunities, you should have seen that there are many companies in the public markets that were never able to generate profits.

Especially small technology companies that say they are focusing on growth and claim that they will see huge profits over the long term.

Their financials look like the ones of start-ups.

Some of them show great potential and manage to make people forget all the years of burning cash.

However, anyone can see that if you forget about profitability long enough, you are left without any money and the business is ruined.

That is the news Lyft (LYFT) finally got…

The ridesharing application’s earnings fell short of estimates, and CEO Logan Green was not happy.

Even though competitors like Uber (UBER) continued to prosper, Lyft failed to recover after the pandemic.

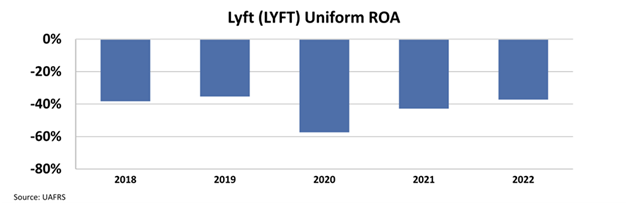

The company had a problem with profitability for a long time. The best its Uniform return on assets (“ROA”) has ever seen is -35%.

It was even worse in 2020 when nobody had a reason to open the application. The ROA could only recover from -57% during the pandemic to -37% in 2022.

Now, the management has to make difficult decisions to keep the business afloat.

Logan Green says the company will focus on lowering prices and improving wait times, so the business can compete and not run out of money.

The stock was already down 63% in 2022. It dropped another 37% after the earnings call.

Even if they do what they say and improve competitiveness, Lyft will have a difficult time getting to positive profitability.

Uniform ROA is still very negative, and the business is burning so much cash.

All this highlights how much the “platform chase” did not ever make sense.

Investors trying to realize returns with this strategy should learn from this story and look for companies with a chance to be profitable instead.

SUMMARY and Lyft, Inc. CorporationTearsheet

As the Uniform Accounting tearsheet for Lyft, Inc. (LYFT:USA) highlights, the Uniform P/E trades at 55.6x, which is above the corporate average of 18.4x and its historical P/E of -9.0x.

High P/Es require high EPS growth to sustain them. In the case of Lyft, the company has recently shown a 17% shrinkage in Uniform EPS.

Wall Street analysts provide stock and valuation recommendations that in general provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, Lyft’s Wall Street analyst-driven forecast is a 77% and 161% EPS shrinkage in 2022 and 2023, respectively.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify Lyft’s $17 stock price. These are often referred to as market embedded expectations.

Furthermore, the company’s earning power is below its long-run corporate average. Moreover, cash flows and cash on hand are 2.3x its total obligations—including debt maturities, capex maintenance, and dividends. Also, the company’s intrinsic credit risk is 110bps above the risk-free rate.

All in all, this signals average credit risk.

Lastly, Lyft’s Uniform earnings growth is below its peer averages but above its average peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

The Uniform Accounting insights in today’s issue are the same ones that power some of our best stock picks and macro research, which can be found in our FA Alpha Daily newsletters.