The pandemic drove growth in home and pet care, which would continue despite the looming recession due to the need for companionship and emotional support. Central Garden & Pet (CENT), a key player in the pet care sector, has proven its resilience amid the shifting economic landscape. However, rating agencies do not see it this way, as they expect the looming recession and the company to do badly. In today’s FA Alpha Daily, we’ll take a look at Central Garden & Pet using Uniform Accounting and see if rating agencies’ concerns are in line with the company’s true credit risk profile.

FA Alpha Daily:

Wednesday Credit

Powered by Valens Research

The COVID-19 pandemic unleashed unprecedented shifts in consumer behavior and spending patterns.

As people were confined to their homes, the demand for home products soared to historic highs. As individuals sought companionship and emotional support amidst isolation, pet ownership became a popular solution. This significant surge in pet adoption brought renewed attention to the pet care industry.

While the pandemic’s aftermath hints at an impending recession, these newfound priorities have proven to be more than fleeting trends.

The pet care sector benefited immensely from this trend, with an upswing in pet food, accessories, grooming services, and veterinary care.

Contrary to initial expectations, this trend has shown no signs of slowing. Instead, pet owners have forged deep bonds with their animal companions, further driving the need for premium care products and services.

During these sector surges, Central Garden & Pet emerged as a formidable player in the pet care market. Despite challenging economic conditions, the company showcased its resilience, with its commitment to providing top-notch products and services remaining unwavering.

However, rating agencies believe a recession is around the corner and the high demand during the pandemic is not sustainable in the long run. Agencies predict that the company will struggle to pay off its obligations going forward.

For this reason, S&P has rated the company “BB”, implying a 10% probability of bankruptcy and placing it in the risky high-yield basket.

However, this is seriously overstating the company’s credit risk.

The company barely has any debt in the next five years and it also has stable cash flows. This means it should have no problems meeting its obligations.

One notable aspect of Central Garden & Pet’s financial strength is its manageable debt profile. The company has no significant debt coming due until 2028, offering a substantial cushion to navigate economic uncertainties.

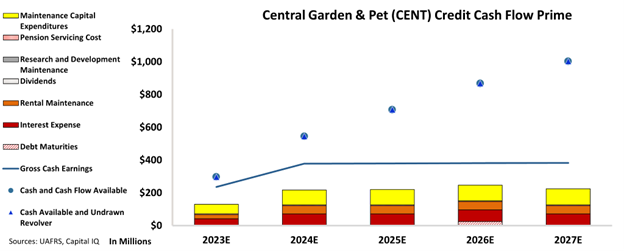

We can figure out if there is a real risk for this company by leveraging the Credit Cash Flow Prime (“CCFP”) to understand how the company’s obligations match against its cash and cash flows.

In the chart below, the stacked bars represent the firm’s obligations each year for the next five years. These obligations are then compared to the firm’s cash flow (blue line) as well as the cash on hand available at the beginning of each period (blue dots) and available cash and undrawn revolver (blue triangles).

The CCFP chart shows that Central Garden & Pet’s cash flows are more than enough to serve all its obligations going forward.

The chart shows that the company’s financial position is strong. The company’s robust cash flows and diligent financial management reinforce the company’s capacity to meet its obligations with ease.

Additionally, the huge spread between its cash flows and obligations provides the company with breathing room in the case of an economic downturn.

Due to these factors, we think that Central Garden & Pet shouldn’t be treated like a high-yield name and should be placed within the investment-grade basket.

Hence, at Valens, we are giving an IG3 rating to this company. As opposed to rating agencies’ unreasonable 10% probability of default, this rating only implies a probability of default of around 1%.

It is our goal to bring forward the real creditworthiness of companies, built on the back of better Uniform Accounting.

To see Credit Cash Flow Prime ratings for thousands of companies, click here to learn more about the various subscription options now available for the full Valens Database.

SUMMARY and Central Garden & Pet (CENT:USA) Tearsheet

As the Uniform Accounting tearsheet for Central Garden & Pet (CENT:USA) highlights, the Uniform P/E trades at 17.2x, which is below the global corporate average of 18.4x but above its historical P/E of 14.4x.

Low P/Es require low EPS growth to sustain them. In the case of Central Garden & Pet, the company has recently shown a 4% Uniform EPS growth.

Wall Street analysts provide stock and valuation recommendations, that in general, provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, Central Garden & Pet’s Wall Street analyst-driven forecast is for a 7% and 13% EPS shrinkage in 2022 and 2023, respectively.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify Central Garden & Pet’s $40 stock price. These are often referred to as market-embedded expectations.

Furthermore, the company’s earning power in 2021 was 2x the long-run corporate average. Moreover, cash flows and cash on hand are below its total obligations—including debt maturities and capex maintenance. The company also has an intrinsic credit risk that is 170bps above the risk-free rate.

Overall, this signals a moderate credit risk.

Lastly, Central Garden & Pet’s Uniform earnings growth is below its peer averages and is trading below its average peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

This analysis of Central Garden & Pet (CENT)’s credit outlook is the same type of analysis that powers our macro research detailed in the member-exclusive FA Alpha Pulse.