FA Alpha Daily:

Monday Macro

Powered by Valens Research

Back in May, we wrote that corporate balance sheets were finally returning to “normal,” down from historically rich levels. This month, things look a little different.

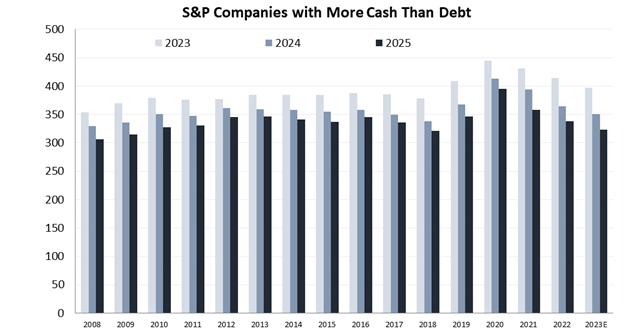

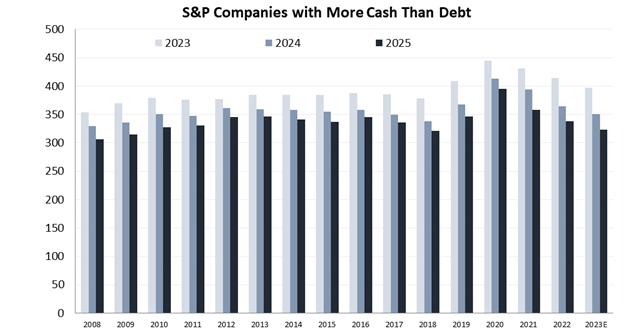

High interest rates are starting to take their toll on corporate balance sheets. You can see this in the chart below. It shows the number of companies in the S&P 500 with enough cash to handle debt coming due in the next three years.

As you can see, most companies still have enough cash to cover this year’s debt. But when you look at all maturing debt through 2025, the picture isn’t so bright.

Companies now have slightly more cash relative to maturing debt than they did in 2009, though it’s a good deal lower than the average over the past 15 years. And that’s a change from April, when companies had way more cash.

The more companies there is with enough cash to cover debt, the less risk there is in the market. Roughly the same number of companies had sufficient cash in 2018 as what we’re seeing today. Any lower, and we’re getting back to Great Recession territory.

Eventually, something has to give. Companies typically refinance their debt roughly one to two years out. So if they want to refinance this 2025 debt, they need to start soon.

We’ve been saying for a while that refinancing issues could surface somewhere between the end of 2023 and early 2024. This data only reaffirms our view.

Unemployment still hasn’t budged from its safe range. The Fed is prepared to keep interest rates high until that number rises. That’s a bad sign for companies that are running out of cash. They might not be able to refinance their 2025 debt maturities.

The credit market is tightening, but the risk of a serious wave of defaults is mitigated by the lack of near-term debt maturities.

At the same time, earnings growth no longer looks like it could help push the market higher. At this point, it appears growth will be on hold and could even fall slightly.

Valuations have elevated after the market rallied to start the year. Earnings growth has turned to shrinking, and credit availability is limited. Overall, there’s not much reason for the market to rise.

And investor sentiment is bullish. That increases the risk of an imminent drop if investors get bad news. We could see more volatility in the coming months.

The warning signs are evident, and the Federal Reserve’s strategy to combat unemployment by maintaining high interest rates could prove detrimental to cash-strapped companies.

We continue to see a recession looming. Even though the market has been rallying recently, we think it could just as easily start falling with a little more bad credit news.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

To see our best macro insights, become an FA Alpha and get access to FA Alpha Pulse.