The real estate industry is facing challenges, with commercial real estate hit hardest due to office abandonment and declining store sales. Meanwhile, homeowners who moved during the pandemic are locked in favorable mortgage rates, making it less likely that they will leave. As many homeowners are choosing to stay and invest in their current houses, this trend has boosted demand for housing supplies, which has benefited TopBuild Corporation (BLD), a major supplier of products to homebuilders. In today’s FA Alpha Daily, let’s look at TopBuild Corporation and see how its stock is trading at a relatively low valuation, making it a great bargain for potential investors.

FA Alpha Daily:

Tuesday Company Specific

Powered by Valens Research

The real estate industry is on thin ice.

One of the biggest drivers of the industry has been cheap financing options. With policy and mortgage rates high, nobody is giving free money to anyone anymore.

That said, not every part of the industry is exposed to the same risk. For several reasons, places like commercial real estate seem to be really in trouble.

Demand for offices has fallen since the pandemic as people and companies got used to working remotely from the comfort of their homes. As a result, office owners struggle to convince people to sign office leases, which creates issues in filling their inventory.

In the meantime, landowners of stores and malls fear falling consumer strength will result in closing stores, causing them to lose tenants.

Even worse, some landowners get royalties per product sold. It means revenue per lease will fall even if the tenant does not leave.

All the while, their financing costs are rising in line with interest rates.

The housing market is operating differently, though. Housing is inherently a bit more stable, as people need places to live no matter what.

Although, we are in the middle of an odd time within residential real estate. A lot of folks moved during the pandemic because they wanted to invest in their homes and be more comfortable in the place they spend 24 hours in.

Back then, during the pandemic, interest rates were still near zero. That means they locked in incredibly affordable mortgages. If they were to move now, they would be leaving those mortgages for those that are a lot more expensive.

Many more families are choosing to stay in their current homes today compared to a few years ago, resulting in a reduced number of existing homes available for sale.

Now, the primary source of housing supply lies in new construction. Contrary to some macro headlines, the construction industry continues to thrive.

One company that has greatly benefited from this trend is TopBuild Corporation (BLD). This company specializes in providing a range of essential products for construction, such as windows, after-paint products, fireproofing materials, doors, and roofing materials.

As the construction industry gained most of the demand for new housing, TopBuild’s demand has been ramping up.

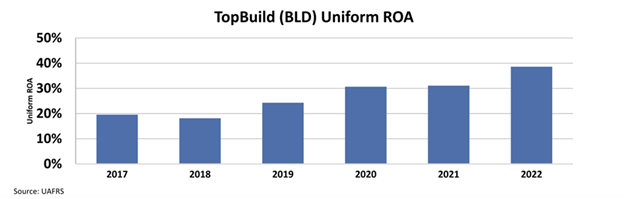

Its return on assets (“ROA”) continuously surged and reached an all-time high last year. ROA was 18% in 2018 and jumped to a massive 39% in 2022.

High demand, and therefore high ROA, is likely to continue if homebuilding construction stays strong. Construction companies will keep buying all building materials. That means sustained high demand for TopBuild.

However, the market is not pricing the company for the success it is poised to have. The stock currently trades at 13.8x Uniform price to earnings (“P/E”), below both the industry’s and the company’s historical averages.

The market still thinks this is just a name exposed to the issues in the whole real estate industry and does not understand the actual fundamentals behind the business.

That is why TopBuild showed up on our screen. Its high returns, essential position in the market, and low valuation make it a great FA Alpha 50 name.

Throughout financial market history, many of the world’s most successful investors have been candid in their belief that Generally Accepted Accounting Principles (“GAAP”) distort economic reality.

Warren Buffett, for example, once said investors should “concentrate on the world of companies, not arcane accounting mathematics.”

Investors who neglect the very real issues with as-reported accounting can find themselves caught up in investing with the crowd, blindly following hot “themes” without a thorough grasp of how to understand the businesses in question.

The only true way to focus on the “world of companies,” as Buffett suggests investors do, is to present a clear picture of how a business operates, something that can only be done by adjusting financial statements to reflect the arbitrary nature of certain accounting rules that leave much to discretion.

The world’s best investors understand the need to make these adjustments, which allows them to focus not on picking out the most popular companies but rather on looking for great names in sleepy areas that the market isn’t paying much attention to. From there, the goal is to then identify quality companies with significant growth potential at reasonable prices.

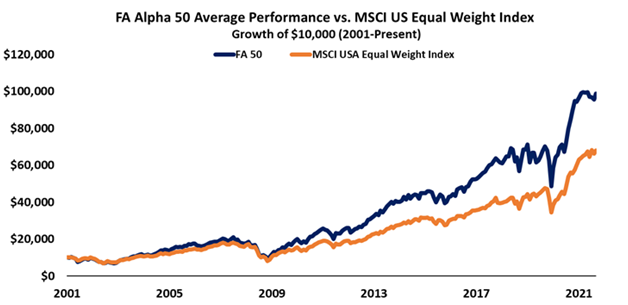

That’s exactly what we’ve set out to do with the FA Alpha, our monthly list of 50 companies that rank at the top for quality, high growth, and low valuations.

This list has outperformed the market by 300 basis points per year for over 20 years now, effectively doubling the performance of the market by focusing on the real fundamentals and valuations of companies with our proprietary Uniform Accounting framework.

See for yourself below.

To see the other 49 names on the list, click here.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

Today’s highlight, TopBuild Corporation (BLD) is one of the top stock picks from FA Alpha 50 this month. To see more stock picks like this, become an FA Alpha get access to FA Alpha 50.