The FA Alpha Daily provides you with insights and tools to help you build your business.

Our credit analysis highlights strategies for your clients’ portfolios and important talking points for your client discussions – points that the mainstream financial media almost always miss.

We hope you find today’s useful.

FA Alpha Daily:

Wednesday Credit

Powered by Valens Research

Back in November, we highlighted a trend that is only becoming more and more apparent as the economy moves into 2022. We are talking about the capex supercycle.

Driven by a combination of historical under-investment in American physical assets the past decade and federal infrastructure spending, the United States is primed to spend record amounts of money in 2022 and beyond, driving even greater economic consumption.

As both government assets and corporate balance sheets have reached record depreciation, the government stepped in with its pocket book. Last November’s $1.2 trillion infrastructure bill should provide big tailwinds for public and private investment across the U.S. economy.

The money will be spent in areas ranging from electric-vehicle charging stations and broadband expansion to more traditional infrastructure like roads and bridges.

Furthermore, the surge in home buying and home building over the past two years has meant capital expenditures of a more local and concentrated sort are rising as well. Construction companies and new home owners are installing or renovating the infrastructure for their living arrangements.

This means a company exposed to all of these trends would excel in the next few years. Advanced Drainage System, a company that creates water pipe solutions for both residential and commercial applications is poised for a strong next few years.

And yet, all three of the large ratings agencies are rating the name as one in distress with the equivalent of a BB- rating thanks to a large outstanding debt coming due in 2028. This rating translates to a chance of defaulting over 10%.

We see things differently.

Using our Credit Cash Flow Prime (“CCFP”) framework, we can get to the heart of Advanced Drainage Systems true fundamental credit risk.

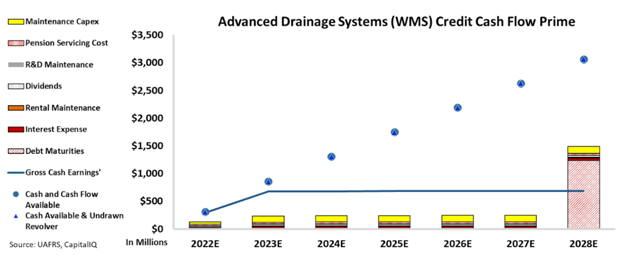

In the chart below, the stacked bars represent the firm’s obligations each year for the next seven years. These obligations are then compared to the firm’s cash flow (blue line) as well as the cash on hand available at the beginning of each period (blue dots) and available cash and undrawn revolver (blue triangles).

As you can see, Advanced Drainage Systems is able to cover all of its operating obligations with its cash flows alone for the next 7 years. Furthermore, it is building a sizable amount of cash on its balance sheet, which means it should have no issue whatsoever with paying off its debt obligation of $1.2 billion in 2028.

Not only is Advanced Drainage Systems not anywhere close to financial troubles, but it also has plenty of capital to invest in the upcoming capex supercycle and ride these favorable economic conditions.

S&P’s BB- high-yield rating for Advanced Drainage Systems does not reflect reality. Instead it highlights Wall Street’s blindness to true credit risk.

That’s why we rate the company as having a much lower risk with an investment-grade rating of IG3+, which corresponds to a default rate of less than 2%.

Using Uniform Accounting, we can see through the distortions of as-reported numbers to get to the true fundamental credit picture for companies in transition such as Advanced Drainage Systems.

To see Credit Cash Flow Prime ratings for thousands of other companies we cover, click here to learn more about the various subscription options now available for the full Valens Database.

SUMMARY and Advanced Drainage Systems, Inc. Tearsheet

As the Uniform Accounting tearsheet for Advanced Drainage Systems, Inc. (WMS:USA) highlights, the Uniform P/E trades at 24.0x, which is around the global corporate average of 24.0x, but above its historical P/E of 18.4x.

Average P/Es require average EPS growth to sustain them. That said, in the case of Advanced Drainage Systems, the company has recently shown a 389% Uniform EPS growth.

Wall Street analysts provide stock and valuation recommendations that in general provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, Advanced Drainage Systems’ Wall Street analyst-driven forecast is for a 24% and 28% EPS growth in 2022 and 2023, respectively.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify Advanced Drainage Systems’ $119 stock price. These are often referred to as market embedded expectations.

The company is currently being valued as if Uniform earnings were to grow by 8% over the next three years. What Wall Street analysts expect for Advanced Drainage Systems’ earnings growth is above what the current stock market valuation requires in 2022 and 2023.

Furthermore, the company’s earning power in 2020 is 3x the long-run corporate average. Moreover, cash flows and cash on hand are above its total obligations—including debt maturities and capex maintenance. Additionally, intrinsic credit risk is 10bps above the risk-free rate. All in all, this signals a low credit and dividend risk.

Lastly, Advanced Drainage Systems’ Uniform earnings growth is below peer averages, but the company is trading in line with peer average valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

This analysis of Advanced Drainage Systems, Inc. credit outlook is the same type of analysis that powers our macro research detailed in the FA Alpha Pulse.